In the world of automated trading, alerts play a crucial role in executing trades based on predefined conditions. This guide will delve into the alert section of automated trading, explaining the components that make up an alert and how they function together for effective trading. Whether you’re using TradingView or another platform, understanding these components is essential for successful trading strategies.

What is an Alert?

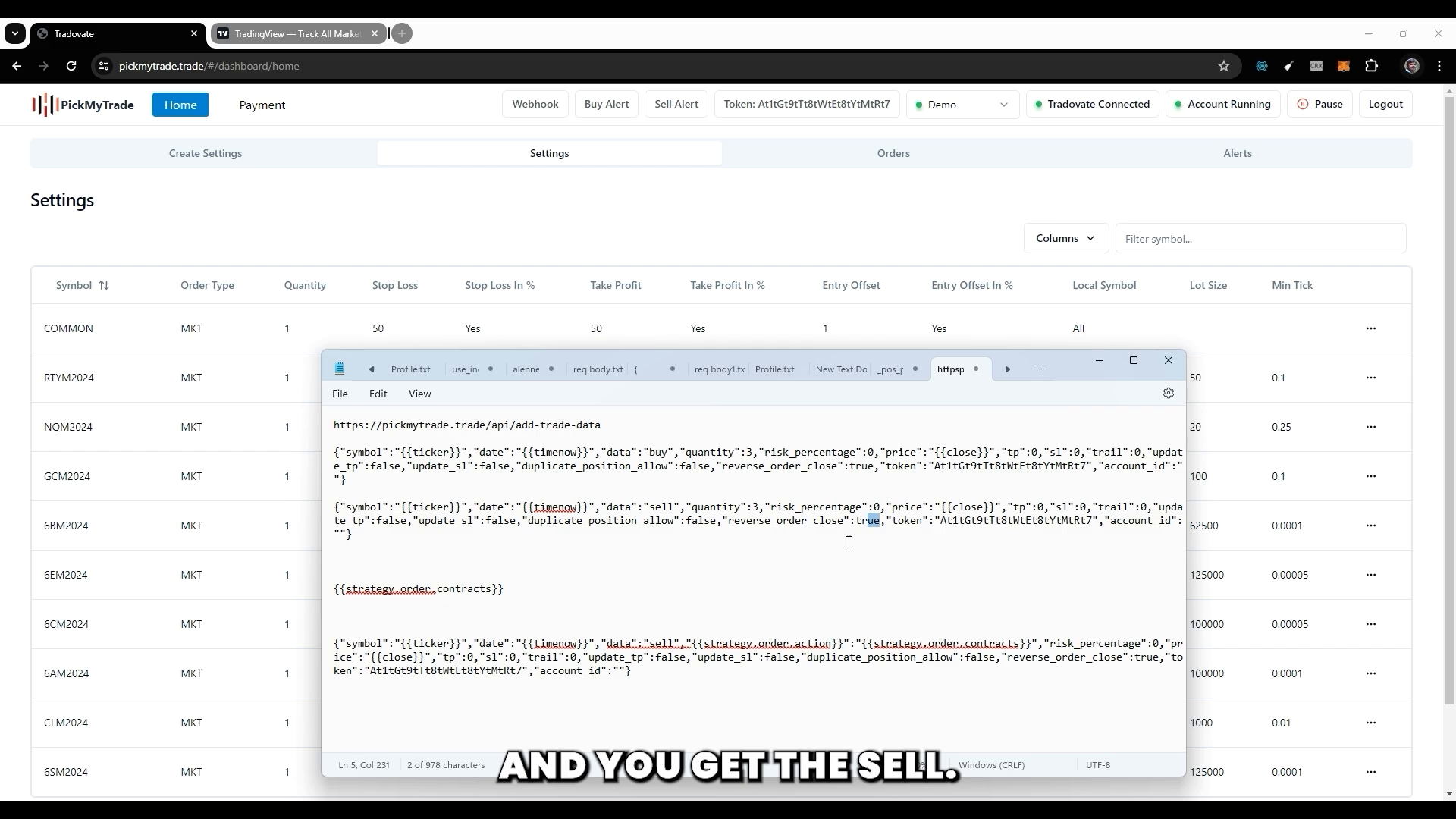

An alert in trading is essentially a notification that prompts action based on specific market conditions. This guide will focus on how to create and configure alerts effectively. The alert system allows traders to automate their strategies, ensuring that trades are executed at the right moment without the need for constant monitoring.

