Futures trading can be intricate, but having the right strategies and tools can streamline the process significantly. In this guide, we will explore the most effective methods for executing futures trades using the Tradovate platform. From identifying entry signals to managing trades efficiently, we will cover everything you need to know to enhance your trading experience.

Understanding the Basics of Futures Trading

Before diving into execution strategies, it’s essential to grasp the fundamentals of futures trading. Futures contracts are agreements to buy or sell an asset at a predetermined future date and price. Traders use these contracts to speculate on the price movements of various assets, including commodities, currencies, and indices.

One of the primary advantages of trading futures is the ability to leverage your investments. This means that you can control a larger position with a smaller amount of capital. However, leverage also increases risk, making it crucial to have a solid trading plan in place.

Optimal Execution Strategy in Tradovate

Executing trades quickly and efficiently is vital for success in futures trading. In Tradovate, there are several methods to achieve this, particularly focusing on signal candles and the Depth of Market (DOM) feature.

Identifying Signal Candles

The first step in executing a futures trade involves identifying a signal candle on your chart. A signal candle typically indicates a potential reversal or continuation in price movement. Traders often look for specific patterns or indicators, such as the Volume Weighted Average Price (VWAP), to confirm their entry points.

For example, when you spot a signal candle forming near the VWAP, it may indicate a strong buying or selling opportunity. Once this signal is confirmed, you can prepare to place your order.

Placing Your Order

After identifying a signal candle, the next step is to place a buy limit order. This is done by selecting the number of contracts you wish to trade (e.g., four contracts) and setting your limit order just above the signal candle. Once the price reaches this level, your order will be filled almost instantly.

Following the order placement, it is crucial to manage your trade effectively. Traders often use the DOM to monitor price movements and adjust their positions accordingly.

