Unlock the Future of Trading: Automated Trading and Prop Firms

In the dynamic world of trading, staying ahead requires more than just knowledge and intuition. It demands efficiency, precision, and the ability to capitalize on opportunities in real-time. This is where automated trading and proprietary (prop) firms come into play, revolutionizing the way traders operate and succeed in the market.

The Rise of Automated Trading

Automated trading, also known as algorithmic trading, uses computer programs to execute trades based on predefined criteria. These criteria can be based on technical analysis, statistical models, or a combination of both. The advantages of automated trading are manifold:

- Speed and Efficiency

- Automated systems can execute trades in milliseconds, much faster than any human can react. This speed is crucial in volatile markets where prices can change in an instant.

- Elimination of Emotions

- Trading decisions are made based on logic and data, eliminating emotional interference that often leads to poor decision-making.

- Consistency

- Automated trading ensures that your strategies are implemented consistently, without deviation, leading to more reliable outcomes.

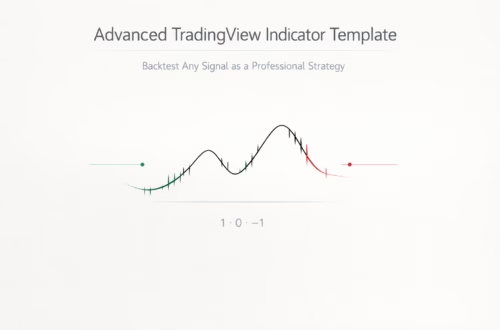

- Backtesting Capabilities

- Traders can backtest their strategies against historical data to see how they would have performed, allowing for refinement and optimization before deploying them in live markets.

Prop Firms: A New Era for Traders

Proprietary trading firms, or prop firms, are companies that invest their own capital in the financial markets, often hiring skilled traders to manage these investments. The synergy between prop firms and automated trading creates a powerful platform for traders to maximize their potential.

- Access to Capital

- Prop firms provide traders with the capital needed to execute large trades, offering the potential for significant profits without risking personal funds.

- Advanced Technology

- Many prop firms invest in cutting-edge technology, including high-speed trading platforms and sophisticated analytical tools, giving their traders a competitive edge.

- Risk Management

- Prop firms often have stringent risk management protocols in place to protect their capital and ensure sustainable trading practices.

- Profit Sharing

- Traders typically earn a percentage of the profits they generate, aligning their interests with the firm’s and providing lucrative earning potential.

Integrating Automation with Prop Firms

The integration of automated trading systems with prop firms offers a unique and powerful combination. Here’s how traders can benefit:

- Enhanced Strategy Implementation

- Traders can leverage automated systems to implement complex strategies that require precise timing and execution, which is difficult to achieve manually.

- Scalability

- Automated trading allows traders to manage multiple strategies and accounts simultaneously, scaling their operations without additional manual effort.

- Improved Performance

- The speed and efficiency of automated systems can lead to better performance, especially in high-frequency trading scenarios where milliseconds matter.

- Risk Mitigation

- Automated systems can be programmed with strict risk management rules, ensuring that trades are executed within predefined risk parameters, thereby protecting the firm’s capital.

Getting Started with Automated Trading and Prop Firms

If you’re interested in harnessing the power of automated trading and prop firms, here’s a simple guide to get you started:

- Choose the Right Platform

- Select a trading platform that supports automated trading and offers the tools you need to develop and test your strategies. Platforms like PickMyTrade offer comprehensive solutions for automated trading.

- Develop Your Strategy

- Define your trading strategy based on thorough analysis and testing. Utilize backtesting features to refine your approach.

- Connect with a Prop Firm

- Research and connect with prop firms that align with your trading style and goals. Ensure they provide the necessary support and technology for automated trading.

- Implement and Monitor

- Deploy your automated trading system and continuously monitor its performance. Make adjustments as needed to adapt to changing market conditions.

Embrace the Future of Trading

By integrating automated trading with the resources and expertise of prop firms, traders can unlock new levels of efficiency, profitability, and success. Embrace this powerful combination and revolutionize your trading journey today.

For more information and to start your automated trading journey, visit PickMyTrade or contact us at [email protected].