In the fast-paced world of trading, efficiency and accuracy are key. Automating your trades can save time and reduce the chances of human error. This blog will explore how to automate your trading strategies using TradingView and Tradovate, focusing on the MACD strategy for quick trades. With the help of PickMyTrade, you can streamline your trading process and improve your results.

Understanding the Basics of Automation

Before diving into the specifics, it’s essential to grasp what trading automation entails. Automated trading uses algorithms to execute trades based on predefined criteria. This method is beneficial for traders who want to take advantage of market opportunities without being glued to their screens.

By using platforms like TradingView and Tradovate, traders can set alerts and automate their trading strategies effectively. This process allows for the execution of buy and sell orders based on real-time market data.

Setting Up Your TradingView Account

The first step in automating your trading strategy is to set up your TradingView account. TradingView is a powerful charting platform that offers a variety of tools for traders. Here’s how to get started:

- Sign up for a TradingView account at TradingView.

- Once registered, navigate to the charting interface.

- Select a timeframe that suits your trading style; for this guide, we’ll use the 1-second chart.

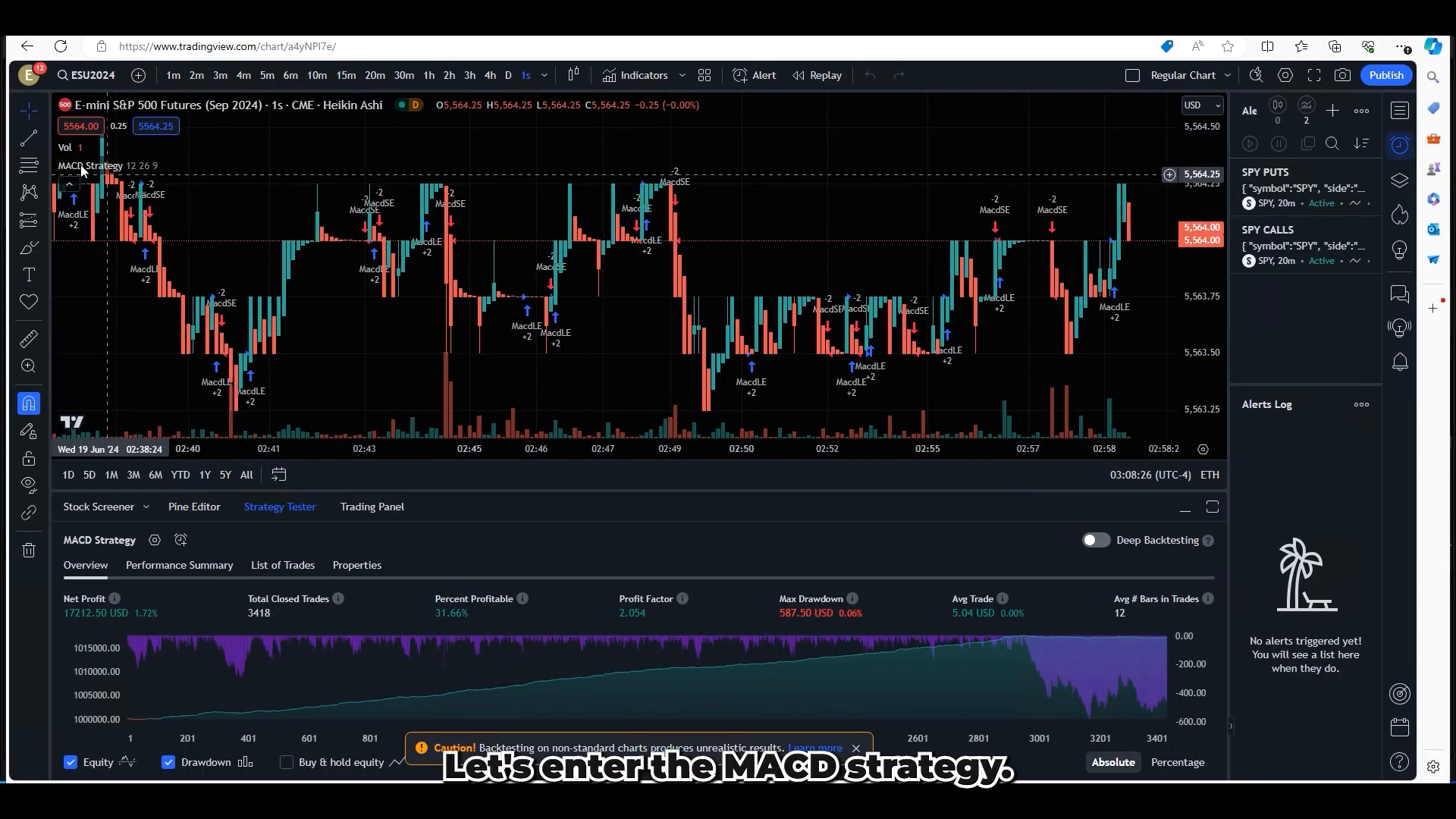

Implementing the MACD Strategy

The MACD (Moving Average Convergence Divergence) strategy is a popular choice among traders for its ability to identify momentum in the market. To automate this strategy:

- Open the 1-second chart on TradingView.

- Add the MACD indicator to your chart.

- Set up the alert for the MACD strategy by clicking on the alert icon.