Components of an Alert

Alerts consist of several key components that dictate how and when they are triggered. Each component must be properly configured to ensure that the alert functions as intended. Here are the primary elements of an alert:

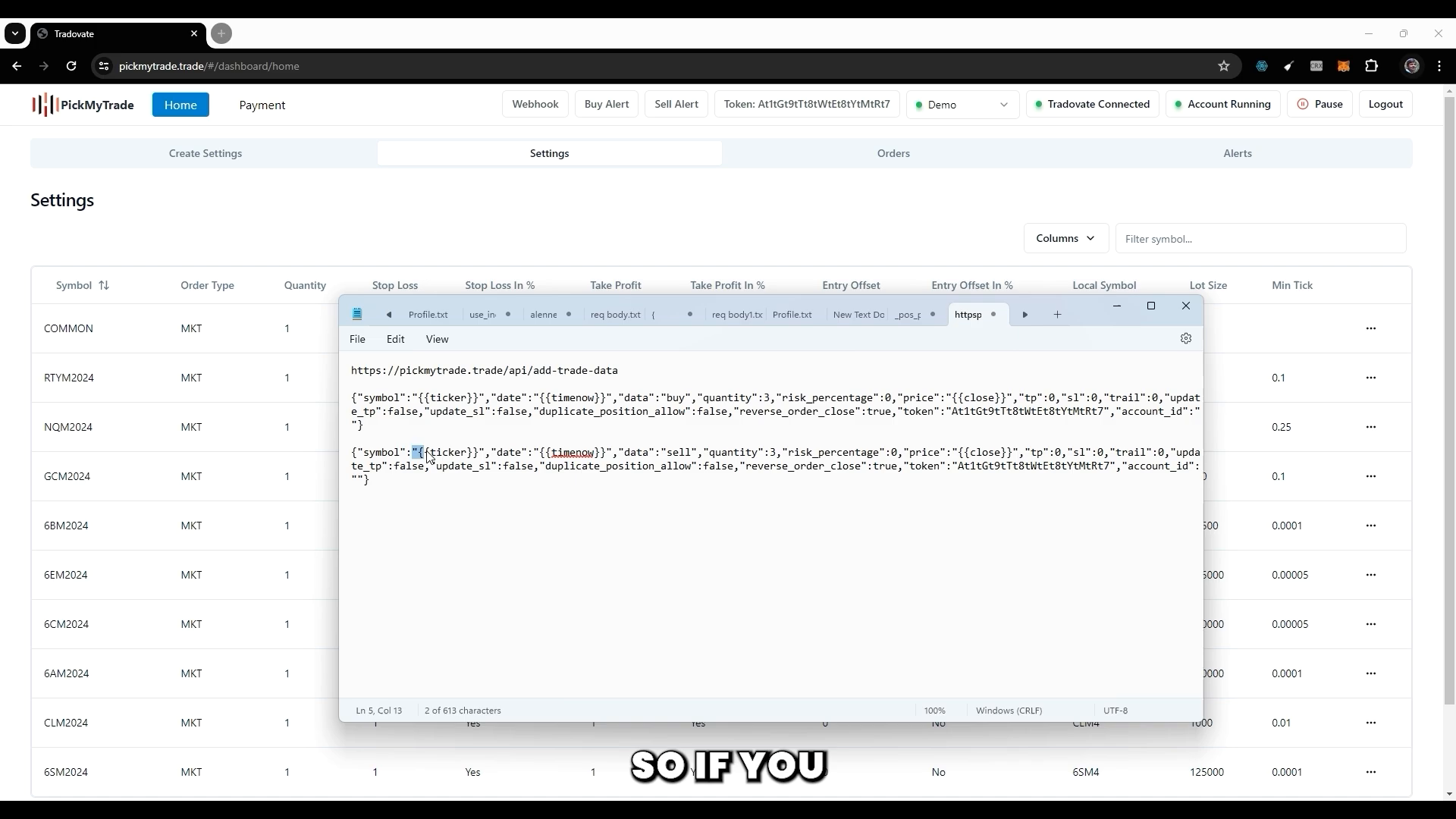

- Symbol: This represents the asset you are trading. When using TradingView, the symbol can be automatically pulled from the ticker in use. It’s crucial to ensure that there is a mapping for the ticker to be valid.

