In the world of trading, having a solid strategy can make all the difference. One such strategy that has gained popularity is the 5 EMA (Exponential Moving Average) strategy. This method is straightforward yet powerful, allowing traders to capitalize on price movements effectively. Whether you are a seasoned trader or just starting, understanding this strategy can enhance your trading skills.

Understanding the Basics of EMA

Before diving into the 5 EMA strategy, it’s essential to grasp what an EMA is. The Exponential Moving Average is a type of moving average that places greater significance on the most recent price data. This makes it more responsive to short-term price movements compared to a Simple Moving Average (SMA).

In essence, while the SMA averages price data over a specific period, the EMA reacts faster to price changes, making it a preferred choice for many traders.

Setting Up the 5 EMA Strategy

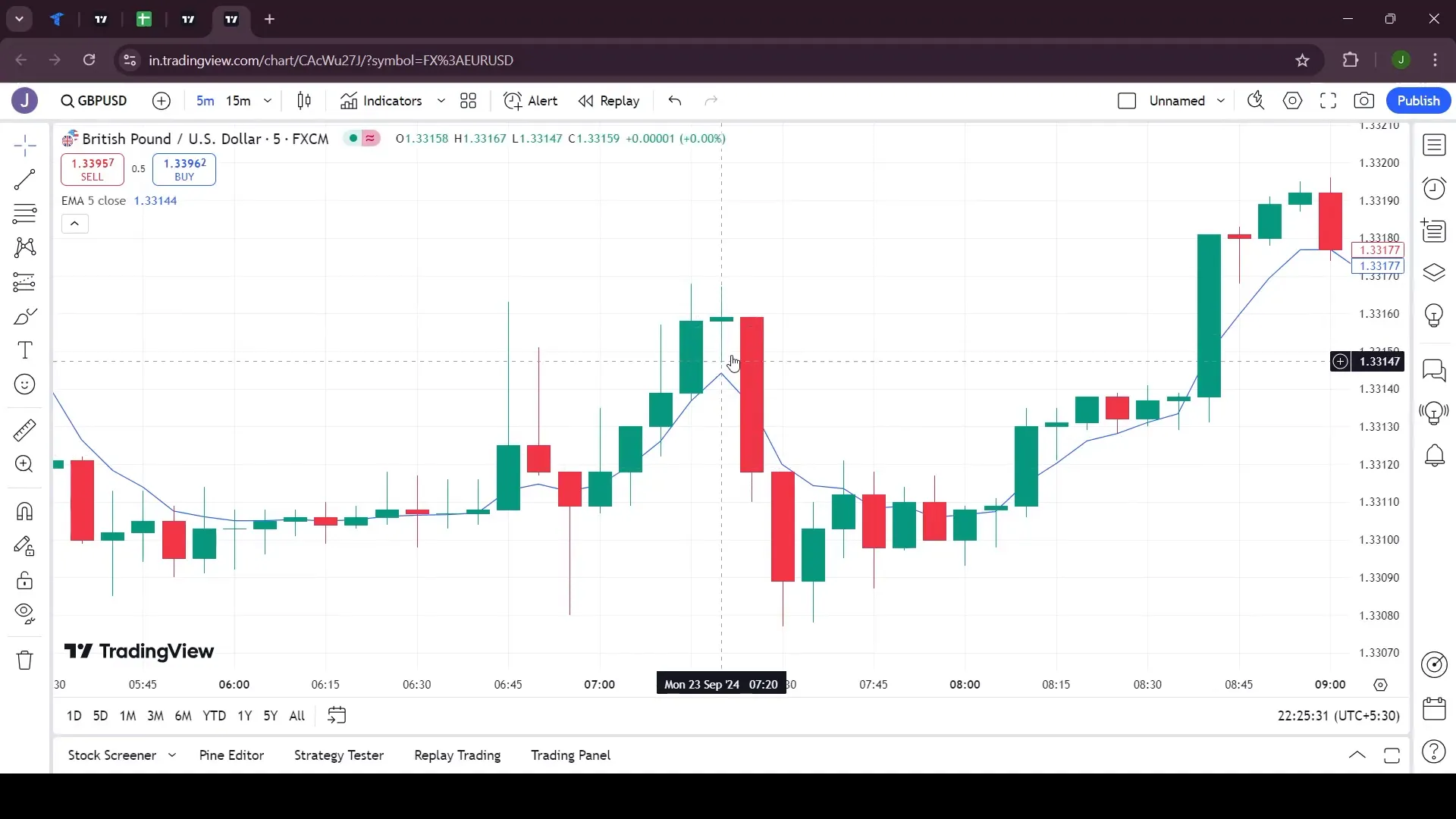

To implement the 5 EMA strategy, you’ll first need to set up your chart. For this example, we will use the British Pound on a five-minute timeframe. Here’s how to do it:

- Open your trading platform, like TradingView.

- Select the 5-minute timeframe for your chart.

- Add the Exponential Moving Average indicator and set the period to 5.

This setup will allow you to identify potential trading signals based on the price action relative to the 5 EMA line.

Executing Sell Trades with the 5 EMA

When looking to short or sell, the strategy involves two key components: the alert candle and the activation candle. Here’s the step-by-step process:

- Identify an alert candle that closes above the 5 EMA line, ensuring that no part of the candle touches the EMA.

- Wait for the next red candle, which should touch the 5 EMA line; this is your activation candle.

- Enter the trade by placing your order at the high of the alert candle.

- Set your stop loss at the low of the activation candle.

- Aim for a risk-reward ratio of 1:3.

This approach helps you capitalize on price drops after the alert candle indicates a potential reversal.

