Whether you’re a beginner or an advanced trader, TradingView offers a wide range of indicators and strategies to help you analyze the markets more effectively. From open-source community scripts to advanced institutional-style toolkits, this guide breaks down the most popular and most-searched TradingView-compatible tools used by traders worldwide.

This list is based on platform data, user reviews, and search trends to help you find the right indicator or strategy for your trading goals.

1. TradingView Public Library – Most Popular Free Indicator Source

TradingView’s built-in Public Library remains the most widely used source of indicators. It offers thousands of free Pine Script tools built by the community. These open-source scripts are trusted by millions of traders across stocks, forex, crypto, and commodities.

Popular scripts include:

- Supertrend (by KivancOzbilgic): A trend-following tool based on ATR, widely used across all asset classes.

- Volume Profile (by TradingView): Highlights price levels with the highest traded volume, ideal for support and resistance.

- 3-Bar Reversal (by LazyBear): Pattern-based reversal detector, popular among swing traders.

- PineCoders Backtesting Templates: Helps you test your custom strategies in TradingView’s Strategy Tester.

Why traders use it:

- 100% free and open source

- Easy one-click chart integration

- The code is fully customizable to align with individual trading strategies

- Backed by strong community support

Ideal for traders who want flexibility, transparency, and control over their indicators and strategies.

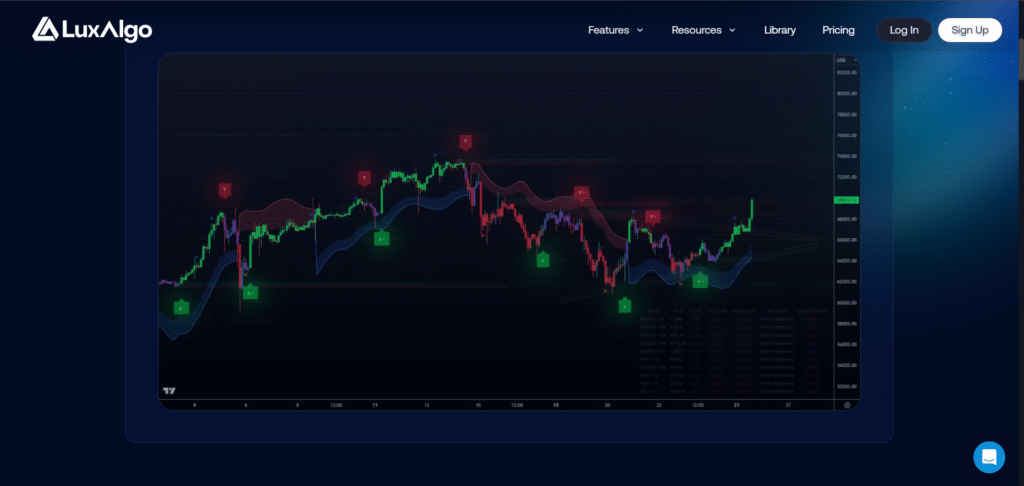

2. LuxAlgo – Most Followed Premium Indicator Provider

LuxAlgo is the most followed premium indicator provider on TradingView, with over 800,000 followers. Their tools are designed to simplify decision-making using trend overlays, confirmation signals, and AI-powered analytics.

Key tools offered:

- Signals & Overlays: Integrates buy/sell signals, candle coloring, volatility indicators, and confirmation tools into one comprehensive system.

- Price Action Concepts: Identifies market structure shifts, order blocks, liquidity grabs, and CHoCH/BOS.

- Liquidity Indicators: Maps institutional-level liquidity zones, voids, and sweep events.

- AI Backtesting Engine: Included in higher-tier plans for optimizing strategies.

Why it’s popular:

- Professional-grade visuals and performance

- Large community (150,000+ Discord members)

- High Trustpilot rating and ongoing development

- Suitable for all markets including crypto, forex, and indices

Access via luxalgo.com. Scripts are invite-only after subscription.

3. Zeiierman – Advanced Smart Money and Trend Tools

Zeiierman is well known for creating professional, easy-to-use indicators focused on smart money concepts and trend detection. It has become a widely recommended alternative to LuxAlgo, especially in Reddit and TradingView communities.

Featured indicators:

- Zeiierman Trend Indicator: Detects adaptive trends with dynamic support and resistance zones.

- Liquidity Hunter: Identifies liquidity zones, stop hunts, and institutional activity.

- Smart Money Concepts Toolkit: Includes order blocks, fair value gaps, CHoCH, and BOS logic.

- Forecast Tools: Uses statistical modeling and AI for future trend projection.

Benefits:

- Polished and modern UI

- Responsive updates and documentation

- High customer satisfaction across review platforms

- Free and premium tools available

Access via zeiierman.com.

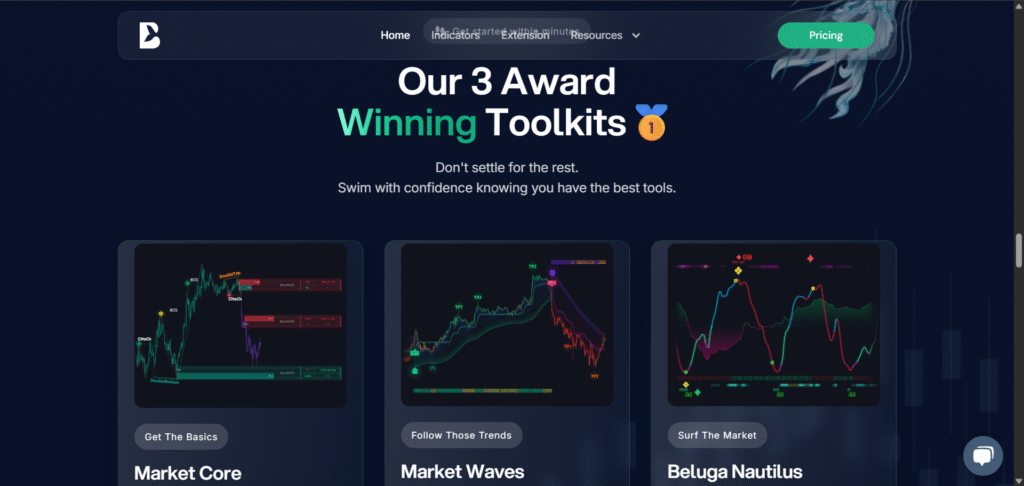

4. BigBeluga – Algorithmic Momentum Specialist

BigBeluga is a well‑known TradingView author whose open‑source and premium scripts focus on momentum, volume flow and algorithmic trend detection.

