The world of finance can often seem overwhelming, especially for those looking to enter the trading arena. Many aspiring traders have a desire to understand financial news, read tickers, and grasp the factors that influence the economy. This blog aims to demystify these concepts and provide a clear pathway for anyone interested in becoming a professional trader.

In this post, we will explore essential financial concepts, how to interpret financial news, and the steps to take to embark on a trading career. Whether you’re a complete beginner or someone looking to sharpen your trading skills, there’s something here for everyone.

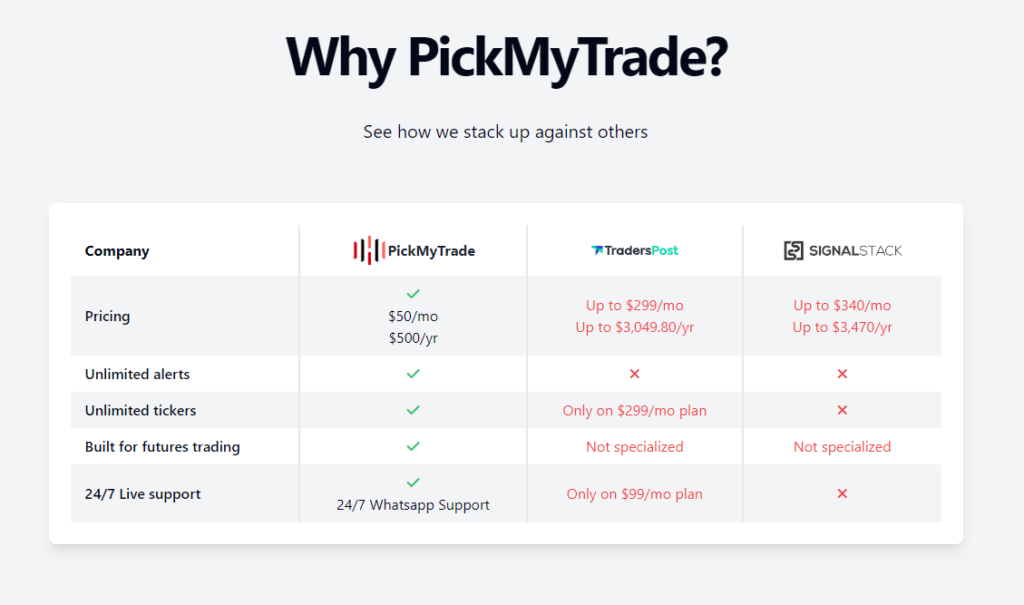

PickMyTrade makes things easy. You will be able to automate your TradingView Strategy/Indicator in just 2 min with PickMyTrade. You don’t need any kind of WebAPi for this and do not forget to take 5 days free trial , its absolutely free and does not require any cards.

Understanding Financial News

Financial news is crucial for traders as it provides insights into market trends, economic conditions, and potential investment opportunities. Understanding how to decode this information is vital for making informed trading decisions.

Financial news can come from various sources, including newspapers, financial websites, and news channels. Here are some key components to pay attention to:

- Economic Indicators: These are statistics that reflect the economic performance of a country. Key indicators include GDP, unemployment rates, inflation rates, and consumer confidence. Traders often use these indicators to gauge the overall health of the economy.

- Market Trends: Understanding whether the market is in a bullish (rising) or bearish (falling) trend can help traders make better decisions regarding buying and selling assets.

- Corporate Earnings Reports: These reports provide insight into a company’s financial performance and can significantly impact stock prices. Traders should pay attention to earnings per share (EPS), revenue growth, and forward guidance provided by companies.

- Geopolitical Events: Political stability, trade agreements, and international relations can all affect market movements. Traders must keep an eye on global news to understand how these events may influence their trades.

