In the ever-evolving world of trading, finding the best strategies is crucial for success. This blog delves into various trading strategies that can be automated through PickMyTrade. We will explore how to implement these strategies effectively and achieve profitable returns. This article is part of a series that aims to guide you through the intricacies of trading automation.

Table of Contents

- Understanding Trailing Take Profit Strategies

- Applying the Strategy to Crude Oil Trading

- Exploring Different Time Frames

- Creating Alerts for Automation

- Performance Analysis of Other Instruments

- Results with Wheat and Soybean Trading

- Conclusion

- Frequently Asked Questions (FAQ)

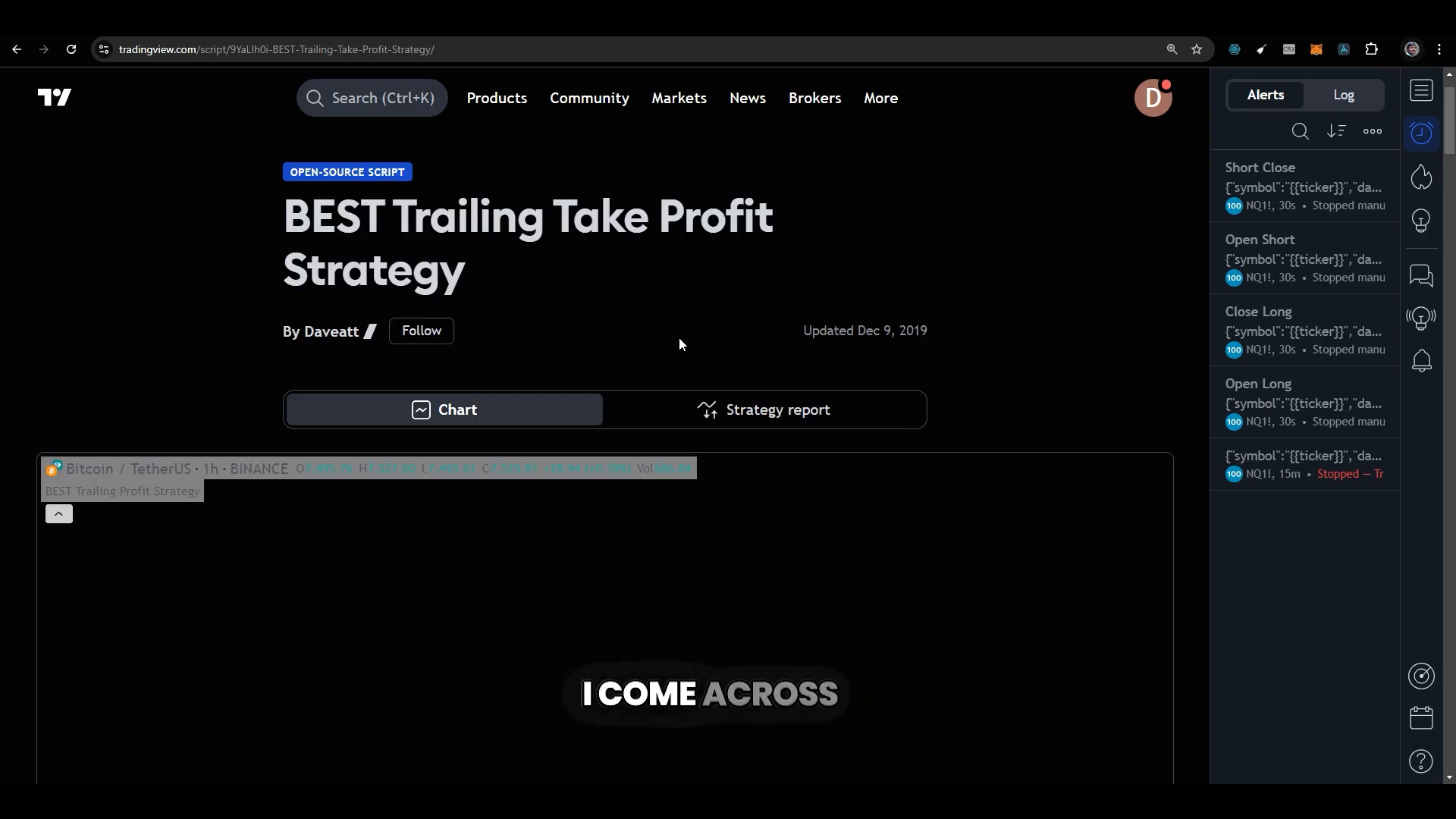

Understanding Trailing Take Profit Strategies

The first strategy we will examine is the trailing take profit strategy. This approach, developed by a trader known as Deat, enhances traditional trailing stop-loss methods by incorporating a trailing take profit mechanism. This strategy allows traders to lock in profits while still capitalising on potential upward movements in the market.

What sets this strategy apart is its open-source nature, allowing traders to apply it directly on their charts. By using this method, traders can take advantage of market movements without constantly monitoring their positions. The trailing take profit strategy is particularly useful for those looking to automate their trading processes.

