Slippage is the silent killer of trading performance. If you want to avoid slippage in futures trading, especially when automating with TradingView, this guide is for you. We’ll cover what slippage is, why it happens, and how to prevent it using limit orders and PickMyTrade.

What Is Slippage in Futures Trading?

Slippage happens when your order gets filled at a different price than expected — usually worse.

Let’s say your trading strategy signals a buy on Nasdaq futures (NQ) at 17,900, but your actual fill comes in at 17,905. That 5-point difference could cost you over $100 if you’re trading multiple contracts.

This kind of cost adds up fast — and it’s not due to your strategy being wrong. It’s simply poor execution.

Why Slippage Happens in Automated Futures Trading

The main cause? Market orders.

Market orders tell the broker: “Execute immediately at the best price available.” But in volatile markets like NQ, MNQ, or ES, that “best price” can shift in milliseconds.

Even if you’re automating via TradingView alerts to Tradovate or Rithmic using PickMyTrade, small delays or spikes in volatility can cause your trade to fill at a worse price than expected.

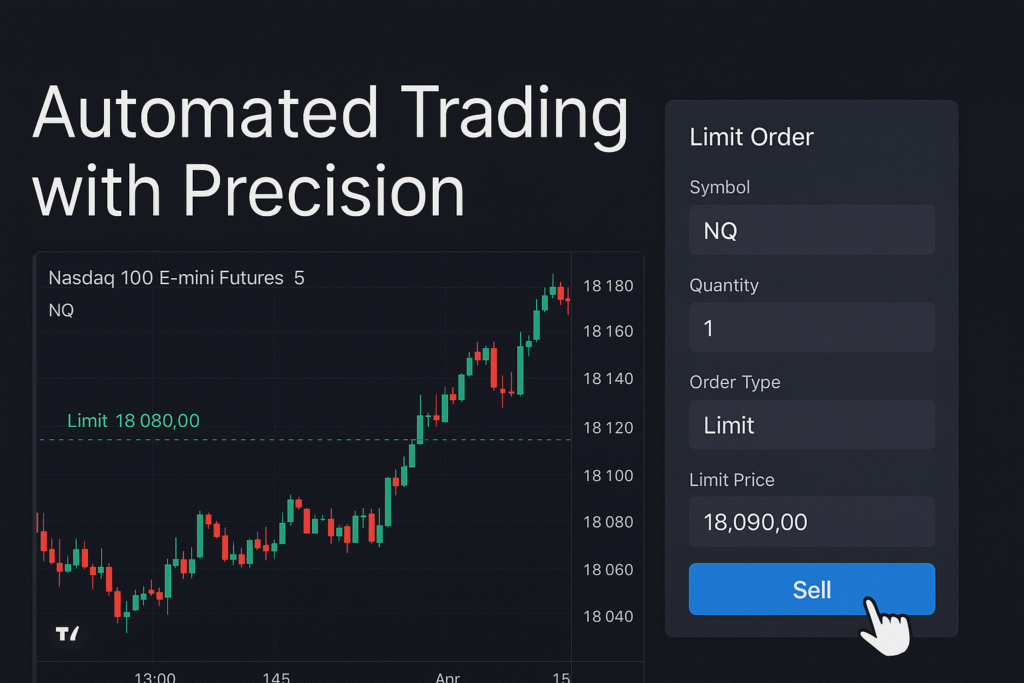

How Limit Orders Help Avoid Slippage in Futures Trading

The best way to reduce slippage? Use limit orders.

Unlike market orders, a limit order tells the platform: “Only buy/sell at this price or better.” If the market doesn’t touch that price, your order simply waits.

This gives you full control over your entry — and keeps you from being at the mercy of volatile price swings.

Why Reducing Slippage Matters in Futures Trading

Precision is everything in futures.

Even a small slippage of 5 points on 2 MNQ contracts can cost $50. Repeat that across 10 trades, and that’s $500 gone — not because your strategy failed, but because your orders weren’t controlled.

When you’re trading consistently, these slippages quietly eat into your edge. And they’re totally preventable.

