RTX Corporation Q1 2025 Results: Impact of Tariffs and Trade Risks

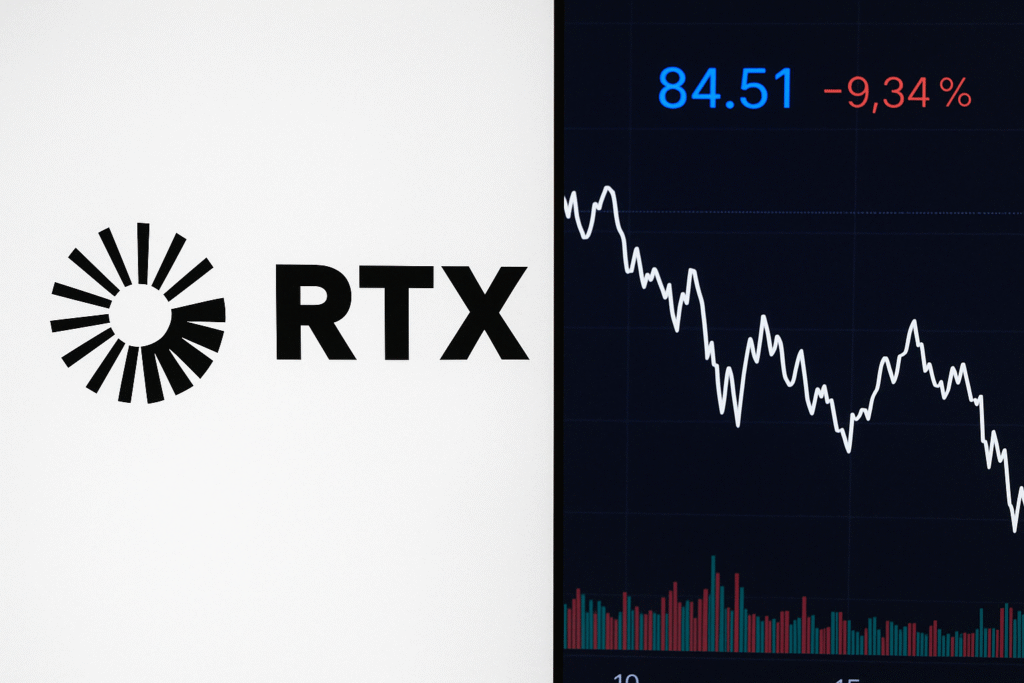

U.S. aerospace and defense giant Raytheon (RTX.US) has warned that the global trade war triggered by President Donald Trump’s latest tariff policies could deliver a severe blow to its operating profit outlook. As a result, Raytheon’s stock plunged nearly 10% in early U.S. trading, leading to a sharp pullback that erased earlier YTD gains which had previously outpaced the S&P 500. The developer of the Patriot missile defense system had risen over 15% earlier this year.

On Monday, President Trump reiterated his criticism of Federal Reserve Chair Jerome Powell, even hinting at a possible dismissal. These comments reignited fears around the politicization of U.S. monetary policy, threatening the Federal Reserve’s long-standing credibility and independence. As a result, markets were hit by a rare “triple whammy” — a simultaneous drop in stocks, bonds, and the U.S. dollar — significantly denting global confidence in U.S. financial assets.

Strategic Exposure and National Security Concerns

Raytheon, now rebranded as RTX, is the world’s second-largest defense contractor, operating across commercial and military aerospace, missile defense, and advanced sensing systems. Key offerings include the Patriot missile system, the Stinger and Javelin platforms, NASAMS air defense, and the F135 engine used in F-35 aircraft. A prolonged earnings decline could delay key technological upgrades to U.S. military equipment across land, sea, and air — raising concerns about the country’s defense dominance and even the sustainability of dollar hegemony.

Estimated Profit Impact of Tariffs

In a recent investor presentation, RTX revealed it’s preparing for up to $850 million in lost profits due to the global tariffs imposed by the Trump administration. This figure includes an estimated $250 million loss each from Canada, Mexico, and China-related impacts, with some mitigation actions already underway.

“We’re trying to estimate the impact if current tariff rates remain unchanged for the rest of the year,” said Neil Mitchill, CFO of RTX, during the earnings call. “There are many uncertainties, and we expect the full effects to emerge in the second half of the year as inventories deplete.”

Guidance and Structural Shifts

RTX reaffirmed its full-year outlook but emphasized that it does not account for the newly imposed tariffs or potential retaliatory actions from global partners. The company expects:

- Full-year revenue: $83 billion – $84 billion

- Adjusted EPS: $6.00 – $6.15

Formerly known as Raytheon Technologies, the company rebranded to RTX in 2023 after the 2020 merger between Raytheon and United Technologies. RTX now includes three key divisions: Raytheon, Pratt & Whitney, and Collins Aerospace, with its defense arm focused on missile defense, radar systems, and high-precision weaponry.

Notable products include the:

- Patriot-3 missile defense system

- Stinger MANPADS

- Javelin anti-tank missile

- NASAMS

- AMRAAM air-to-air missile

- SPY-6 radar

- Tomahawk cruise missile

- Pratt & Whitney F135 jet engine

Commercial Pressures and Civil Aviation Risks

If global trade tensions continue to escalate, commercial aircraft manufacturers like Boeing and Airbus may face delays or cancellations of new aircraft orders. This could put pressure on suppliers such as RTX, particularly in its aerospace division. Industry-wide, manufacturers are bracing for more downside.

Pockets of Optimism

Despite near-term risks, RTX and GE Aerospace are expected to benefit from strong demand for jet engine servicing, driven by the resurgence in global air travel. RTX remains particularly optimistic about its defense business. Mitchill confirmed the company is “fully prepared” to support the Trump administration’s proposed “New Era Missile Defense System.” A record-breaking $1 trillion defense budget has also been proposed, which could lift long-term procurement volumes.

However, in the short term, tariff-driven profit erosion may disrupt funding for new R&D initiatives — especially critical for high-cost military technologies.

RTX CEO Christopher Calio added that a surge in European defense spending — estimated in the tens of billions — presents a “clear growth opportunity” for RTX’s military business.

Q1 2025 Financial Highlights:

- Adjusted EPS: $1.47 (vs. estimate of $1.38)

- Revenue: $20.3 billion (vs. estimate of $19.8 billion)

In-Depth Third-Party Video Analysis

In-Depth Third-Party Video Analysis

For an institutional perspective on RTX’s positioning, defense sector resilience, and tariff headwinds, watch this segment from the Schwab Network:

Note: The content provided is strictly for educational and informational use and should not be taken as financial or investment advice. The embedded video is the property of Schwab Network and is not affiliated with or endorsed by PickMyTrade.