Choosing the right trading platform can significantly impact your trading experience and success. Among the many options available, Rithmic and Tradovate stand out as two prominent platforms used by traders, especially within the realm of futures trading. This article will delve into the key differences between Rithmic and Tradovate, their unique features, and the factors to consider when selecting the best platform for your trading needs.

Understanding Rithmic and Tradovate

Both Rithmic and Tradovate have their own strengths and weaknesses. Understanding these can help you make an informed decision about which platform suits your trading style and requirements. Let’s explore each platform in more detail.

Rithmic: Overview

Rithmic is known for its high-performance trading capabilities, particularly in providing ultra-low latency data feeds. This feature is crucial for traders who rely on speed and precision, such as high-frequency traders and institutional investors. Rithmic provides direct market access (DMA), which allows traders to execute orders directly onto the market, enhancing efficiency and transparency.

Key Features of Rithmic

- Ultra-Low Latency Data Feeds: Rithmic offers some of the fastest data feeds in the industry, making it ideal for traders who require real-time information for decision-making.

- Advanced Charting Tools: The platform includes sophisticated charting features that allow for in-depth technical analysis.

- Risk Management Tools: Rithmic provides advanced risk management features to help traders manage their exposure effectively.

- Historical Data Analysis: Access to extensive historical data supports backtesting and strategy development.

Tradovate: Overview

Tradovate is a more user-friendly platform designed to simplify the trading experience, particularly for futures trading. It is cloud-based, which means traders can access their accounts from any device with an internet connection, making it convenient for those who prefer flexibility.

Key Features of Tradovate

- Commission-Free Trading: Tradovate offers a commission-free model, which can significantly reduce trading costs for active traders.

- Customizable Interface: The platform’s interface is highly customizable, allowing traders to tailor their workspace according to their preferences.

- Mobile Trading: Tradovate supports mobile trading, enabling users to manage their trades on the go.

- Real-Time Market Data: Access to real-time data ensures timely and informed trading decisions.

Comparing Costs: Rithmic vs Tradovate

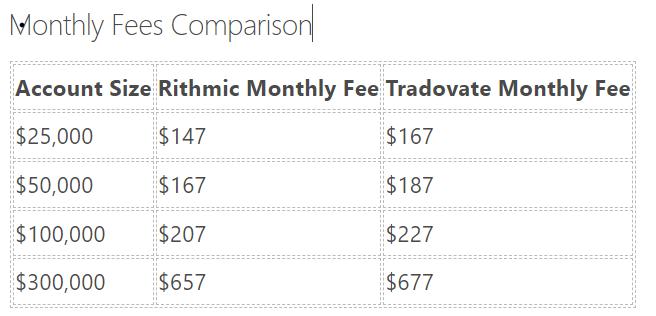

Cost is a significant factor when choosing a trading platform. Rithmic is generally cheaper than Tradovate, offering lower monthly fees for similar account sizes. For example, a $25,000 account on Rithmic may cost around $147 per month, while the same account on Tradovate could be priced at $167 per month. This cost difference can add up over time, especially for active traders.

User Experience: Which Platform is Easier to Use?

User experience is another crucial aspect of choosing a trading platform. Tradovate’s cloud-based infrastructure makes it more accessible and easier to use, especially for those who may not be as tech-savvy. In contrast, Rithmic requires the use of NinjaTrader, which is only available for Windows users and can be more complex to navigate.

Accessibility

Tradovate can be accessed from any device, including smartphones and tablets, making it a more versatile option for traders who are frequently on the move. Rithmic, while powerful, may pose challenges for Mac users, as it is not natively supported on that operating system.

Interface and Customization

Tradovate’s interface is designed to be user-friendly, with customizable layouts that allow traders to arrange tools and information according to their preferences. Rithmic, on the other hand, offers extensive customization options but may require a steeper learning curve to utilize effectively.

Trading Features and Tools

Both platforms offer a range of trading features and tools, but they cater to different types of traders. Rithmic is more suited for professional traders who need advanced tools for high-frequency trading. In contrast, Tradovate is ideal for traders looking for a comprehensive yet straightforward trading solution.

Rithmic’s Advanced Trading Tools

- Direct Market Access: Enables traders to place orders directly into the market.

- High-Speed Execution: Essential for traders who rely on speed for their strategies.

- Custom Risk Parameters: Allows traders to set personal risk limits to manage their exposure effectively.

Tradovate’s Comprehensive Features

- Integrated Trading Tools: Offers a range of built-in tools to assist traders with analysis and execution.

- Educational Resources: Provides access to educational materials for traders at all levels.

- Community Features: Facilitates interaction among traders through forums and groups.

Final Thoughts: Choosing Between Rithmic and Tradovate

When deciding between Rithmic and Tradovate, consider your trading style, preferences, and budget. If you prioritize speed, advanced trading tools, and direct market access, Rithmic may be the better choice. However, if you prefer a user-friendly platform with comprehensive features and lower costs, Tradovate could be more suitable.

Ultimately, both platforms have their merits, and the best choice will depend on your individual trading needs. Take the time to explore each platform, consider your trading goals, and choose the one that aligns best with your strategy.

In conclusion, whether you opt for Rithmic or Tradovate, both platforms offer valuable tools and resources to enhance your trading experience. Happy trading!

Great comparison! I appreciated the in-depth analysis of both platforms. It’s helpful to see the strengths and weaknesses laid out so clearly. I was leaning towards Rithmic, but the insights on Tradovate’s user-friendly interface and pricing structure made me reconsider. Thanks for the valuable information!

Great comparison! I appreciate how you highlighted the key features and differences between Rithmic and Tradovate. It’s helpful to see the pros and cons laid out so clearly. Looking forward to using this information to make a more informed decision on my trading platform!