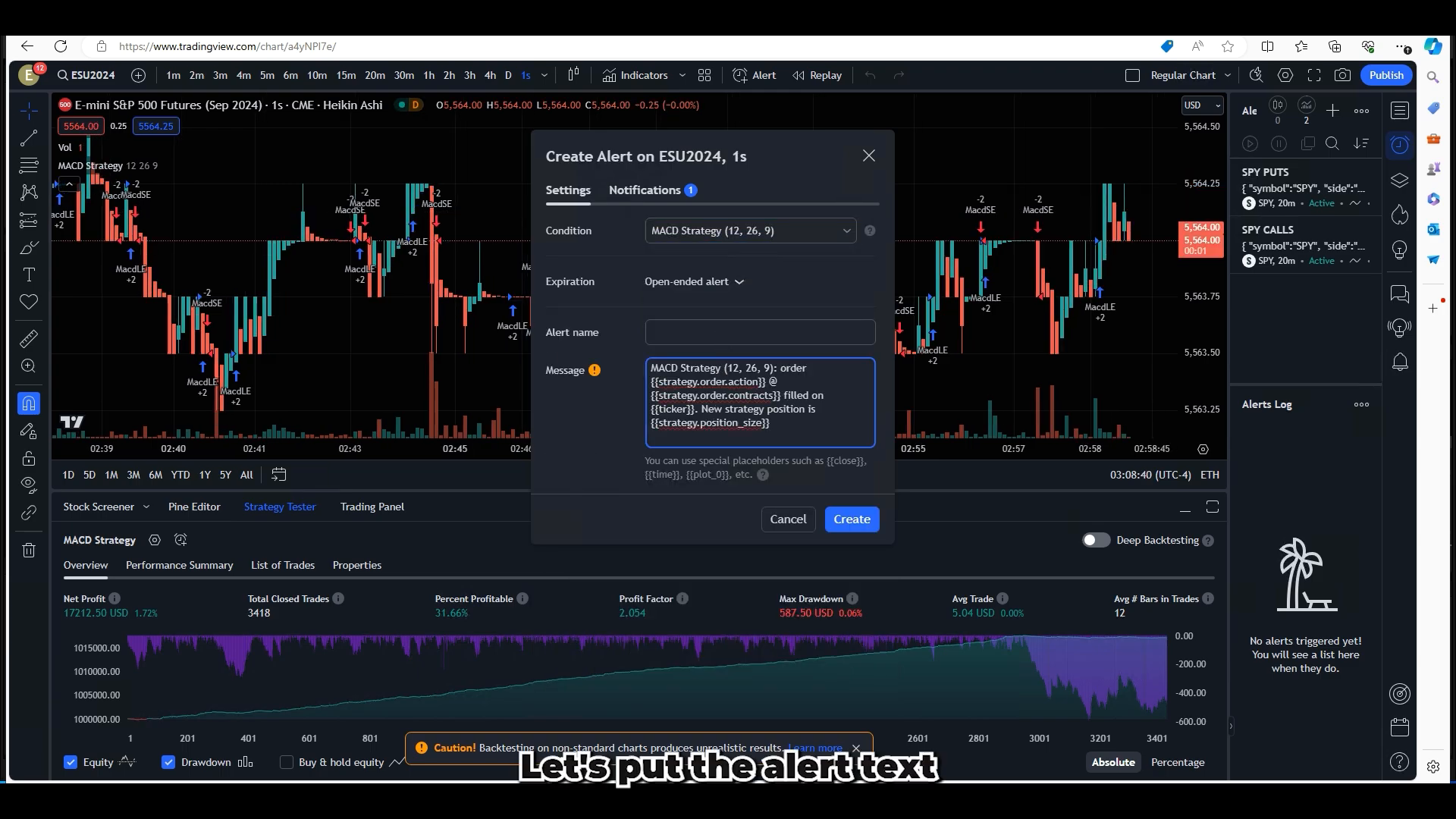

Creating Alerts for Automated Trades

Alerts are crucial for automated trading as they notify you when specific conditions are met. Here’s how to create an alert for the MACD strategy:

- Select the MACD strategy from the indicator list.

- In the alert settings, enter the notification message, including “Pick My Trade” for clarity.

- Insert the webhook URL to connect your TradingView alerts with Tradovate.

- Click ‘Create Alert’ to finalize.