- Date/Time: This can be set to “time now,” which retrieves the current time from TradingView. This is a static value that marks when the alert was generated.

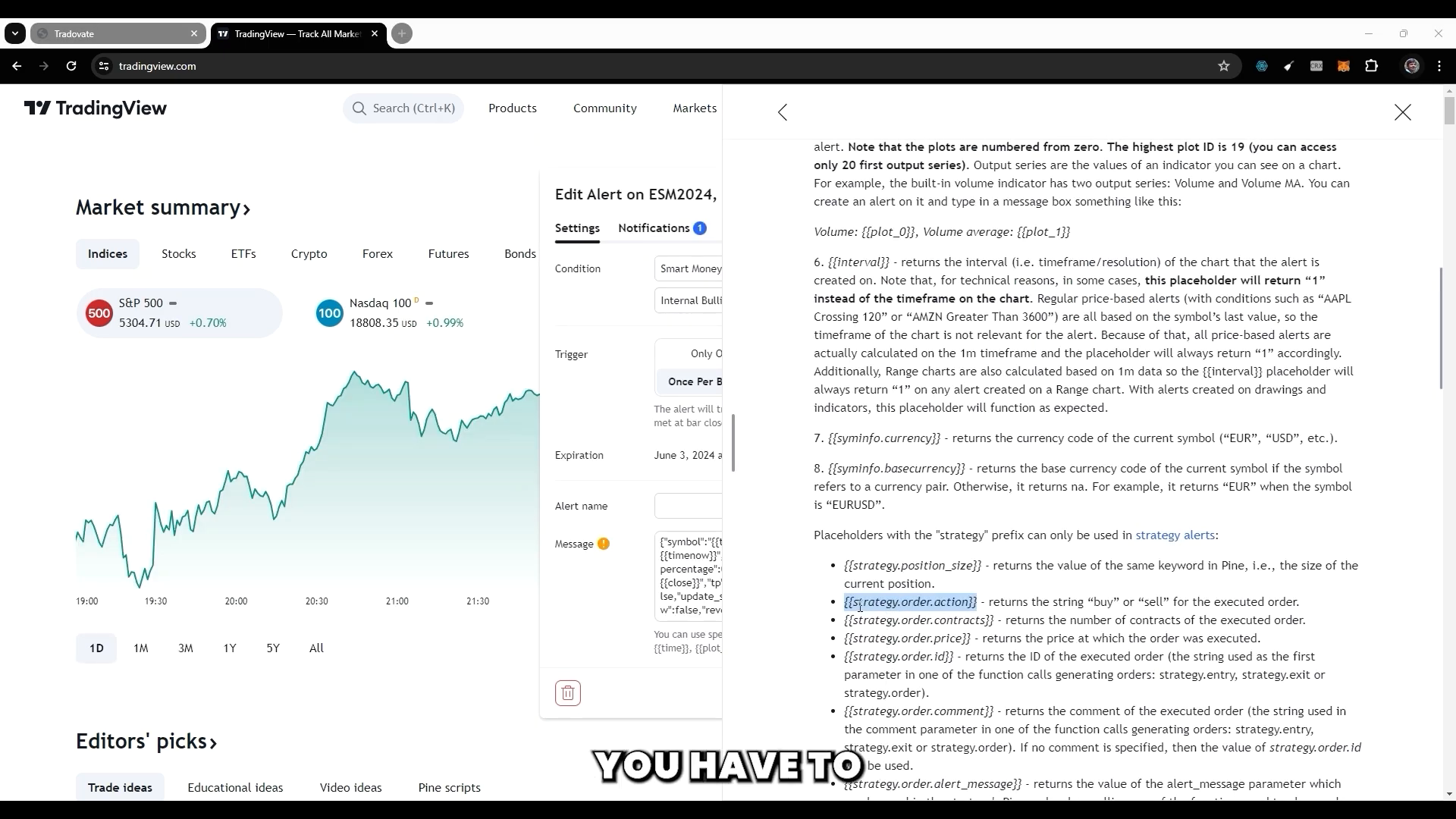

- Data: This includes the action you want to take – buy, sell, or close a position. Depending on whether you are using a strategy or an indicator, the action may vary.