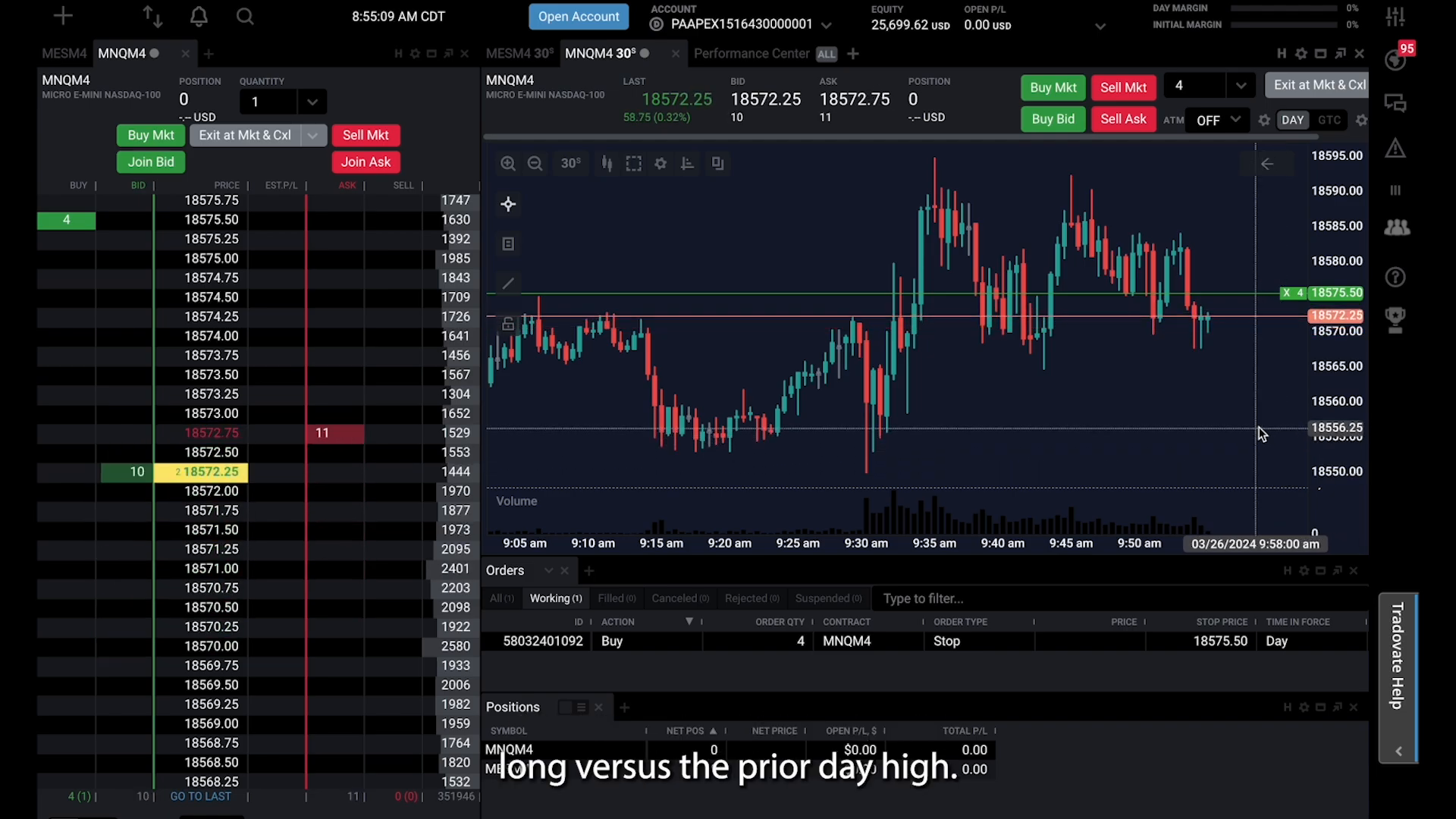

Live Trade Example

Let’s walk through a live trade example to illustrate the execution process in detail. In this scenario, we will consider a simple long trade based on the prior day’s high, as suggested by a trading community member.

Executing the Trade

Once the signal candle is identified, you place a buy order for four contracts above the candle. After the order is filled, you should immediately set a stop order for the same number of contracts to protect your position. This step is crucial as it helps manage risk effectively.

As the price moves in your favor, you can begin offering out contracts in singles as the price increases. This method allows you to lock in profits while still maintaining a position in the market.

Managing Your Position

During the trade, it’s essential to keep an eye on your profit and loss (PnL) estimates. You can adjust your stop orders to break even as the price moves higher, which helps to minimize potential losses. Regularly updating your stop orders based on the latest price action is a key aspect of effective trade management.

If the price reaches a significant resistance level, consider taking partial profits by selling some of your contracts. This strategy allows you to capitalize on the upward movement while still remaining in the trade for potential further gains.

Quick Tips for Effective Execution

Here are some quick tips to enhance your futures trading execution:

- Stay Informed: Keep an eye on economic indicators and news releases that may impact market volatility.

- Practice Patience: Wait for the right signals before entering a trade to avoid impulsive decisions.

- Utilize Technology: Leverage tools and features within the Tradovate platform for better trade management.

- Review Your Trades: After executing trades, take the time to review what worked and what didn’t for continuous improvement.