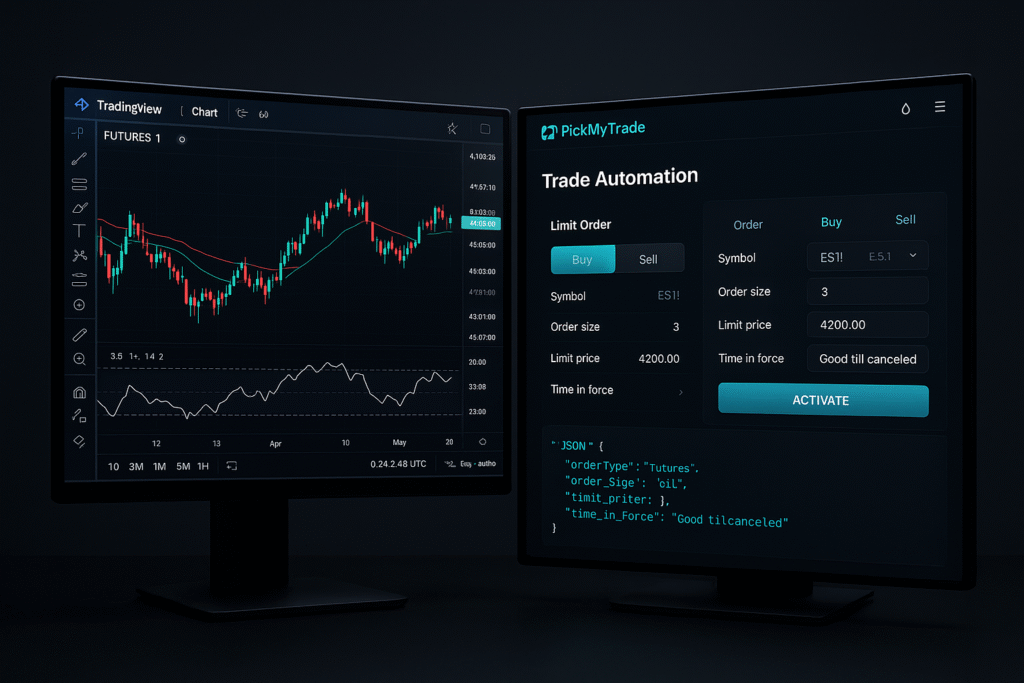

How PickMyTrade Helps Avoid Slippage in Futures Automation

PickMyTrade connects TradingView alerts to live trading accounts on Tradovate or Rithmic, allowing precise and reliable automation of your futures strategies.

To reduce slippage with PickMyTrade, all you need to do is:

Set "order_type": "limit" in your TradingView alert message

Use TradingView variables like {{close}} or a specific price to define the entry

Example Alert Message (JSON Format):

{

"order_type": "limit",

"price": "{{close}}"

}

This ensures your order will only fill at your price or better, giving you the execution control you need — even in volatile markets.

Additional Tips to Avoid Slippage

- Avoid trading during high-impact news events

- Monitor spread on lower liquidity contracts

- Always test automation with limit orders before going live

- Use PickMyTrade’s risk controls to avoid accidental overfills

Final Thoughts on Avoiding Slippage in Futures with PickMyTrade

To avoid slippage in futures trading, you don’t need expensive tools — just smarter execution.

With PickMyTrade, you can send limit orders directly from TradingView to Tradovate or Rithmic, ensuring your trades fill only at the prices you want.

- Define your price

- Automate with precision

- Let PickMyTrade handle the rest

Further Reading: Automation & Trading Concepts

Automate TradingView Indicators with Tradovate Using PickMyTrade

Slippage: What It Means in Finance, With Examples – Investopedia

How to avoid slippage in futures?

Use limit orders instead of market orders to control your entry price. Market orders fill at the next available price, which can shift during volatile moves. Limit orders wait until your defined price is hit, reducing slippage.

How do you prevent slippage?

Combine these methods:

- Trade during high liquidity hours (like U.S. market open)

- Use limit orders with clear price conditions

- Avoid trading during high-impact news events

- Automate entries using platforms like PickMyTrade to reduce manual delay

How can I trade without slippage?

You may not eliminate all slippage, but using limit orders, low-latency automation, and avoiding illiquid contracts gets you very close. Tools like PickMyTrade help execute TradingView signals with better precision and less price deviation.

How do you overcome slippage?

You overcome slippage by anticipating it and designing your strategy to avoid it:

- Automate with reliable tools like PickMyTrade to avoid human delay

- Use limit entries

- Test your strategy with real market data

- Account for slippage in backtests

How not to lose money on futures trading?

Don’t just focus on entries—focus on risk management:

- Let automation handle execution, but you manage the rules

- Use stop-losses and limit orders

- Avoid over-leveraging

- Trade only during optimal hours

- Stick to a proven, backtested strategy

How do you eliminate slippage?

While you can’t eliminate slippage completely, you can eliminate most of it by:

- Avoiding thin markets and low-volume contracts

- Using limit orders instead of market orders

- Setting up your trades to fire automatically via PickMyTrade

How to trade futures without liquidation?

To avoid liquidation in futures:

- Use risk controls in automation tools like PickMyTrade to prevent overexposure

- Keep leverage conservative (especially with volatile assets like NQ or BTC)

- Always use stop-loss orders

- Monitor your margin levels