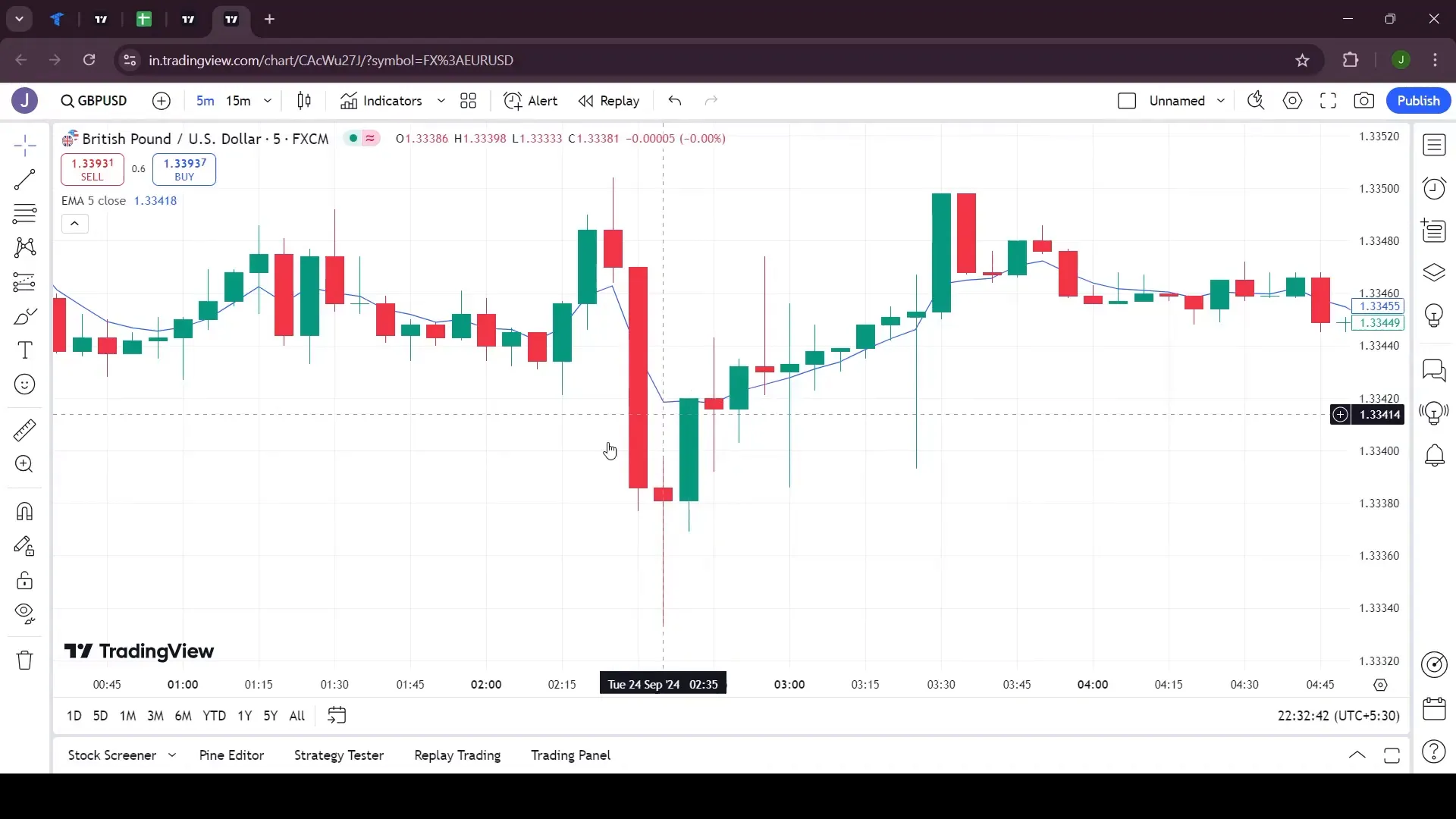

Executing Buy Trades with the 5 EMA

For buy trades, the process is quite similar but in reverse:

- Identify an alert candle that closes below the 5 EMA line without touching it.

- Wait for the next green candle to touch the 5 EMA; this becomes your activation candle.

- Enter the trade at the low of the alert candle.

- Set your stop loss at the low of the alert candle.

- Aim for a risk-reward ratio of 1:3.

This method allows you to take advantage of price increases following a confirmed signal from the EMA.