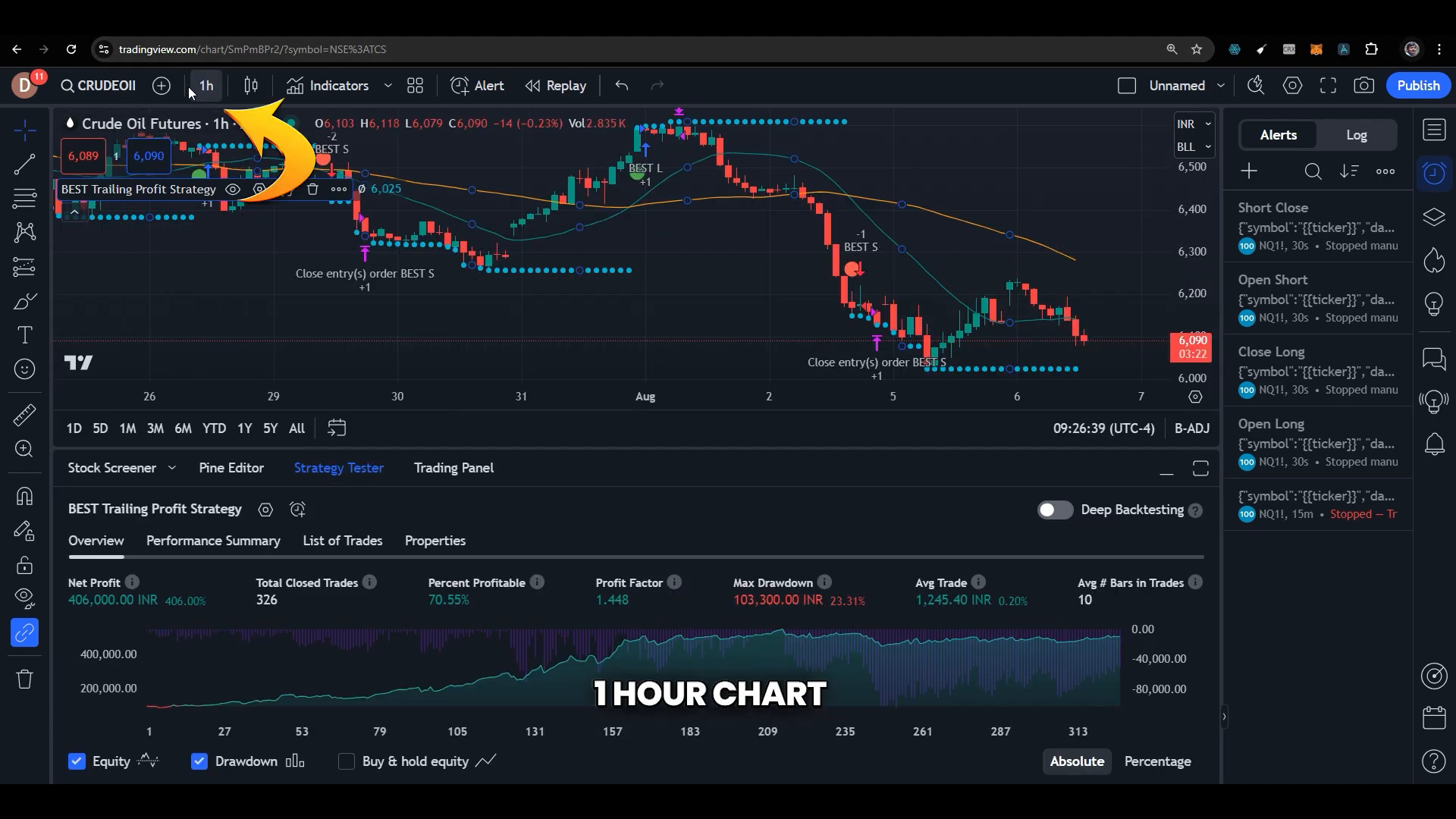

Applying the Strategy to Crude Oil Trading

To demonstrate the effectiveness of the trailing take profit strategy, we applied it to crude oil trading. The initial step involves configuring the settings appropriately. Traders can adjust the take profit trigger to suit their specific trading symbols. For instance, when analysed on a one-hour chart, the results indicate a substantial profit potential.

During our analysis, we observed that a profit of approximately 400k could be generated with an accuracy rate of around 70%. This level of accuracy, combined with a risk factor of 1.4, indicates that the strategy holds promise for traders seeking reliable returns.