Setting Up the Symbol

The symbol is the foundation of your alert. If you are trading a continuous contract, you must ensure that the symbol exists in your system. Without the correct mapping, the alert will not function correctly. Always verify that the symbol is recognized by your trading platform.

Defining Actions in the Alert

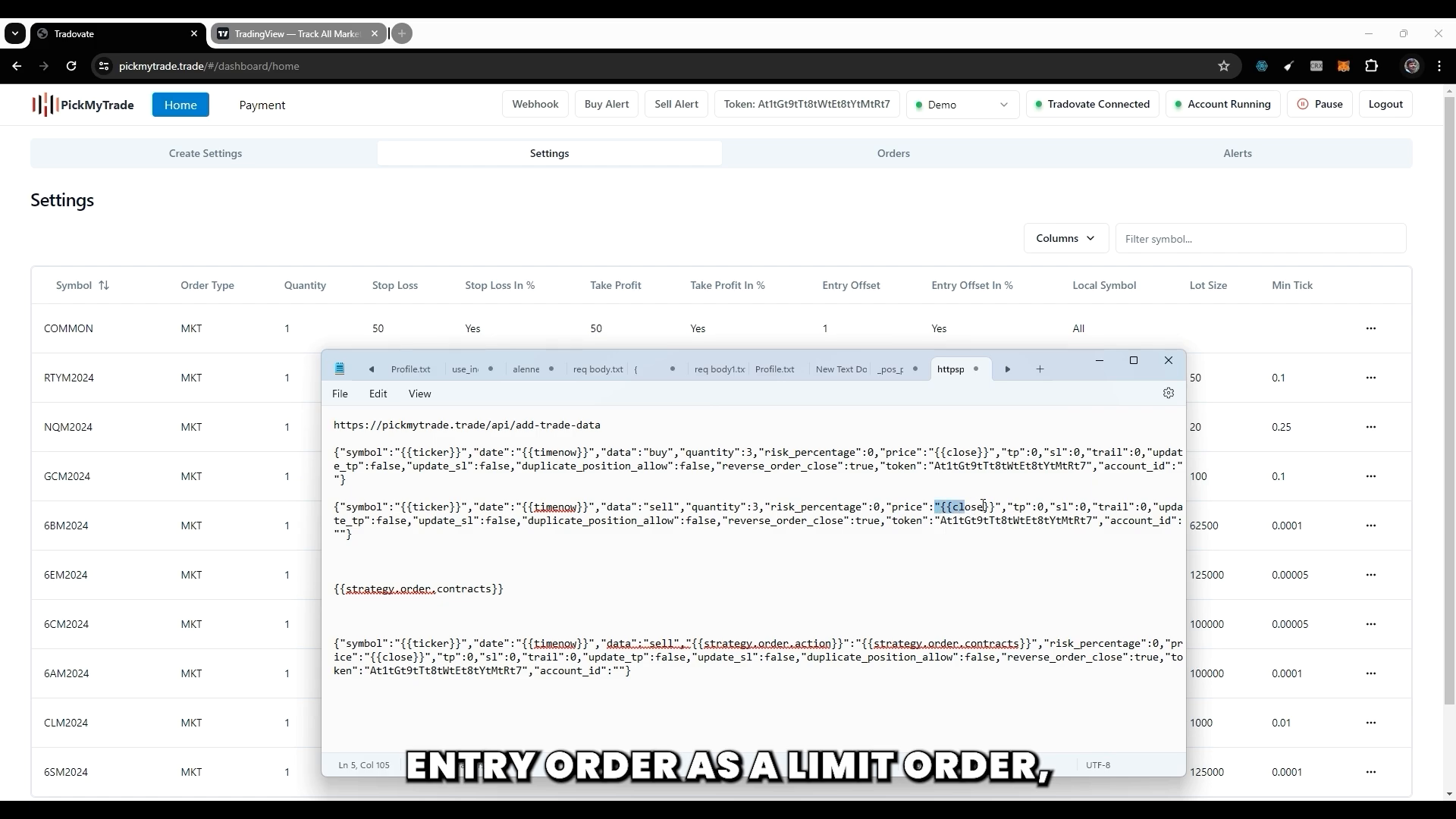

When creating an alert, you need to specify the action you want to take. If you are running a trading strategy, the action can be pulled from the strategy’s order settings. However, if you are working with an indicator, you must explicitly define whether the action is a buy or sell.

Defining Quantity in Alerts

Quantity is another critical aspect of alerts. You have two primary options for defining how much of an asset to trade:

- Absolute Quantity: This allows you to specify a fixed number of units to buy or sell.

- Absolute Lot: Alternatively, you can define the quantity based on lots. This is useful for larger trades where you want to manage risk more effectively.

For example, if you set the quantity to “2,” the alert will execute a buy or sell of two units based on the incoming data. If you are employing a strategy, you would typically refer to the strategy’s order contracts to determine the quantity.

Calculating Risk and Stop-Loss

Managing risk is vital in trading, and alerts can be configured to include risk management parameters. When defining your stop-loss, consider the following:

- Define a risk percentage based on your total account size.

- Set an absolute stop-loss value (e.g., $100) based on your risk tolerance.

For instance, if your account balance is $1,000 and you are willing to risk $10 per trade, you would set your stop-loss accordingly. The alert will then calculate the quantity of units to trade based on your risk parameters, ensuring that you do not exceed your set risk limit.

Price Settings in Alerts

Another critical setting in alerts is the price at which to execute trades. This includes:

- Current Close Price: This is the last price at which the asset traded. It is used to calculate stop-loss levels and take profits.