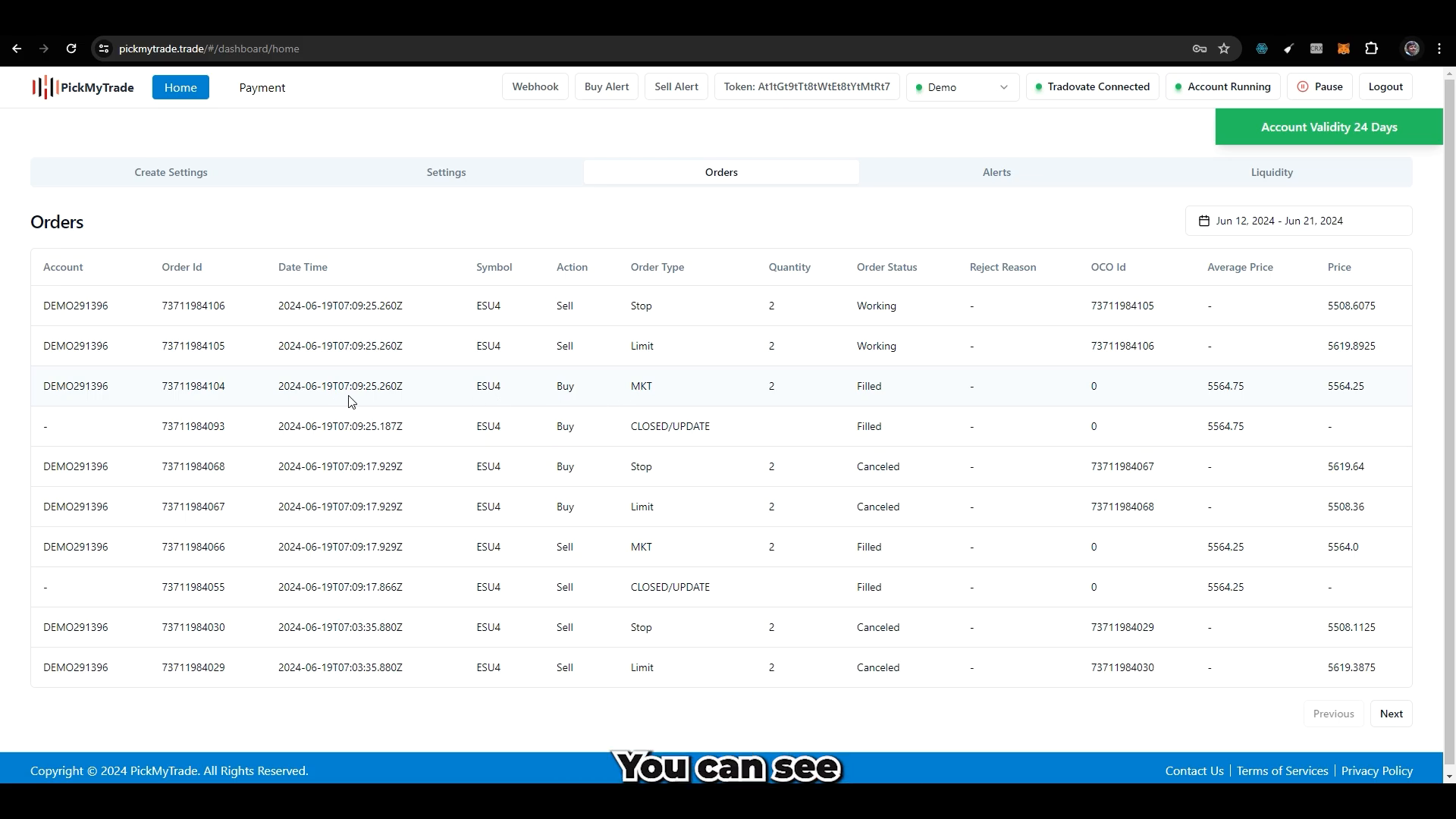

Monitoring Trade Alerts

Once your alerts are set, it’s time to monitor them. The alerts will notify you when a trade opportunity arises based on the MACD signals. You can view the last alert trade and verify its status:

- Check the alert notifications for trade signals.

- Confirm if the order has been filled or if it requires further action.