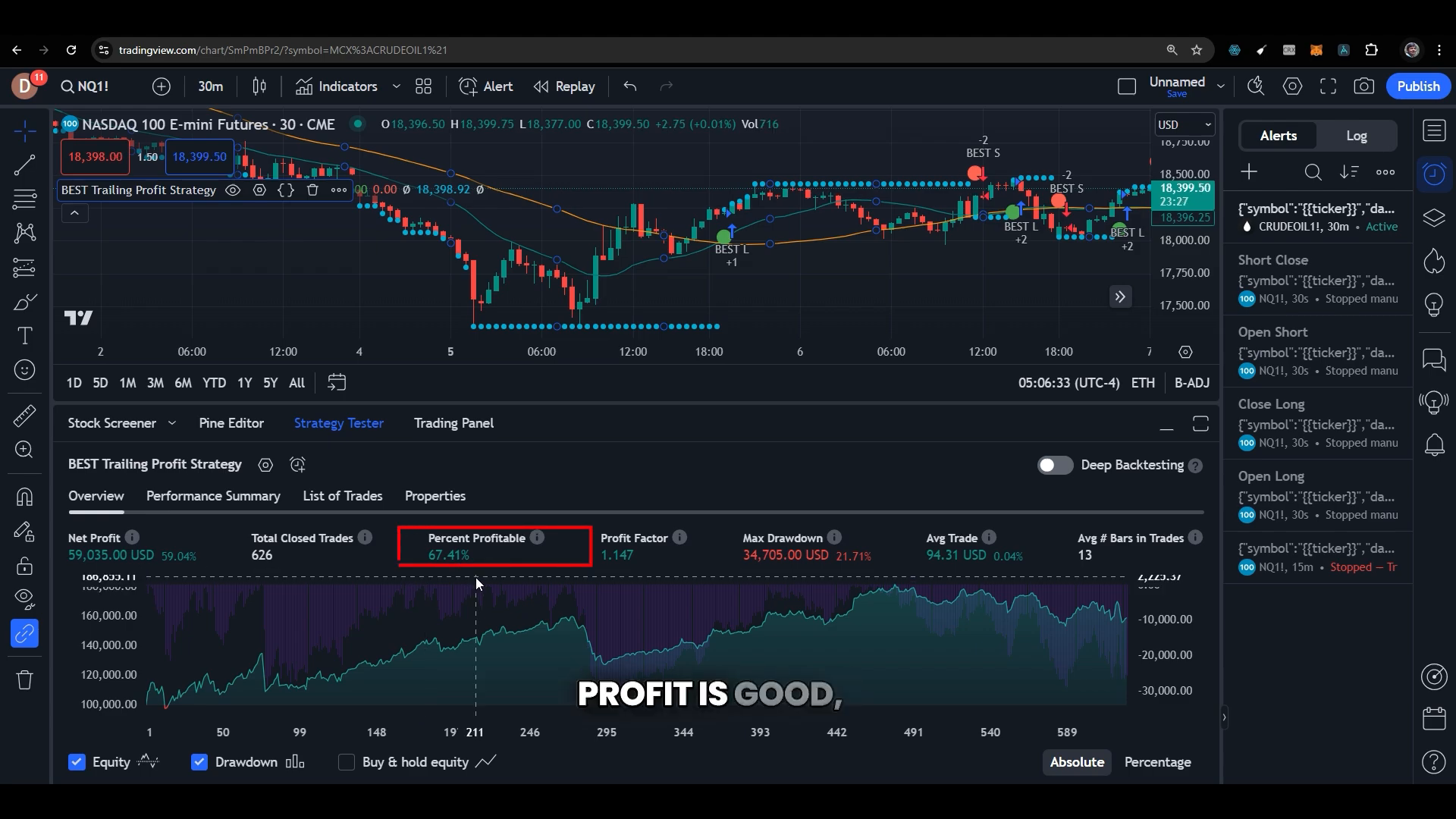

Exploring Different Time Frames

One of the key advantages of this strategy is its adaptability across various time frames. By switching to a 30-minute chart, we found that the percentage profit remained consistent, while the risk factor improved. This flexibility allows traders to optimise their strategies based on market conditions and personal preferences.

As traders experiment with different time frames, they can find the settings that yield the best results. This adaptability is essential for maximising profits while minimising risks.

