Trading the financial markets has always been about balancing risk and reward. Many traders today turn to automation to cut out human error, speed up execution, and stick to disciplined rules. One such experiment was recently run under the Quant Tekel approach, where a bot originally built for cryptocurrency trading was tested on the EUR/JPY Forex pair.

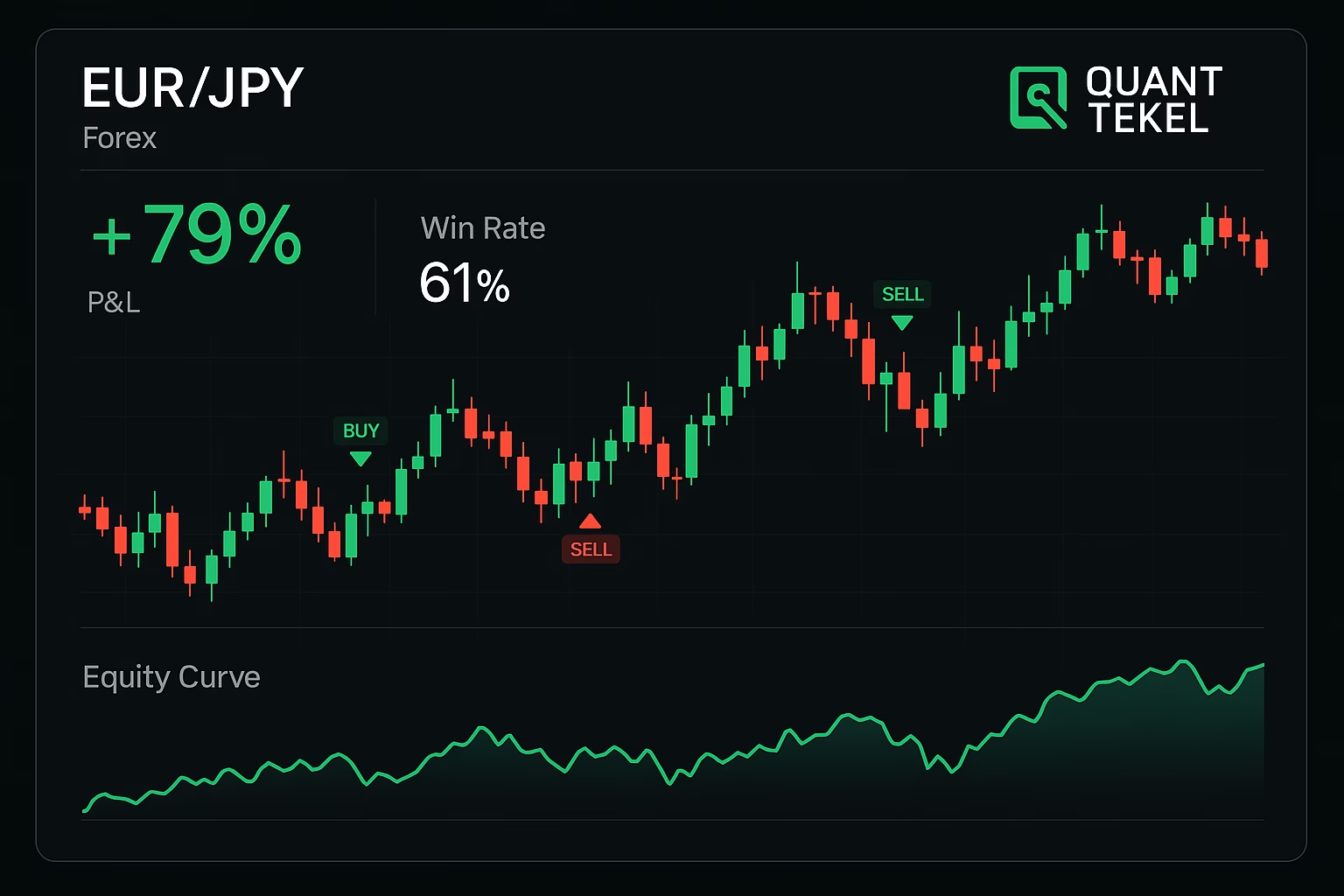

The results were impressive — 79% profit, a 61% win rate, but also a steep 46% drawdown. Let’s dive into how the Quant Tekel bot performed, what it means for traders, and the balance between high profits and high risks.

From Crypto to Forex: The Quant Tekel Shift

Cryptocurrency markets run 24/7 and are known for their volatility. Forex markets, however, operate in sessions and react to different global events. Moving the bot from Bitcoin to EUR/JPY was a test of adaptability.

Why EUR/JPY?

- Strong liquidity

- Consistent volatility

- Attractive for trend-following strategies

This made it the perfect battleground to test Quant Tekel’s automated bot.

Key Metrics of the Quant Tekel Forex Bot

Here’s how the bot stacked up when tested on EUR/JPY:

- Total Trades: 65 — higher than in crypto, showing more frequent opportunities.

- Win Rate: 61% — more winning trades than losing ones, a solid figure for automated systems.

- Profit Factor: 1.2 — for every $1 lost, $1.20 was gained. Profitable, but efficiency could improve.

- Total Profit (P&L): 79% return on capital. A remarkable figure for any trading bot.

- Drawdown: 46% — nearly half the account value lost at one point, showing significant risk.

These numbers highlight the Quant Tekel dilemma: strong profitability but extreme volatility in account equity.

Profit vs Stress: The Drawdown Challenge

The 79% profit is eye-catching, but the 46% drawdown is the real test for traders.

Why drawdown matters:

- Emotional Stress: Seeing nearly half your account vanish is not easy to stomach.

- Capital Erosion: Large losses require equally large recoveries (a 50% loss needs a 100% gain).

- Risk Management: Even profitable bots can sink accounts if drawdowns are ignored.

The Quant Tekel bot outperformed a simple buy-and-hold strategy, but the ride was far rougher. Traders must decide if they can handle the bumps on the way to high returns.

Why Automated Trading Fits Quant Tekel

Automation has clear advantages, especially in high-frequency markets like Forex:

- Speed: Bots react instantly to signals.

- No Emotions: Fear and greed are eliminated.

- Consistency: Rules are followed with zero deviation.

- Backtesting: Strategies can be tested before going live.

Quant Tekel thrives on these principles — structured, rule-driven, and data-backed.

Connecting Automated Trades

If you want to apply Quant Tekel-style strategies in your own account, platforms exist to make automation seamless:

- Tradovate users → Automate Trades with Tradovate

- Rithmic, Interactive Brokers, TradeLocker, TradeStation, ProjectX users → Automate Trades with Multiple Brokers

These integrations allow you to link TradingView strategies directly to your broker — often with zero coding required.

Conclusion: The Quant Tekel Reality

The Quant Tekel Forex bot proved it can deliver outsized returns:

- 79% Profit

- 61% Win Rate

- 46% Drawdown

It’s a classic case of high reward, high risk. For disciplined traders who can handle volatility, Quant Tekel offers an edge in automated trading. But for those uncomfortable with deep drawdowns, risk management adjustments are essential.

At the end of the day, Quant Tekel shows what automation can achieve — but it also reminds us that the path to profit is rarely smooth.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade