Welcome to a deep dive into a powerful trading strategy known as the Inside Candle Strategy. This approach is not just for seasoned traders; it’s accessible for newcomers as well. By understanding how to identify inside candles, you can leverage their potential for breakouts or reversals in the market.

Understanding Inside Candles

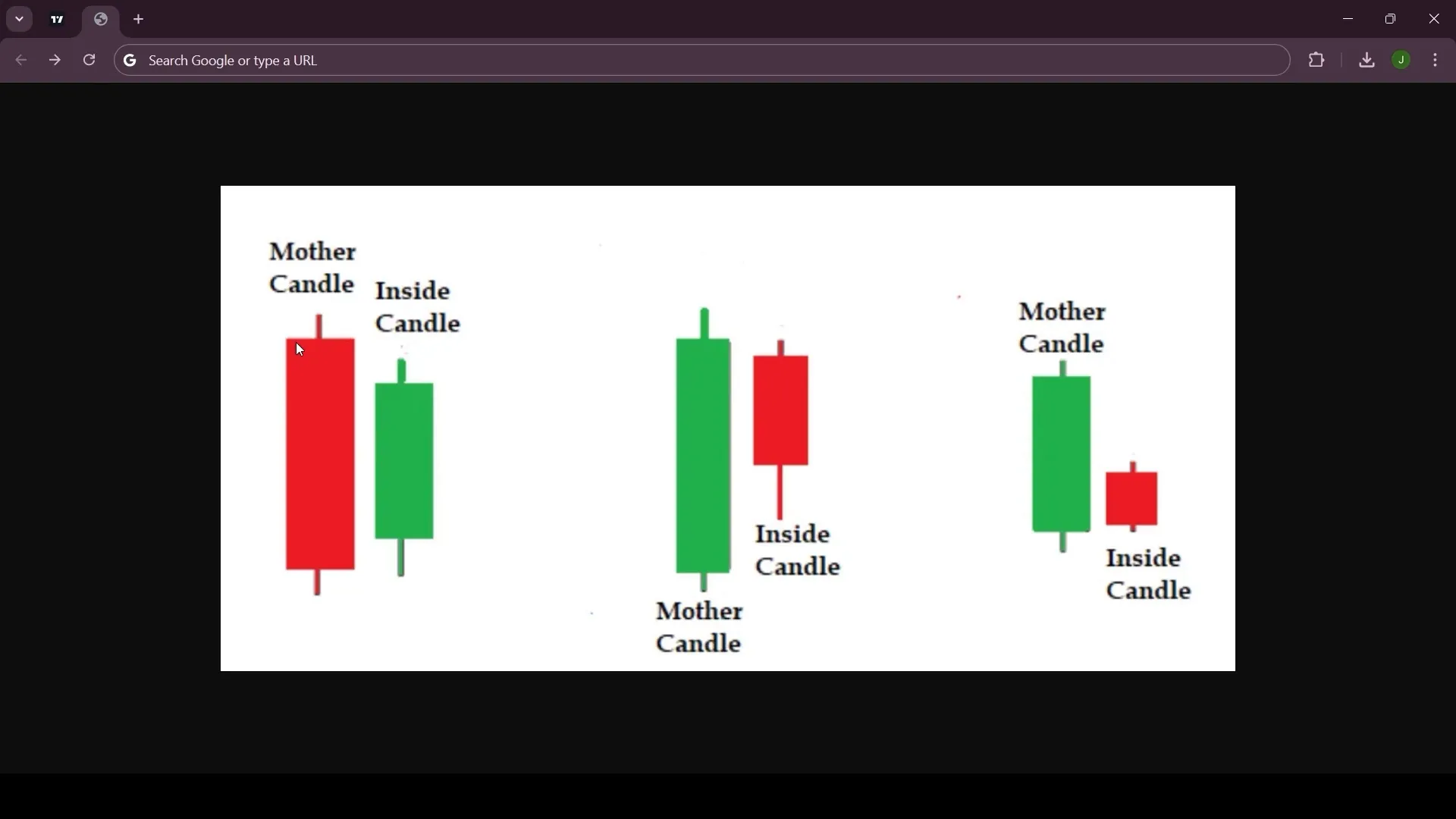

So, what exactly is an inside candle? In simple terms, it’s a two-candle pattern where the second candle, known as the inside candle, is completely contained within the range of the previous candle, called the mother candle. This means that the inside candle has a lower high and a higher low than the mother candle. It often indicates a period of market consolidation, akin to a pause before the next significant market move.

Recognizing Patterns

Inside candles can appear at critical points in the market and typically signal one of two scenarios: a breakout in the direction of the current trend or a reversal at a significant support or resistance level. Understanding where these patterns form is essential for effective trading.

How It Works

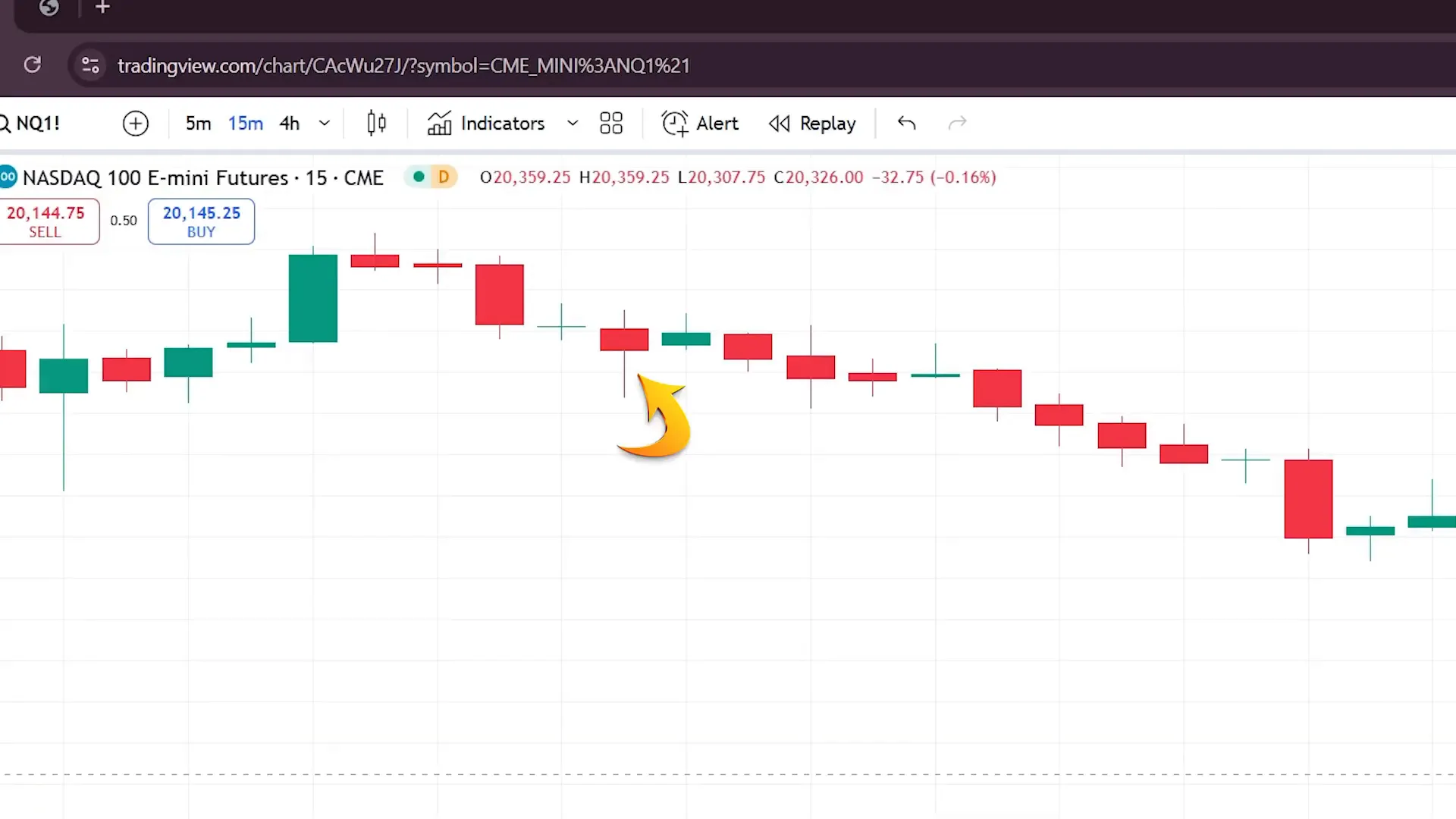

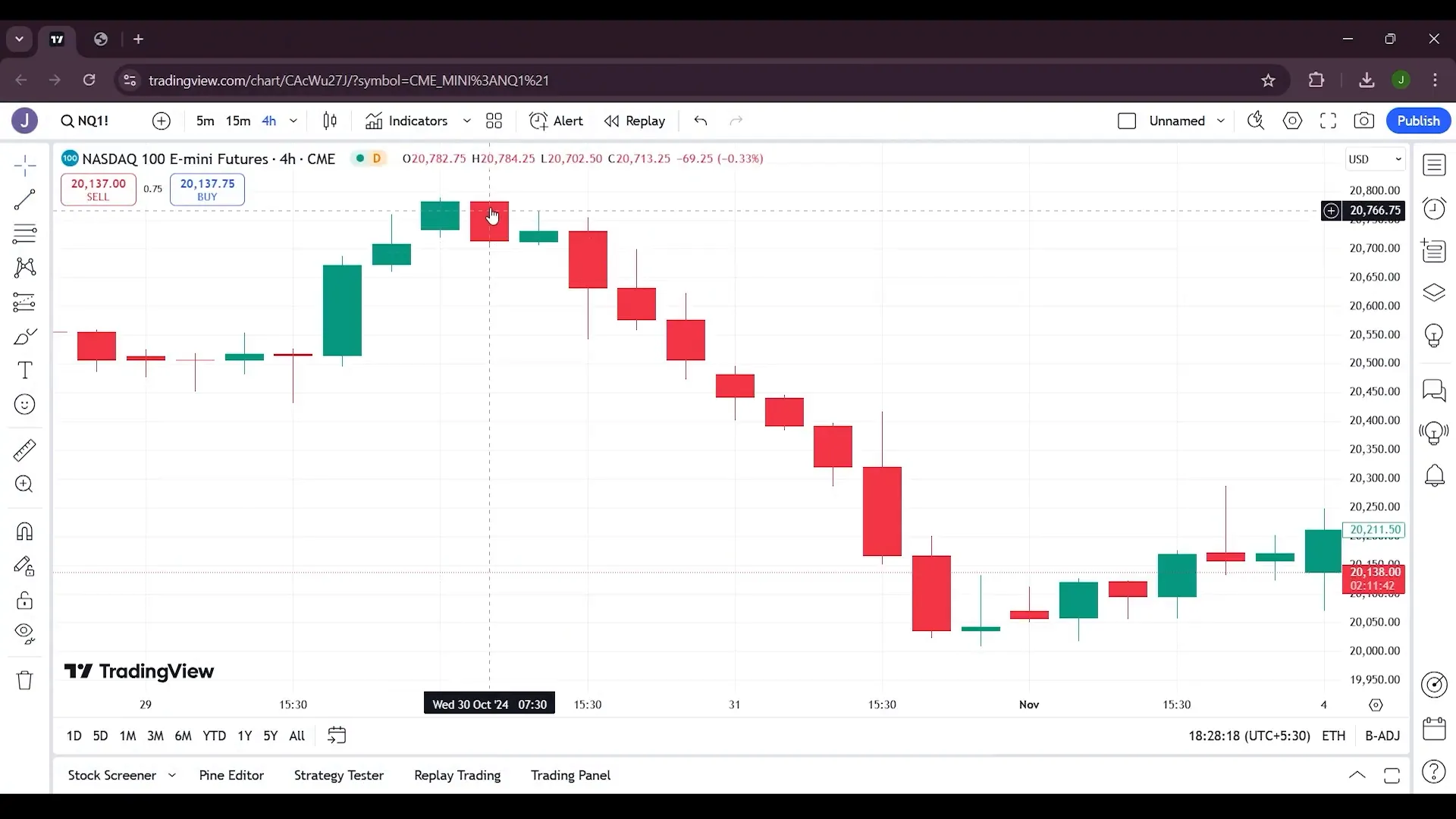

Let’s explore how to implement this strategy using a trading platform. For instance, you can utilize TradingView and apply this strategy on a 15-minute timeframe. Here’s a step-by-step breakdown of how it operates:

Step-by-Step Strategy

- Identify the mother candle, which is the larger candle that precedes the inside candle.

- Locate the inside candle (the smaller candle) that fits within the range of the mother candle.

- Take your position based on the lower wick of the inside candle, placing a stop loss at the upper wick.

This setup allows for a clear risk management strategy. If the market moves in your favor, you will see profits, but if it goes against you, your stop loss will limit your losses.

Interpreting Market Signals

It’s crucial to note the color and implications of the mother candle. If the mother candle is red, it signals a potential downward trend post-consolidation. Conversely, if the mother candle is green, it suggests an upward movement following the consolidation.

Finding Similar Patterns

When identifying these candles, consistency is key. Look for red mother candles followed by inside candles, indicating possible market consolidation before a downward move. Similarly, green mother candles followed by inside candles can signal potential upward movements.

Optimal Timeframes

This strategy works well on multiple timeframes, but it’s particularly effective on the 15-minute and 4-hour charts. The optimal entry point is just below the inside candle or baby candle. This positioning helps capture the breakout while controlling risk.

Advantages of the Inside Candle Strategy

Why should you consider using the inside candle strategy? Here are some compelling reasons:

- Strong Risk-Reward Ratio: It provides a favorable risk-reward ratio, allowing for tight stop losses and clear entry points.

- Capturing Breakouts: By using this strategy, you can catch strong breakouts without exposing yourself to significant risk.

- Simple Yet Effective: The simplicity of the strategy makes it easy to implement, even for novice traders.

Conclusion

In summary, the inside candle strategy is a straightforward yet powerful method to identify potential breakouts or reversals in the market. By learning to spot these patterns and understanding their implications, you can enhance your trading strategy significantly. Whether you’re a beginner or an experienced trader, incorporating this technique into your trading arsenal can lead to more informed decisions and improved trading outcomes.

For those looking to automate their trading strategies, consider exploring PickMyTrade’s automated trading solutions. With expert strategies and real-time insights, you can optimize your investments efficiently.

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.