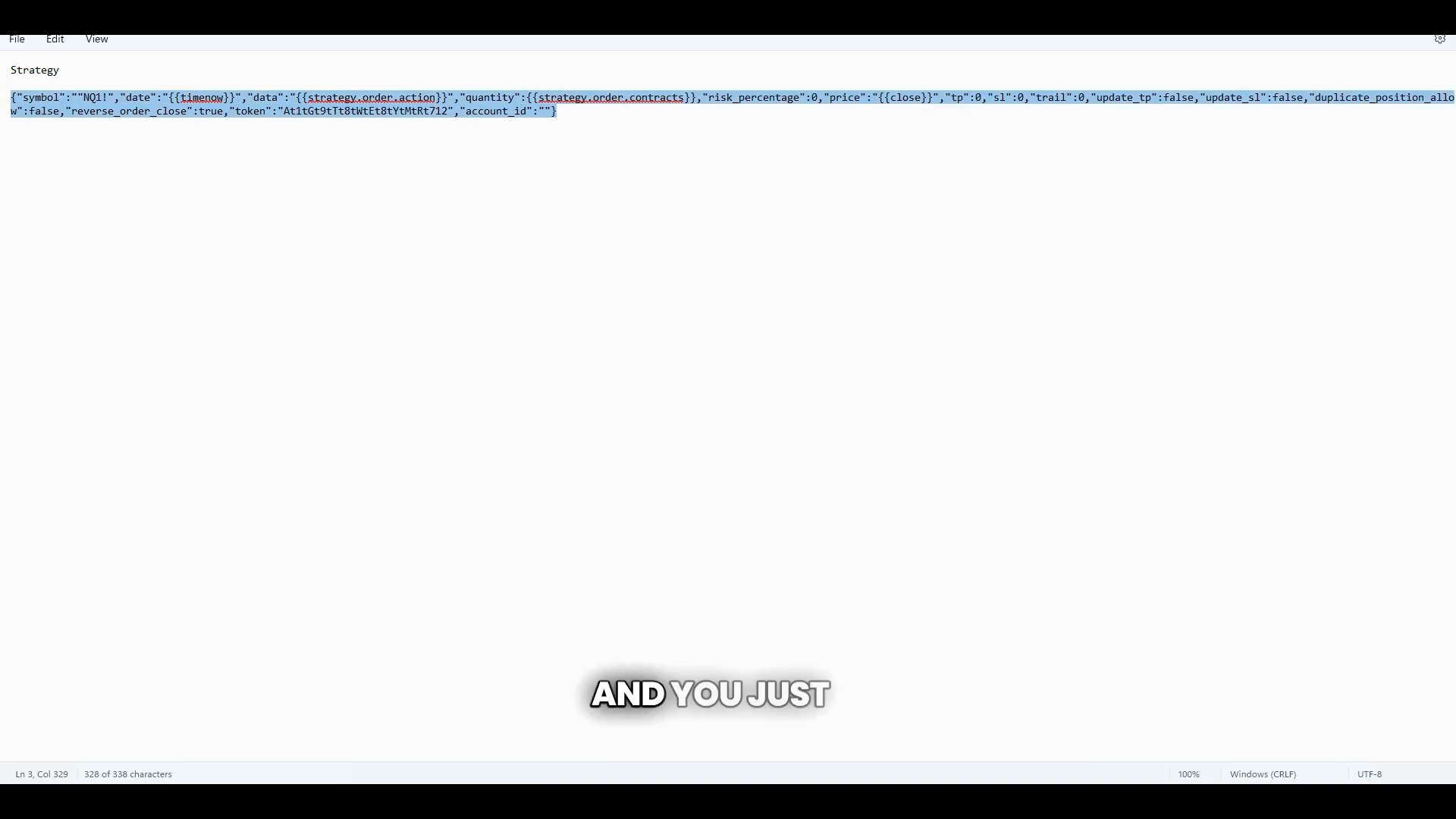

Creating Alerts for Automation

To fully automate the trading process, traders need to create alerts within the PickMyTrade platform. This simple step involves selecting the desired strategy and setting up alerts based on specific criteria. For example, to set up an alert for crude oil trading, traders can copy a predefined alert format and insert their unique token.

Once the alert is activated, trades will be automatically executed based on the defined parameters. This automation reduces the need for constant monitoring, allowing traders to focus on other aspects of their trading strategies.

Performance Analysis of Other Instruments

While crude oil trading yielded promising results, it is essential to explore other instruments to gauge the strategy’s versatility. For instance, when testing the strategy with the INQ, we observed decent returns, although the drawdown was slightly higher than with crude oil.

Further analysis on a one-hour frame showed improved net profits and a better profit factor. This indicates that the strategy can be effectively applied across various instruments, making it a valuable tool for traders.