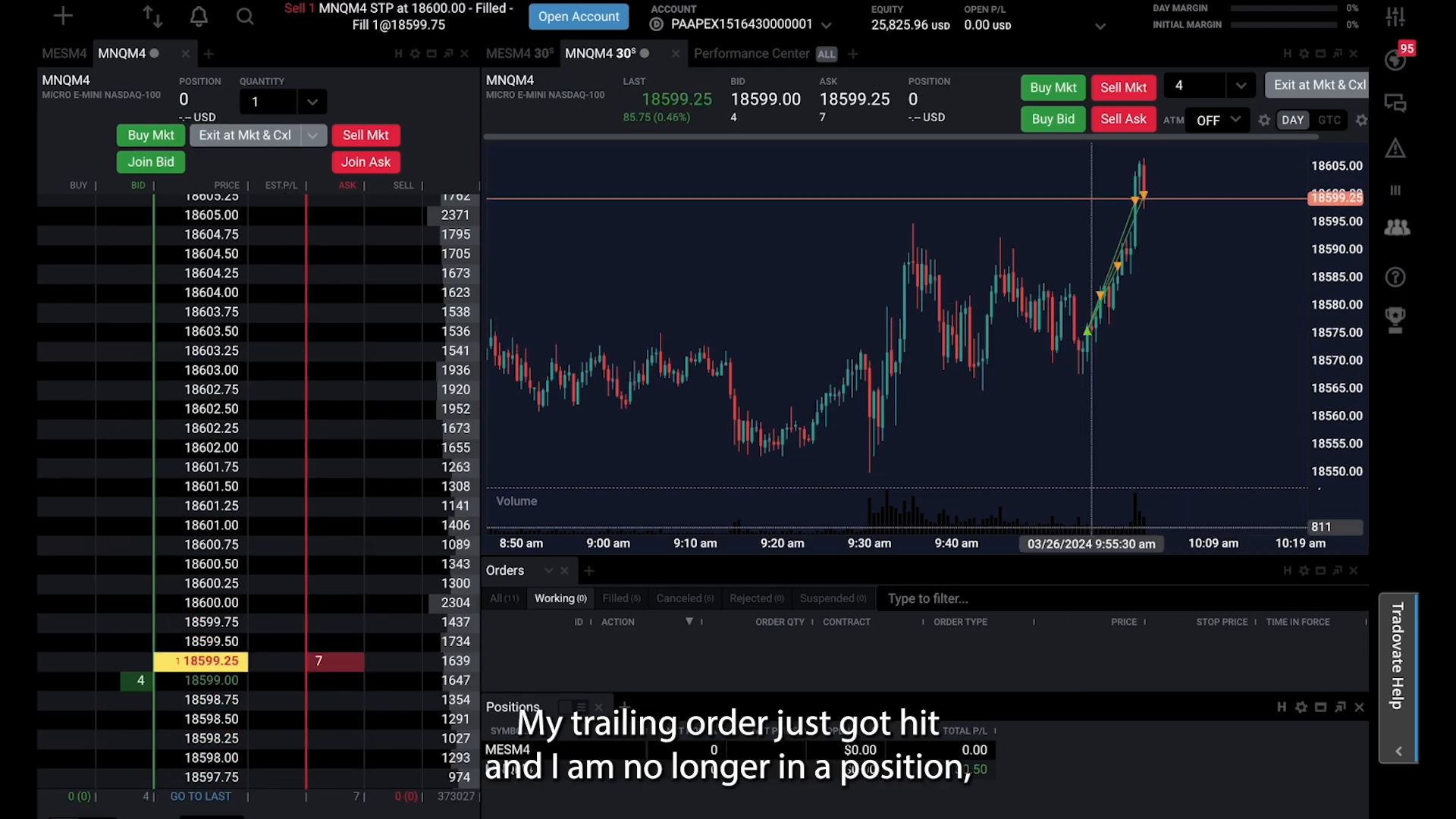

Exiting Your Trade

Knowing when to exit a trade is just as important as knowing when to enter. As you approach your target price or if you notice signs of exhaustion in price movement, it may be time to consider exiting your position.

In the case of our example, once the price starts to show signs of slowing down, you can sell your remaining contracts. Ensure that your working orders are cleared after exiting to avoid unexpected fills when you are not monitoring the market.

PICKMYTRADE

Final Thoughts on Futures Trading Execution

Effective execution of futures trades requires a combination of strategy, market awareness, and the right tools. By identifying signal candles, placing orders strategically, and managing your trades diligently, you can enhance your trading performance on the Tradovate platform.

Always remember to review your trades and refine your strategies based on your experiences. As you grow more comfortable with the platform and the market, your execution speed and efficiency will improve, leading to better trading outcomes.

Greetings from Los angeles! I’m bored to death at work so I decided to check

out your site on my iphone during lunch break.

I love the information you provide here and can’t

wait to take a look when I get home. I’m shocked at how quick your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyways, superb

blog!

This is a topic that’s near to my heart… Cheers!

Where are your contact details though?