Popular indicators

- Commodity Trend Reactor – a CCI‑based oscillator that adds automatic trailing stops and reversal markers for clear trend confirmation

- Whalemap – plots “whale” buy/sell bubbles when volume spikes reveal large orders, helping traders spot accumulation or distribution zones

- Gaussian Filter – smooths price with a Gaussian kernel, then signals directional shifts for cleaner entries and exits

Premium toolkits

BigBeluga’s paid membership bundles the Market Waves Toolkit, Market Core Toolkit and Beluga Nautilus Oscillator, plus 24/7 support and a private Discord/Telegram community BigBeluga.

Why traders choose BigBeluga

- Transparent open‑source code for core indicators; premium upgrades for deeper analytics

- Blend of momentum, volume and reversal logic useful across crypto, forex and indices

- Regular updates and active community channels

Access: Add open‑source scripts directly from TradingView’s public library, or subscribe at bigbeluga.com for premium invite‑only tools.

5. Flux Charts – Advanced Premium Suite for Multi‑Market Traders

Flux Charts provides an all‑inclusive set of invite‑only TradingView indicators aimed at forex, crypto and futures traders who want supply‑demand, price‑action and algorithmic signals in one package.

Flagship tools

- SFX Algo – non‑repaint buy/sell signals with a 1‑to‑5 confidence rating and real‑time alerts

- MTF Supply & Demand Zones – shows institutional zones on up to three time‑frames simultaneously, with breakout/retest notifications

- Price Action Toolkit – volumetric order blocks, breaker blocks, fair value gaps, liquidity grabs and a multi‑ticker screener

Why Flux Charts is popular

- Beginner‑friendly setup guides, videos and 24/7 support

- Real‑time mobile/desktop alerts for every signal or zone event

- 7‑day money‑back guarantee and community of 2,000+ users

- Works with the free version of TradingView; no platform lock‑in

Pricing & access

Subscribe at fluxcharts.com; indicators are delivered as invite‑only TradingView scripts

Monthly, quarterly and yearly plans (with up‑to‑45 % discounts)

Conclusion

The TradingView ecosystem offers a wide variety of indicators and strategies suitable for all experience levels—whether you’re a beginner looking for free tools or an advanced trader seeking professional-grade systems. From the open-source flexibility of the TradingView Public Library to the premium precision of providers like LuxAlgo, Zeiierman, BigBeluga, and Flux Charts, there’s a solution that fits your trading style and market.

Each of these providers brings something unique:

- LuxAlgo and Zeiierman offer institutional-grade toolkits for trend, structure, and liquidity analysis.

- BigBeluga focuses on momentum, divergence, and volume-based tools for clean algorithmic setups.

- Flux Charts delivers a complete, multi-timeframe system for supply/demand, price action, and automated signals.

That said, indicators are only one part of a successful trading strategy. It’s essential to backtest thoroughly, understand the logic behind each tool, and use proper risk management.

If you’re exploring options for a specific asset, strategy, or timeframe, consider browsing TradingView’s script library, reading user reviews on Reddit or Trustpilot, or visiting provider websites directly.

And as always—do your own research before relying on any indicator or strategy. No tool guarantees profits, and the best results come from combining well-built tools with sound decision-making and consistent execution.

Take It Further: Automate Your TradingView Strategies with PickMyTrade

Once you’ve chosen the right indicator or strategy on TradingView, the next challenge is execution especially if you’re managing multiple accounts or working through prop firm evaluations. Manual execution can lead to slippage, missed signals, and inconsistent results.

That’s where PickMyTrade comes in.

PickMyTrade connects directly to your TradingView strategies, enabling real-time, automated trade execution across supported brokers. No coding. No delays. Just reliable automation that keeps your strategy running exactly as intended.

Whether you’re scalping, swing trading, or running a fully automated system, PickMyTrade supports:

- Live and demo execution

- Multiple broker integrations including Rithmic, TradeStation, Interactive Brokers, and TradeLocker

- Lightning-fast strategy execution with zero lag from TradingView alerts

To start automating your TradingView strategies, visit PickMyTrade.io.

Using Tradovate? Head to PickMyTrade.trade for seamless Tradovate integration.

What are the best free indicators on TradingView?

Supertrend, RSI, Volume Profile, and 3-Bar Reversal are among the most widely used.

Can I build my own strategy in TradingView?

Yes, TradingView supports custom Pine Script. You can build or modify open-source strategies using the Pine Editor.

Are invite-only indicators worth it?

Invite-only tools like LuxAlgo or Zeiierman offer advanced features and community support. They’re ideal if you’re looking for institutional-style analysis and don’t want to code.

What is the best TradingView strategy for scalping?

Scalpers often use 5-minute strategies with indicators like EMA, MACD, and custom volume-based entries.

Are there AI-powered indicators for TradingView?

Some providers offer AI-style tools for forecasting trends and optimizing signals, but results vary. Always backtest thoroughly.