Results with Wheat and Soybean Trading

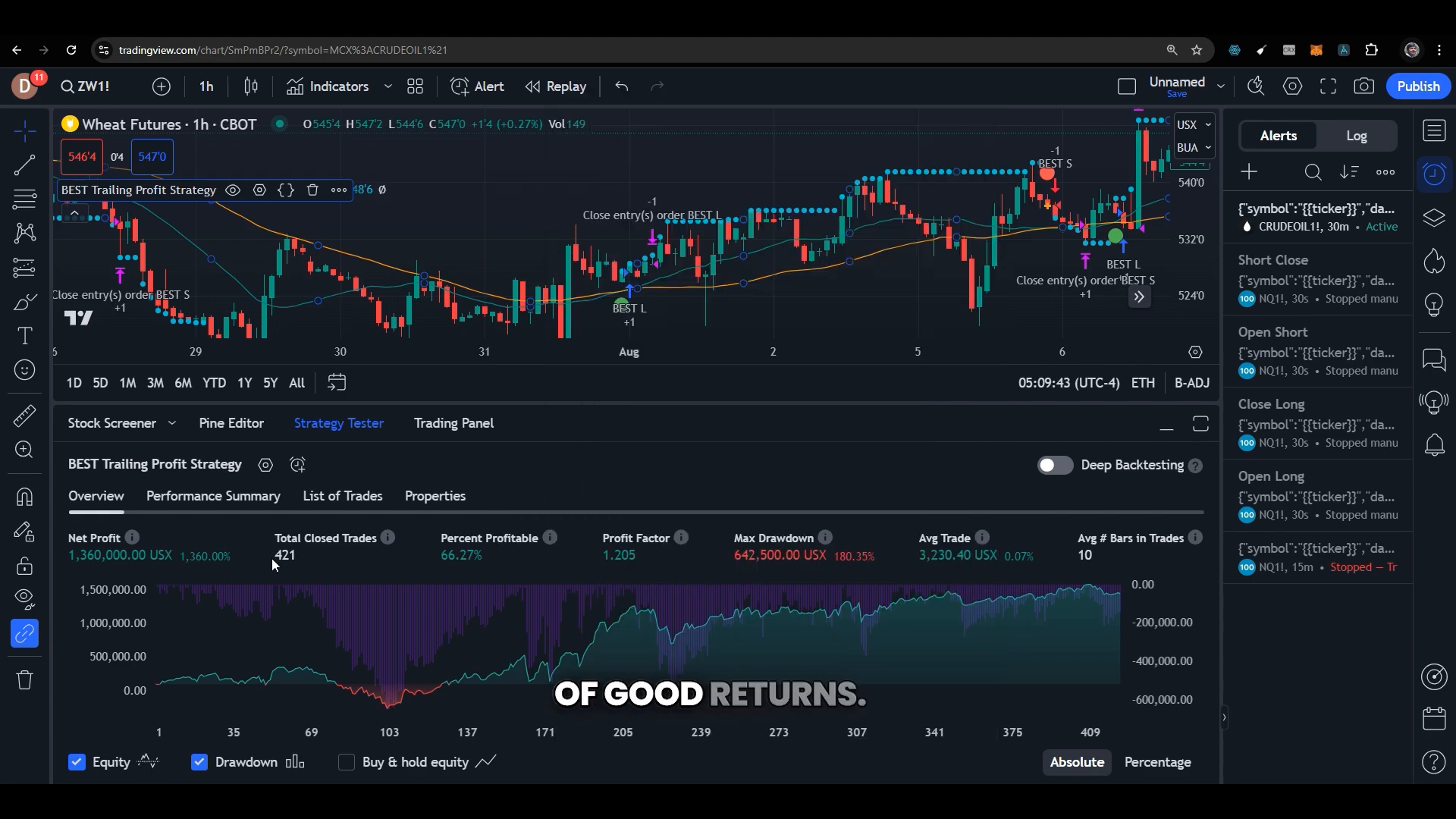

Expanding our analysis, we also tested the strategy with wheat and soybean futures. The results for wheat were particularly impressive, with potential returns exceeding one million. This highlights the effectiveness of the trailing take profit strategy in diverse trading environments.

In contrast, while soybean trading also demonstrated positive returns, the profit factor was lower, and the drawdown was higher. This variance underscores the importance of testing the strategy across multiple instruments to identify the best opportunities.

Conclusion

The trailing take profit strategy is a powerful tool for traders seeking to automate their trading processes. By leveraging the capabilities of PickMyTrade, traders can implement this strategy across various instruments, optimising their returns and managing risks effectively. With the ability to adapt across different time frames and create automated alerts, this strategy opens new avenues for trading success.

Frequently Asked Questions (FAQ)

What is PickMyTrade?

PickMyTrade is a platform that allows traders to automate their trading strategies seamlessly, connecting different trading tools for enhanced performance.

How does the trailing take profit strategy work?

This strategy locks in profits by dynamically adjusting the take profit level as the market moves in favour of the trade, thus maximising potential returns.

Can I use PickMyTrade for different instruments?

Yes, PickMyTrade is versatile and can be applied to various instruments, including crude oil, wheat, soybean, and many others.

Is there a risk involved in using automated trading strategies?

As with any trading strategy, there are inherent risks. It’s essential to backtest strategies and consult with financial advisors before investing.

How can I learn more about trading strategies?

For more insights, you can check out additional resources on YouTube, such as this video that explains various trading strategies.

For those interested in further exploration of trading, consider visiting HFT Solution for more educational content.

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.