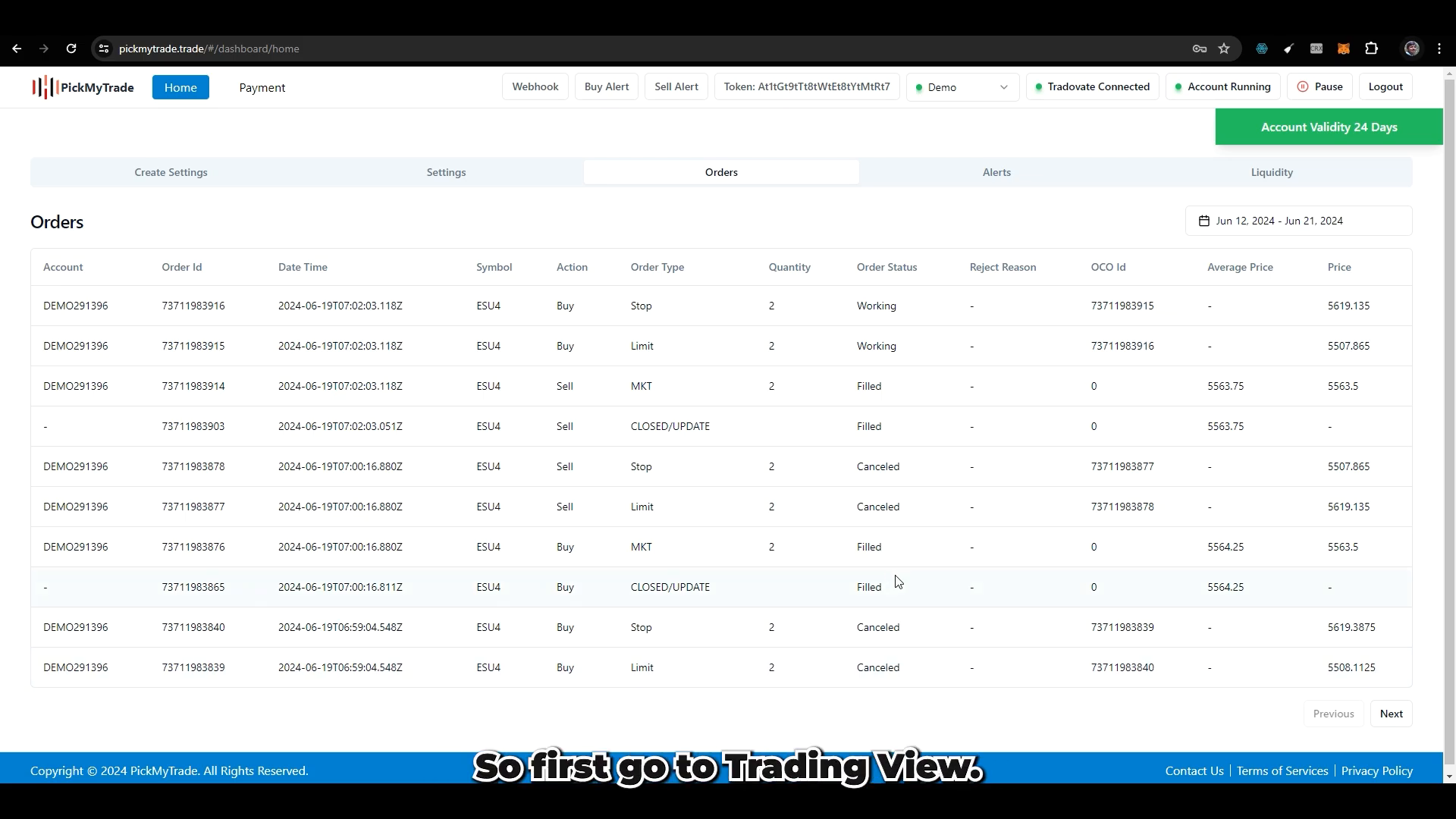

Executing Trades in Tradovate

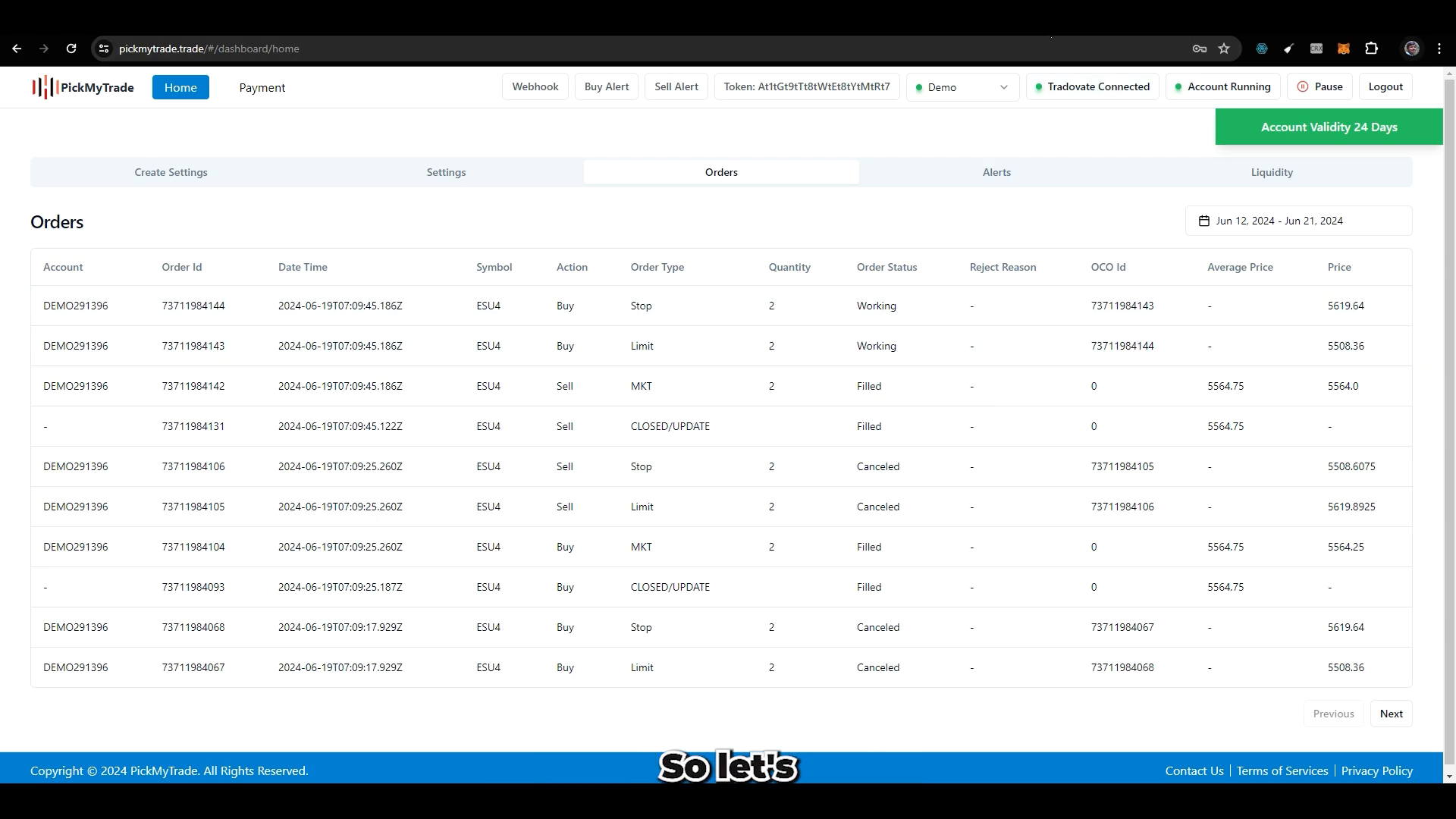

After receiving an alert from TradingView, the next step involves executing the trade in Tradovate. Here’s how the process works:

- When an alert is received, a market order is triggered in Tradovate.

- Simultaneously, a stop order and a limit order are placed.

- Monitor the status of these orders to ensure they are filled appropriately.

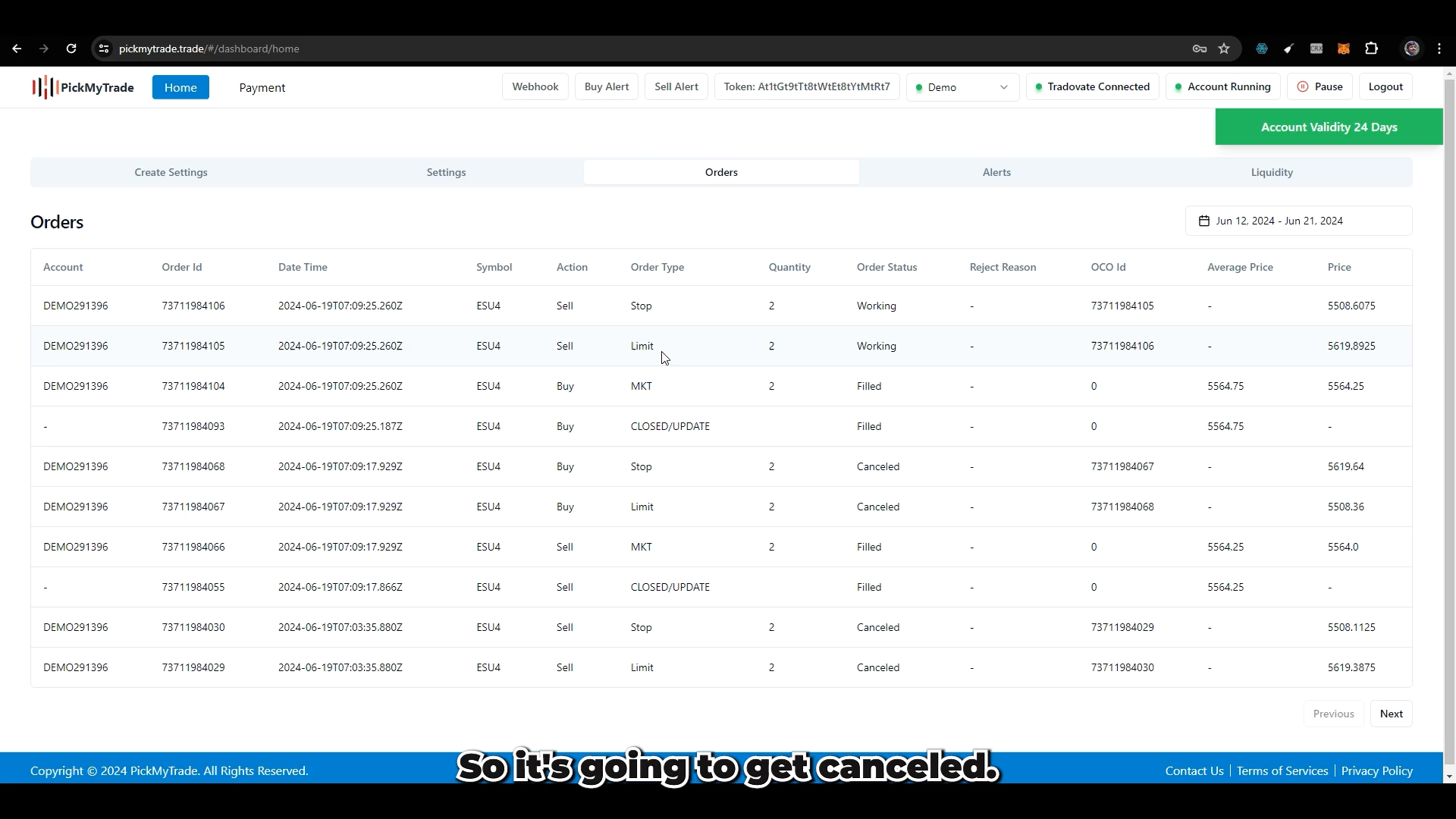

Handling Opposing Trades

In trading, it’s common to encounter opposing signals. If a sell alert comes in while you have a buy order, you need to manage these trades carefully:

- If a stop limit order does not get filled, it may be cancelled automatically.

- Keep track of the alerts to avoid missing any critical trade signals.

Reviewing Completed Trades

After executing your trades, review them to understand your performance better. In Tradovate, you can see all your trades, including:

- Entry orders

- Limit orders

- Stop orders

Understanding how these trades align with your strategy is vital for improving future performance.

Maximizing Your Trading Efficiency

Automating trades can significantly enhance your trading efficiency. With platforms like PickMyTrade, you can take your trading to the next level. Here are some tips to maximise your trading efficiency:

- Regularly review your trading strategies and adjust them based on market conditions.

- Keep your alerts updated to reflect any changes in your trading plan.

- Utilize tools offered by PickMyTrade for advanced trading insights.

By following these practices, you can ensure that your automated trading strategy remains effective and profitable.

Final Thoughts

Automating your trades with Tradovate and TradingView can be a game-changer in your trading journey. By implementing the MACD strategy and utilizing PickMyTrade, you can streamline your trading process, allowing for quicker execution and reduced error rates.

For further assistance or to start automating your trades, consider reaching out via WhatsApp or visiting PickMyTrade for automated trading solutions.

Remember, continuous learning and adaptation are key in the trading world. Embrace automation, and you may find it enhances your trading experience and profitability.