Reading Tickers

The ticker symbol is a unique series of letters assigned to a security or stock for trading purposes. Understanding how to read tickers is essential for any trader. Here’s a breakdown of what you need to know:

- Ticker Symbols: These are typically one to four letters long. For example, Apple Inc. is represented as AAPL, and Microsoft Corporation is MSFT. Familiarizing yourself with the tickers of companies you’re interested in will streamline your trading process.

- Price Movement: Tickers often display real-time price changes. A green ticker indicates a price increase, while a red ticker signifies a decrease. Understanding these movements can help you make timely decisions.

- Volume: This indicates the number of shares traded during a specific period. High volume can signify strong interest in a stock, while low volume may indicate a lack of interest.

- Market Capitalization: This is calculated by multiplying the stock price by the total number of outstanding shares. It provides insight into a company’s size and growth potential.

Factors That Move the Economy

Several factors influence the economy and, by extension, the stock market. Understanding these factors can help aspiring traders predict market movements more accurately.

- Monetary Policy: Central banks, like the Federal Reserve in the U.S., influence the economy through interest rates and money supply. Changes in monetary policy can affect borrowing costs and consumer spending.

- Fiscal Policy: Government spending and taxation policies also play a significant role in economic performance. Expansionary fiscal policies can stimulate the economy, while contractionary policies can slow it down.

- Consumer Behavior: Consumer spending accounts for a significant portion of economic activity. Understanding trends in consumer behavior can provide insights into the strength of the economy.

- Global Economic Conditions: The interconnectedness of global economies means that events in one country can have ripple effects worldwide. Traders should be aware of international economic conditions and how they may impact domestic markets.

Steps to Become a Trader

Now that we have covered the foundational concepts of financial news, tickers, and economic factors, let’s outline the steps to becoming a professional trader.

Step 1: Educate Yourself

Before diving into trading, it’s crucial to educate yourself about the financial markets. Consider the following resources:

- Books: Read books on trading strategies, market analysis, and economics. Some popular recommendations include “The Intelligent Investor” by Benjamin Graham and “A Random Walk Down Wall Street” by Burton Malkiel.

- Online Courses: Enroll in online courses that cover trading fundamentals and advanced strategies. Platforms like Coursera and Udemy offer various options.

- Webinars and Seminars: Attend trading webinars and seminars to learn from experienced traders and industry experts.

Step 2: Choose a Trading Style

There are several trading styles to consider, including:

- Day Trading: Involves making multiple trades within a single day, aiming to profit from short-term price movements.

- Swing Trading: Focuses on holding positions for several days or weeks to capture short- to medium-term market moves.

- Long-Term Investing: Involves buying and holding assets for an extended period, focusing on long-term growth.

Choose a style that aligns with your risk tolerance, time commitment, and financial goals.

Step 3: Develop a Trading Plan

A trading plan outlines your trading strategy, risk management techniques, and financial goals. Key components of a trading plan include:

- Entry and Exit Strategies: Define the criteria for entering and exiting trades based on your analysis.

- Risk Management: Determine how much capital you are willing to risk on each trade and set stop-loss orders to limit potential losses.

- Performance Evaluation: Regularly review your trades to assess your performance and make necessary adjustments to your strategy.

Step 4: Practice with a Demo Account

Before trading with real money, practice your strategies using a demo account. Most trading platforms offer demo accounts that allow you to trade with virtual funds. This practice will help you gain confidence and refine your skills without the risk of losing real money.

Step 5: Start Trading with Real Capital

Once you feel comfortable with your trading strategies and have a solid plan in place, you can start trading with real capital. Begin with a small amount of money to minimize risk as you gain experience. As you become more proficient, you can gradually increase your trading size.

Conclusion

Becoming a professional trader requires dedication, education, and a willingness to learn from both successes and failures. By understanding financial news, reading tickers, and grasping the factors that influence the economy, you can lay a solid foundation for your trading career.

As you embark on this journey, remember that continuous learning and adaptation are key to long-term success in trading. With the right mindset and resources, you can achieve your goal of becoming a professional trader.