In the world of trading, understanding the settings for various trading platforms is crucial for optimizing performance and ensuring smooth operations. This guide will delve into the specifics of trading settings, particularly focusing on how to effectively manage symbol mappings, order types, and other essential configurations. By the end of this article, you will have a clearer understanding of how to set up your trading environment for success.

Introduction to Trading Settings

Trading settings are the backbone of your trading strategy. They dictate how your trades are executed, how alerts are generated, and how profits and losses are managed. Most users find that the default settings are adequate for their needs, but understanding the nuances can help in making informed adjustments. Here, we will explore the key aspects of trading settings that every trader should know.

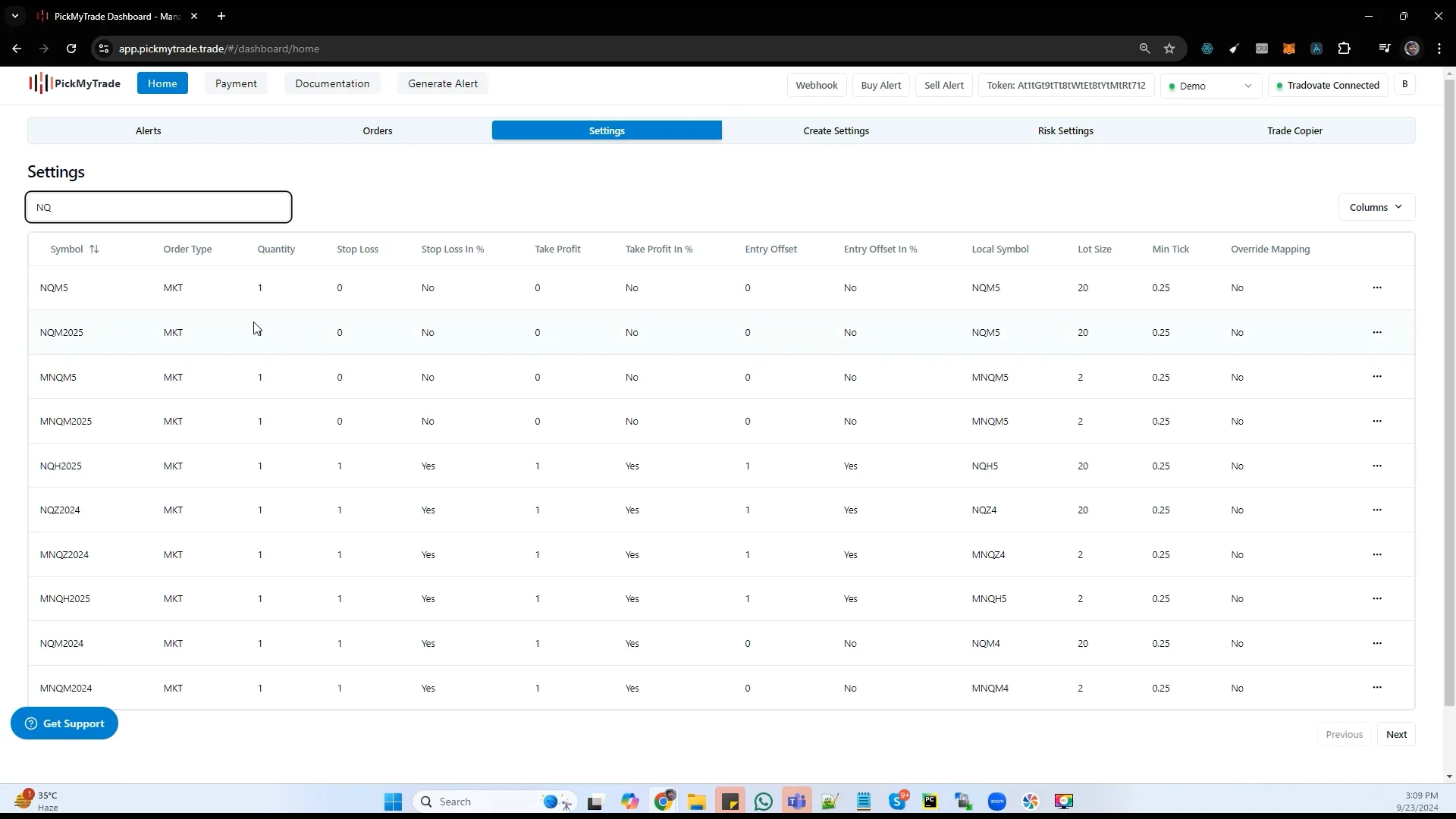

Symbol Mapping Explained

One of the most important features in trading settings is symbol mapping. This is the process of linking the symbols used in your trading platform to those recognized by your broker. For instance, when a signal is generated from TradingView, it may use a symbol that your broker does not recognize. In such cases, a mapping is necessary.

For example, when a signal for NQ is generated, the trade will be placed as “nqm 5”. This is because Tradovate, a popular trading platform, only understands specific symbols. The mapping ensures that trades are executed correctly without any manual intervention.

Setting Stop-Loss and Take-Profit

Setting stop-loss and take-profit levels is essential for risk management in trading. Previously, these settings were often adjusted manually, but now they can be set directly within the trading interface. This streamlines the process and reduces the risk of errors.

Traders can now specify their stop-loss and take-profit levels directly from the settings section. This means that once the trade is executed, the designated levels will automatically trigger the necessary actions. This automation is particularly beneficial for those who may not be able to monitor their trades constantly.

