Generative AI is changing the way traders look at markets. Unlike older algorithms that only crunch numbers, AI tools like ChatGPT can create insights, summarize news, and even write trading code.

Even if you’re a beginner, you can use AI to make trading easier and more systematic. In this post, I’ll walk you through a clear roadmap to get started with generative AI in trading, step by step.

What Is Generative AI?

Generative AI doesn’t just analyze data it creates new content such as text, code, or predictions based on what it has learned.

In trading, this means:

- Summarizing market news instead of you reading dozens of articles

- Suggesting strategies or combining indicators

- Writing scripts for platforms like TradingView

- Explaining market concepts in plain English

Think of it as a research assistant that speeds up your learning and analysis.

Why Traders Should Use It

Markets generate endless information: news, price charts, social media sentiment, and economic data. No human can process all of it.

Generative AI helps by:

- Filtering noise and highlighting key points

- Turning trading ideas into strategy code

- Acting as a tutor to explain technical setups

- Suggesting improvements when you backtest strategies

It won’t make you profitable overnight, but it can save hours and spark ideas you wouldn’t think of alone.

Practical Ways AI Supports Trading

Market News and Sentiment

Feed an earnings article into ChatGPT and ask, “What is the sentiment, positive or negative?” It can quickly summarize key points, saving time.

Technical Analysis Support

You might say, “The 50-day moving average has crossed above the 200-day. RSI is 25. What does this usually mean?”

The AI will explain in plain language, helping you connect signals to market behavior.