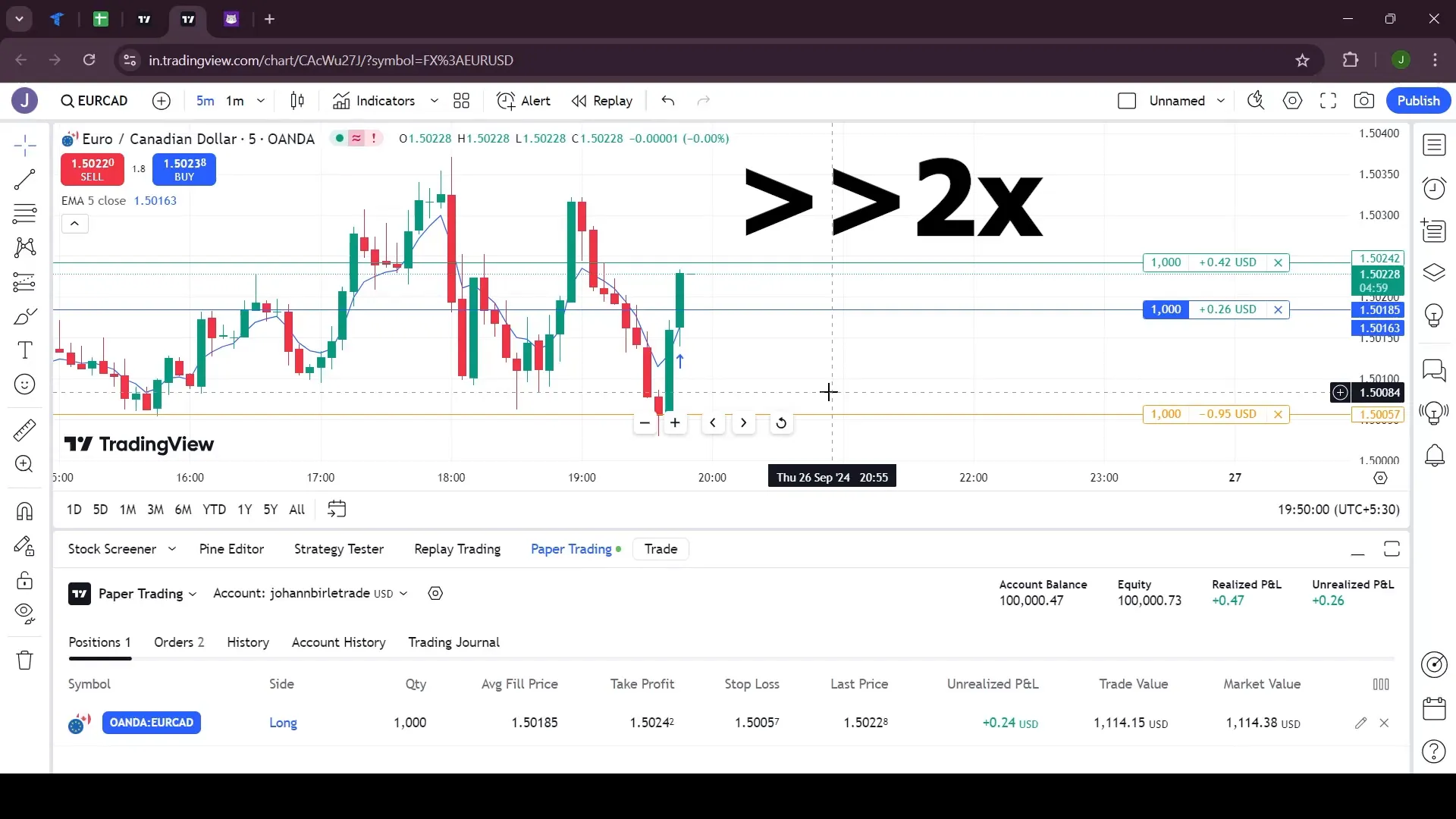

Real-Time Trading Example

Let’s look at a practical example of trading using the 5 EMA strategy. Imagine you are monitoring the market and identify a potential buying opportunity:

- You place an order at a specific price based on your analysis.

- Set your stop loss to manage risk effectively.

- As the market moves in your favor, adjust your take profit level accordingly.

In this scenario, the trade executes successfully, and you achieve a profit that aligns with your target risk-reward ratio.

Key Tips for Success with the 5 EMA Strategy

To maximize your success with the 5 EMA strategy, consider these essential tips:

- Respect Your Stop Loss: Always set your stop loss at the appropriate levels based on the alert or activation candle to minimize losses.

- Be Patient: Sometimes, waiting for the perfect activation candle is necessary. Don’t rush into trades.

- Aim for Consistent Risk-Reward Ratios: Target at least a 1:3 reward ratio to ensure long-term profitability, even if some trades result in losses.

Remember, no trading strategy is foolproof. However, with discipline and careful execution, you can achieve consistent profits over time.

Conclusion

The 5 EMA trading strategy is a powerful tool for traders looking to enhance their trading performance. By understanding how to identify alert and activation candles and executing trades with a clear plan, you can improve your chances of success. As you implement this strategy, remember to stay disciplined, manage your risks, and continuously refine your approach based on market conditions.

For those interested in automating their trading strategies, you can explore automated solutions available at PickMyTrade. These tools can help streamline your trading process and make it more efficient.

Happy trading!

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.

Do you suggest trading slope and direction of 5 ema for trading with the trend.For example one could also insert 3 ema on the sme chart.Basically 3 ema denotes line chart of the price.When 3 ema is above 5 ema then trend is up & if slope of both emas’ is up,it is safe to buy.In 3 ema 87% of weight is contributed by last 3 candles–thus 3 ema is line price chart with little delay.These emas’ on weekly chart will show longer time period trend with out any fancy calculations/analysis