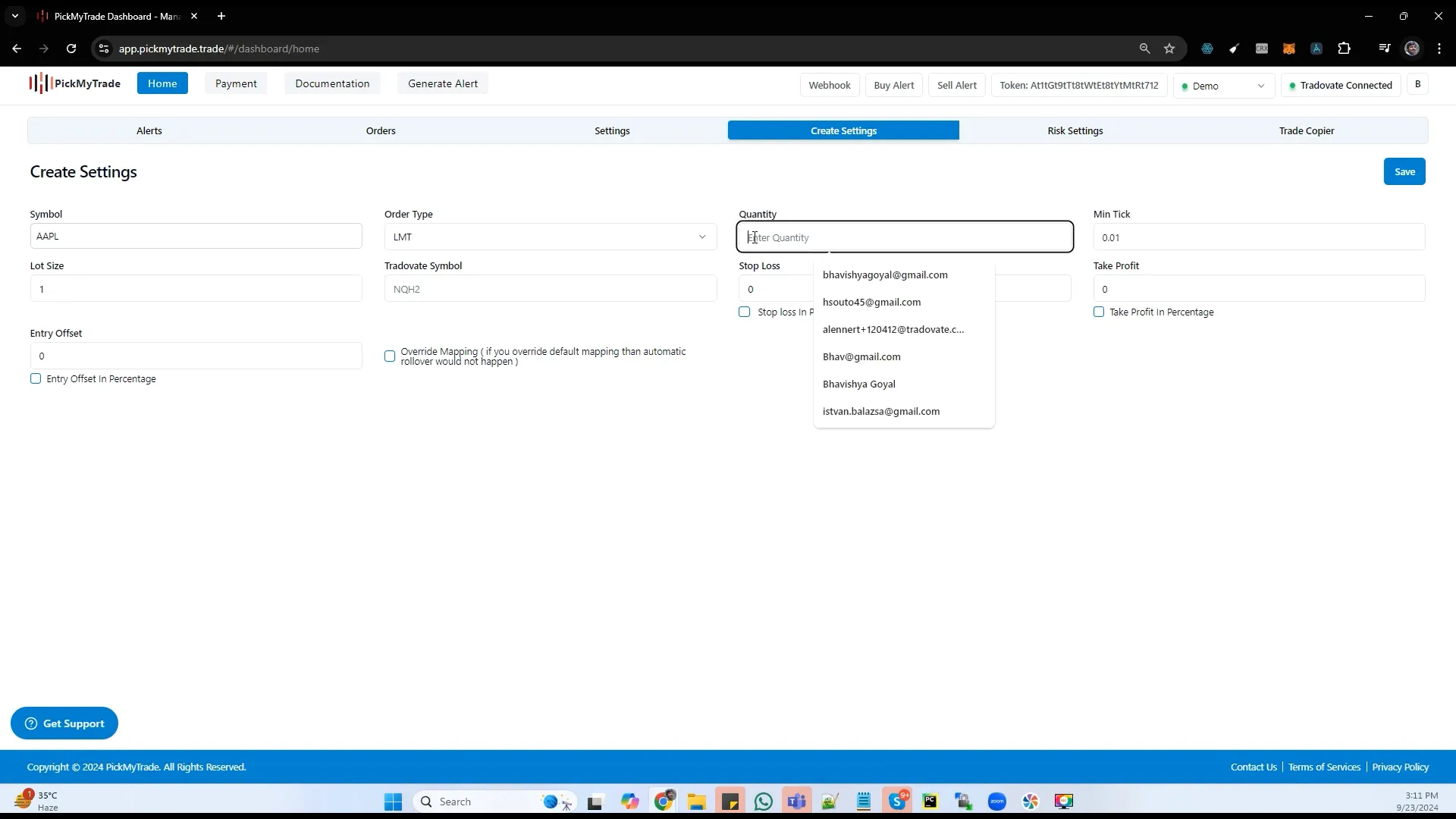

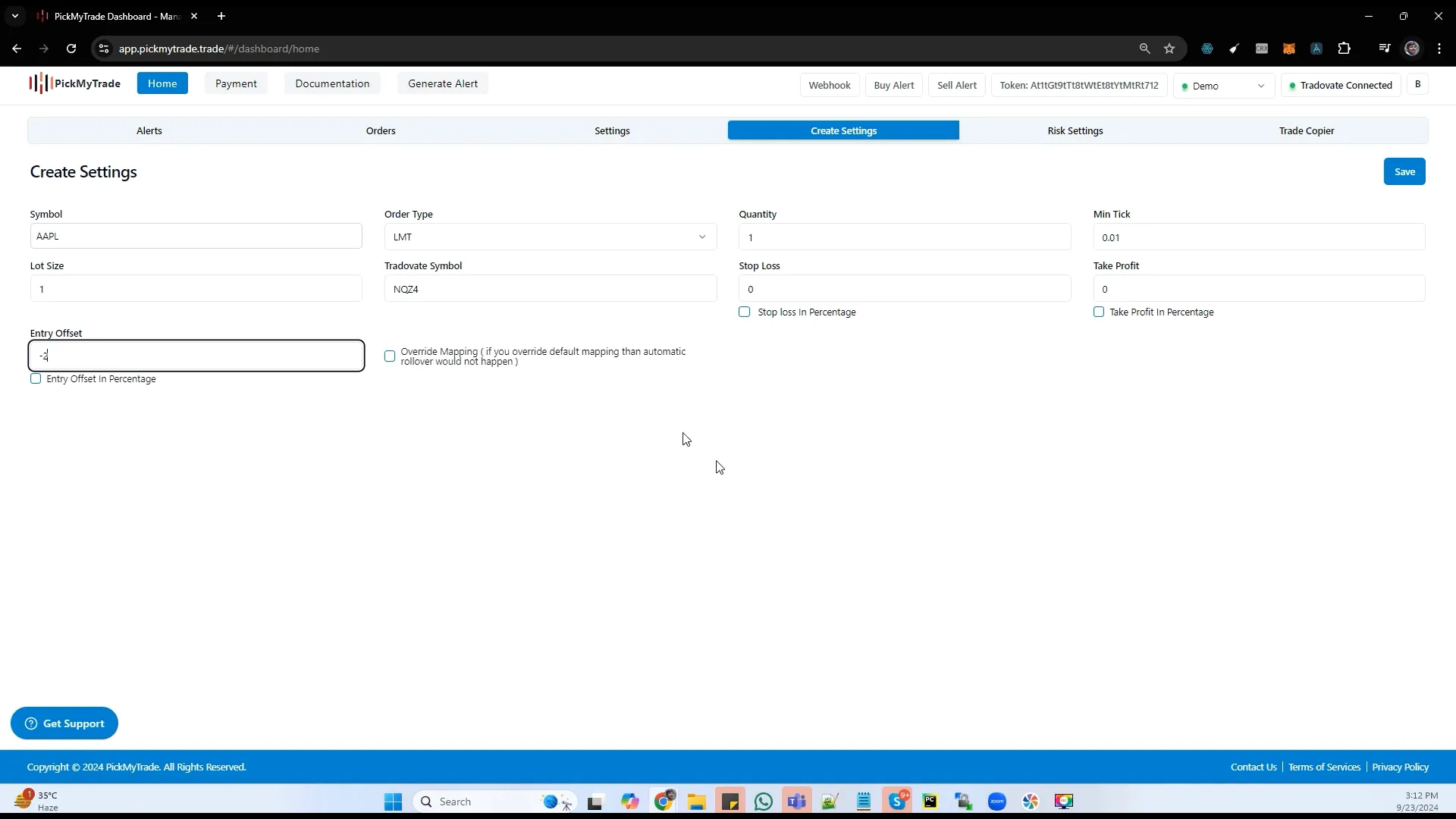

Order Types: Market vs. Limit

Understanding the difference between market and limit orders is crucial for effective trading. A market order is executed immediately at the current market price, while a limit order sets a specific price at which you are willing to buy or sell.

If you prefer to use limit orders for your trades, you need to adjust your settings accordingly. For instance, if you are tracking a chart for Apple and wish to place a limit order when a signal is generated, you must ensure that your settings reflect this preference.

Creating Custom Settings

Custom settings allow traders to tailor their trading experience to their specific needs. When creating custom mappings, it’s essential to ensure that you click the appropriate options to save your settings. This guarantees that your manual configurations are recognized by the trading platform.

Moreover, if you are using a limit order, you can specify an entry offset. This feature allows you to place your order above the current market price, which can increase the likelihood of your order being filled.

Managing Auto Rollover

Auto rollover is a feature that ensures your positions are carried over to the next contract automatically. This is particularly useful for futures trading, where contracts expire periodically. By default, the settings may indicate ‘no’ for auto rollover, but if you want this feature, you must manually adjust it.

When a contract expires, if you have open orders, you will need to close them manually. The system will then take care of the new orders based on your updated settings.

