Slippage in Futures Trading: How to Estimate Slippage and Reduce Risk

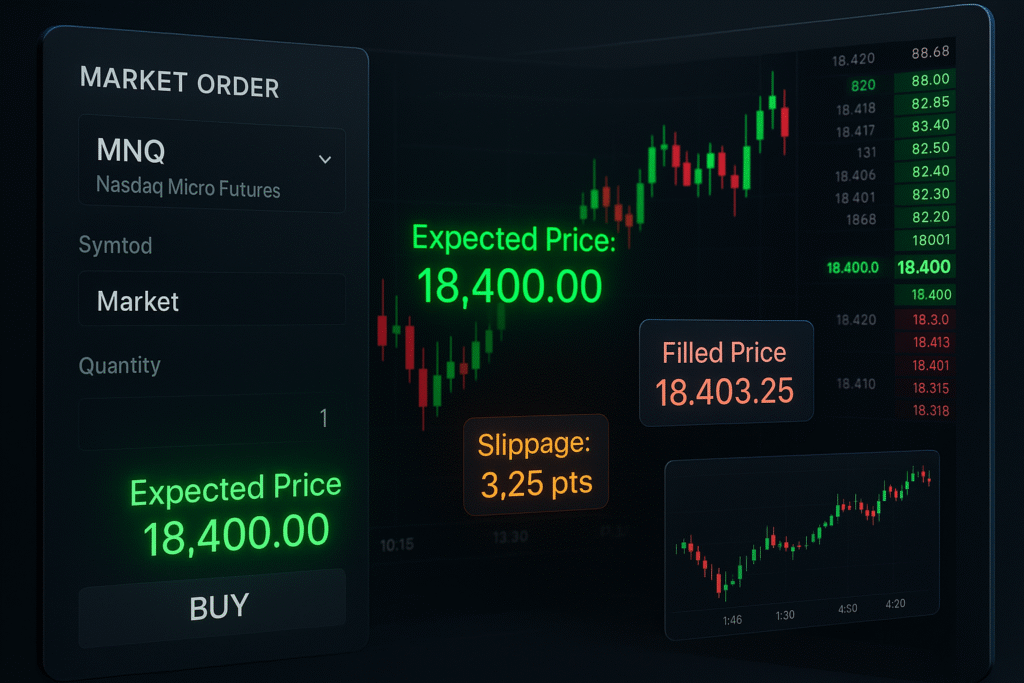

Slippage in futures trading is a silent profit killer. It happens when your trade fills at a worse price than expected. While it’s a normal part of trading — especially in fast-paced markets — understanding and managing it can make or break your performance.

Why Slippage Happens in Futures Markets

Slippage often occurs when the market moves quickly, spreads widen, or liquidity vanishes. A market order placed after a major economic announcement might fill several ticks away from your intended price — leading to smaller profits or even unexpected losses.

Can You Predict Slippage in Futures Trading?

Not precisely. There’s no perfect tool for forecasting slippage. But experienced traders can estimate it using market observation, backtests, and volatility indicators like ATR.

How to Estimate Slippage Like a Pro

1. Place Small Test Orders

Try executing a single micro or mini contract at various times. Track the difference between your expected entry and actual fill.

2. Monitor the Bid-Ask Spread

In highly liquid contracts like the E-mini S&P 500, a 1-tick spread is normal. Wider spreads increase the likelihood of slippage.

3. Use ATR to Gauge Market Volatility

The Average True Range (ATR) shows how much a market typically moves. A higher ATR often signals higher slippage potential.

4. Avoid Trading Around Major Events

During high-impact news releases or the market open, volatility spikes — making fills less predictable and slippage more severe.

Why Slippage Hits Short-Term Traders Hardest

On lower timeframes like 1-minute or tick charts, trades aim for small profits (5–10 ticks). Even minor slippage can ruin the risk-reward. But for swing traders aiming for 100+ ticks, the impact is far less.

That’s why many in the PickMyTrade community prefer higher timeframes — they reduce the effect of execution issues.

How to Reduce Slippage in Futures Trading

Try these tips to control slippage and improve execution quality:

- Use limit orders instead of market orders to control entry prices

- Trade during high-volume hours (U.S. session open is ideal)

- Avoid trading during major news releases

- Scale in/out of large trades, rather than entering all at once

- Factor slippage into your backtests and profit targets

Learn more in our guide to futures order types and how they impact trade execution.

Final Thoughts on Slippage

Slippage in futures trading can’t be completely avoided but it can be managed. At PickMyTrade, we recommend building slippage tolerance into your strategy testing and using R-based risk models to cushion the impact. When you trade with realistic expectations, you protect your edge.

A Full Guide to Auto Trading in TradingView: 2025 Update

Mastering Trailing Stop Loss with TradingView and Tradovate

Beginner’s Guide to Tradovate: Demo Account Setup + Paper Trading Tutorial

Slippage: What It Means in Finance, With Examples