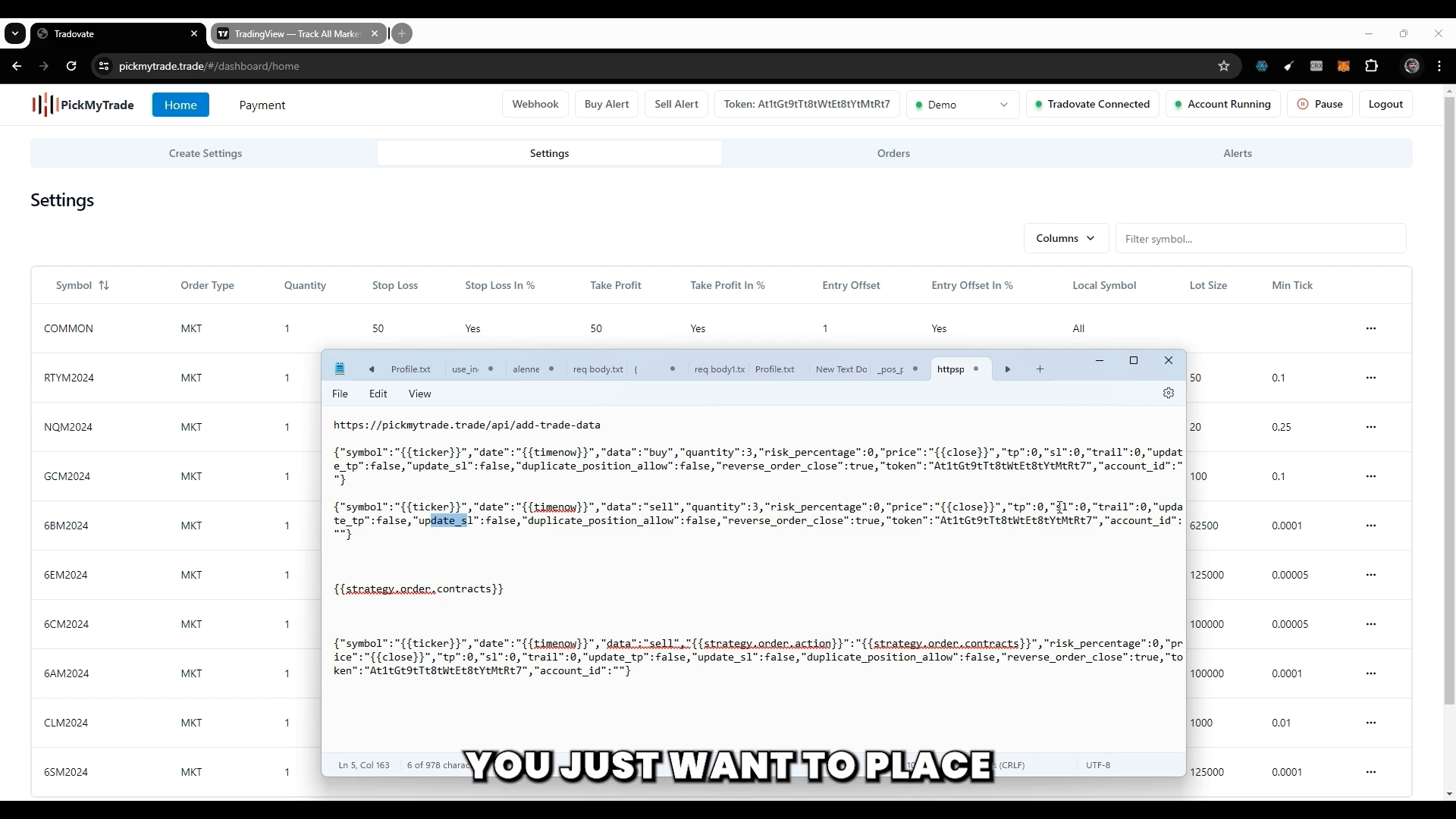

- Entry Order Price: If you wish to place a limit order, you need to specify the exact price at which you want the order to be executed.

When setting a take profit, you should input the exact value you want to achieve. If this is not specified, the alert will reference the settings defined in your trading strategy.

Updating Orders and Position Management

Alerts can also be configured to update existing orders rather than placing new ones. This is particularly useful for managing take profits and stop-losses:

- Update Take Profit: If you want to modify the take profit for an open order, you can set the update TP parameter to true and specify the new value.

- Update Stop-Loss: Similarly, if you wish to change the stop-loss, you can adjust the SL with the new value.

By allowing updates, you can effectively manage your trades without needing to create new orders, streamlining your trading process.

Handling Multiple Positions

When trading, you may encounter situations where you want to allow or prevent duplicate positions. The default setting is to disallow duplicate positions. However, you can change this based on your trading strategy:

- Duplicate Position Allow: Set this to true if you want to allow multiple trades for the same position.

- Reverse Order Closed Rule: This feature enables the closure of an existing position if an opposing alert is received. For example, if you have a buy position and receive a sell alert, the buy position will be closed before the sell is executed.

This flexibility allows traders to adapt to market conditions dynamically and manage their positions effectively.

Token and Account Management

Every alert also includes a unique token that identifies your account. This token is essential for ensuring that alerts are executed correctly on the intended account:

- Token: This is your unique identifier for the account, and it is automatically generated.

- Account ID: If you have multiple accounts, you can specify which account to trade through. If not specified, the alert will default to the latest account associated with your trading platform.

By managing tokens and account IDs effectively, you can execute trades across different accounts without confusion.

Conclusion

Understanding the alert section of automated trading is crucial for executing successful trading strategies. By configuring alerts correctly, traders can automate their trades, manage risk, and react swiftly to market changes. Each component—from symbols and actions to risk management and account settings—plays a vital role in the overall effectiveness of your trading strategy.

As you practice and refine your alert settings, you’ll find that automation can significantly enhance your trading efficiency. Whether you’re a beginner or an experienced trader, mastering alerts will empower you to make informed trading decisions with confidence.

I always spent my half an hour to read this webpage’s content daily along with a cup of coffee.