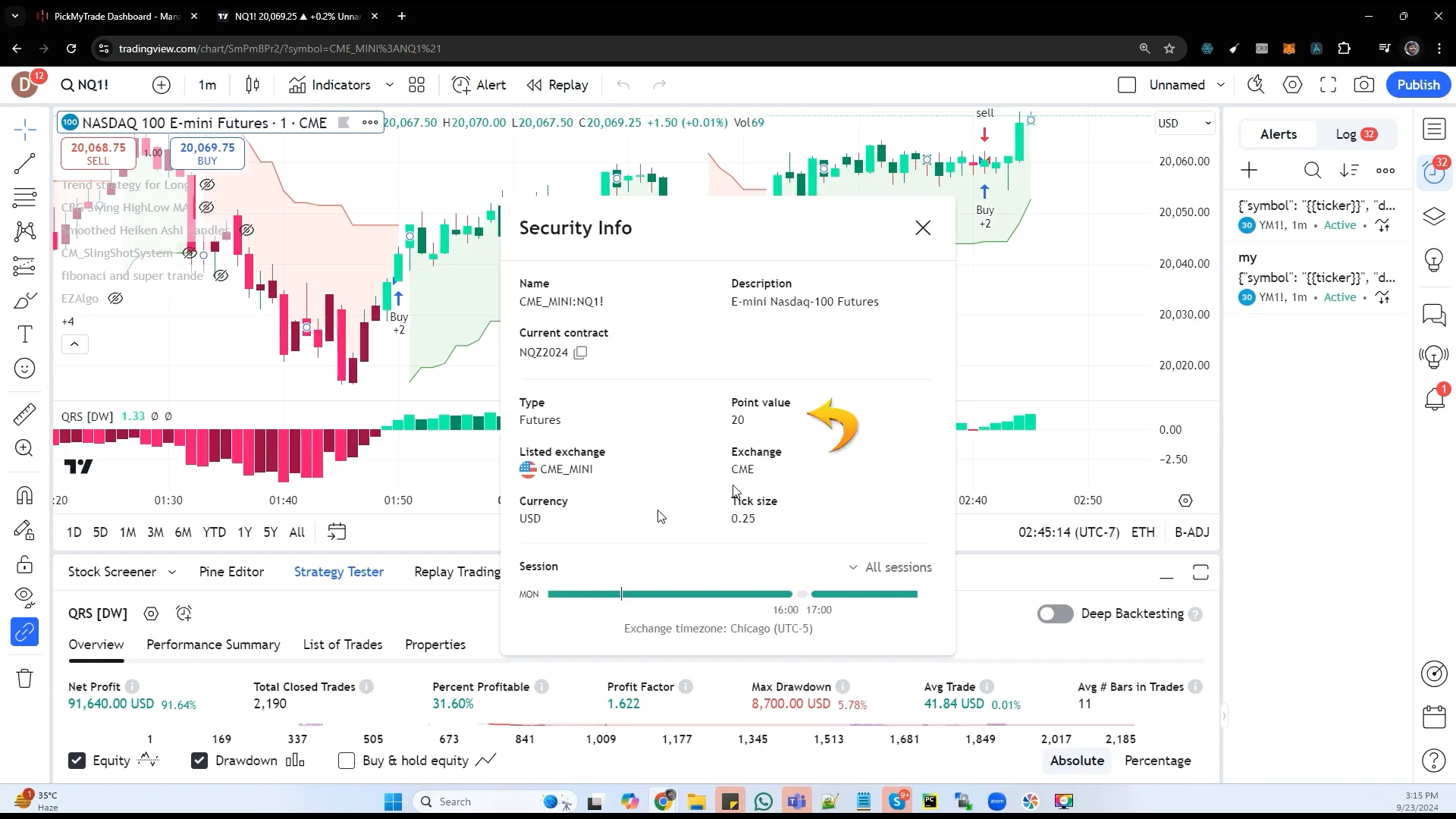

Understanding Contract Specifications

To effectively manage your trades, it’s vital to understand the specifications of the contracts you are trading. This includes knowing the minimum tick size and lot size. You can find this information in the security info section of TradingView.

Knowing these details allows you to input the correct values into your trading settings, ensuring that your trades are executed as intended. This knowledge is particularly important when setting stop-loss and take-profit levels.

Final Thoughts on Trading Settings

In conclusion, understanding and managing your trading settings is vital for successful trading. From symbol mapping to order types and custom settings, each aspect plays a crucial role in how trades are executed. By taking the time to configure these settings, you can enhance your trading efficiency and effectiveness.

As you navigate the world of trading, consider utilizing automated trading solutions to streamline your processes further. Platforms like PickMyTrade offer automated trading options that can optimize your investments and provide real-time insights.

Resources for Further Learning

If you’re looking to deepen your understanding of trading settings and strategies, there are numerous resources available. Here are a few videos that could be helpful:

- Complete Video Explained from TradingView to Tradovate

- How to Create Alert Message for TradingView Strategy

- How to Create Alert Message for TradingView Indicator

By investing time in learning and adapting your trading settings, you can position yourself for success in the dynamic world of trading.

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.