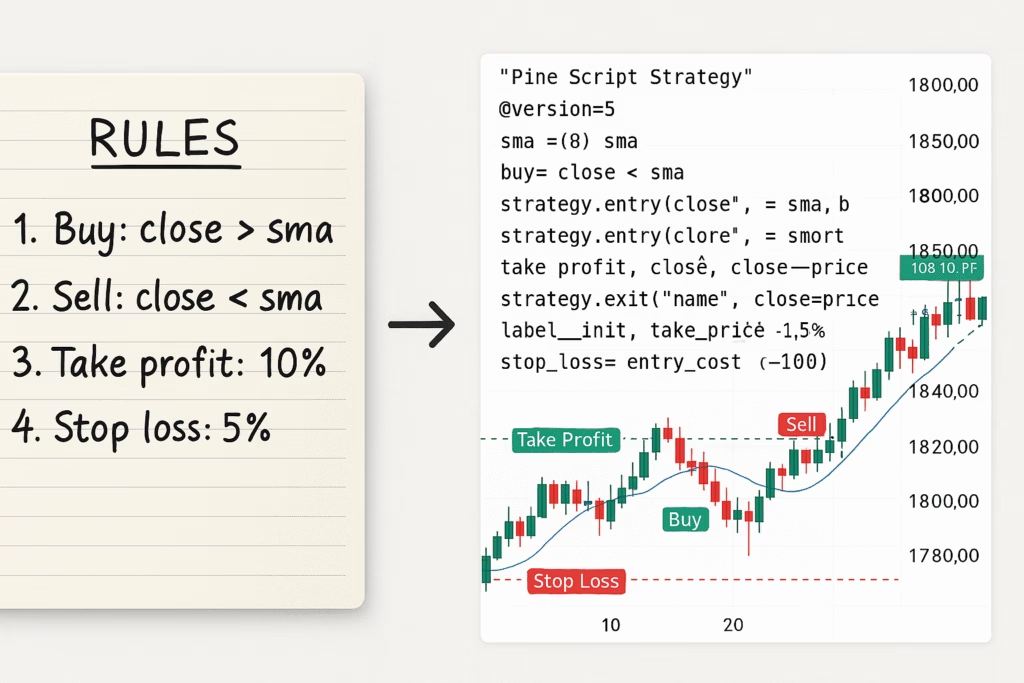

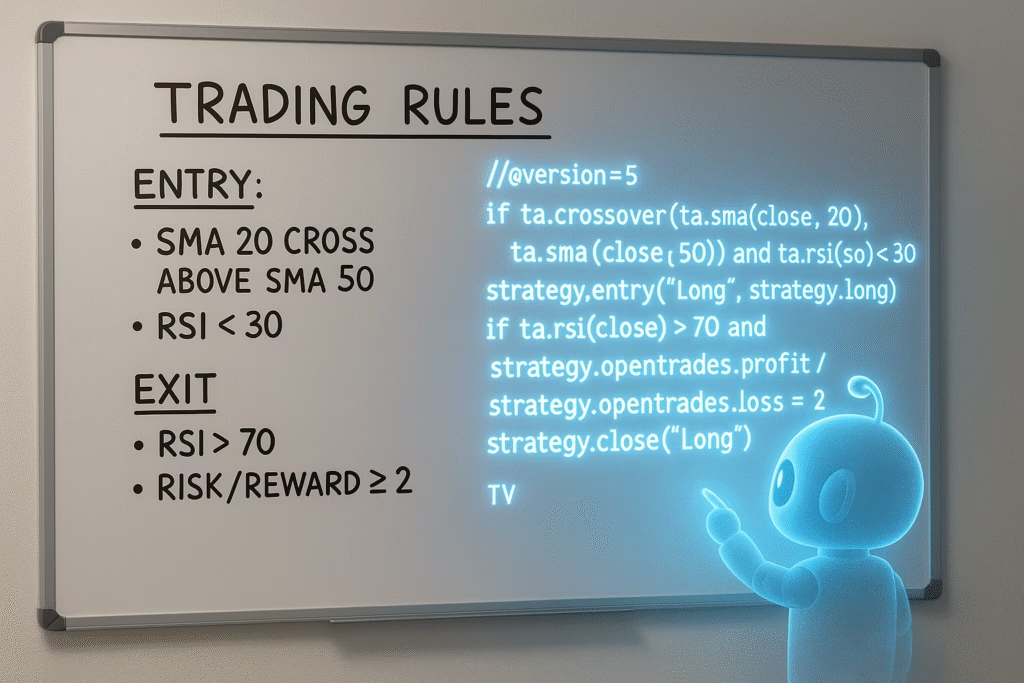

Strategy Creation

Describe your rules, such as “Buy above the 100-day moving average with positive sentiment. Take profit at 5%.” AI can turn this into Pine Script code for TradingView.

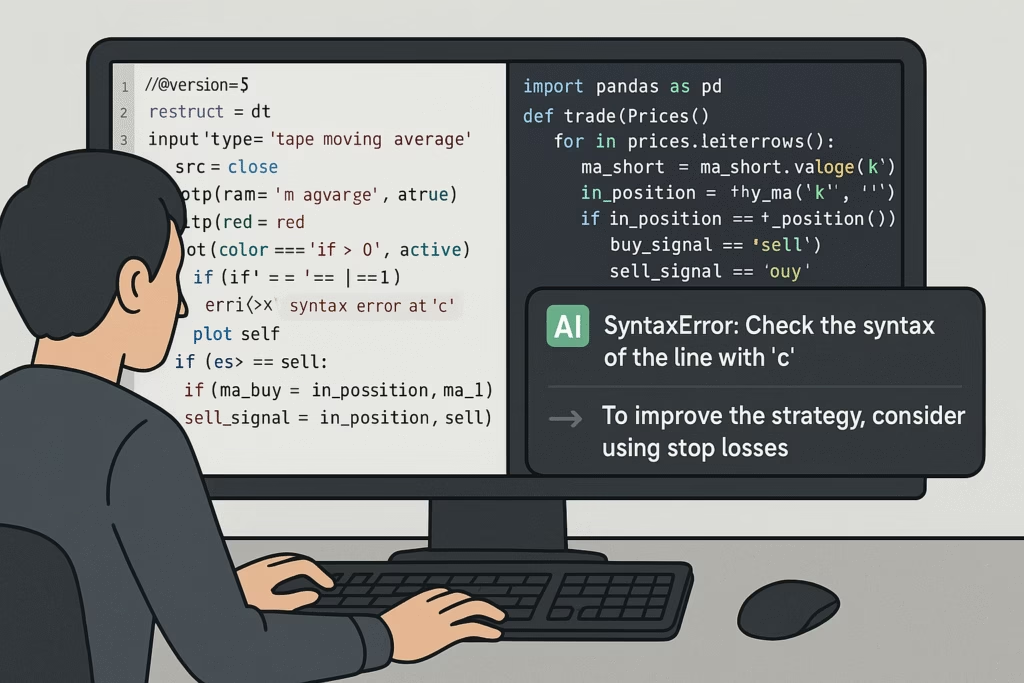

Coding Assistance

If you aren’t comfortable with programming, AI can:

- Generate Pine Script or Python code

- Debug errors

- Suggest improvements based on test results

Trading Education

Ask AI to explain concepts like options delta, stop-loss placement, or forex interest rate impact. It can also help you journal trades and reflect on mistakes.

Beginner’s Roadmap

Here is a practical sequence to follow:

Step 1: Learn the Basics

Understand market fundamentals and what indicators mean. AI is a helper, but you must know the essentials.

Step 2: Set Up Tools

- ChatGPT or another AI assistant

- TradingView account for charting and coding

- (Optional) Python environment for deeper automation later

Step 3: Use AI for Market Research

Summarize news, interpret charts, brainstorm trade ideas, and ask AI to explain anything unclear.

Step 4: Build a Strategy

Write down clear entry and exit rules. Ask AI to draft Pine Script code so you can test them in TradingView.

Step 5: Backtest Thoroughly

Run your strategy on historical data. Study win rates, profit factor, and drawdowns. Refine the rules with AI guidance, but avoid overfitting.

Step 6: Automate Trades

Use TradingView alerts linked to a service like PickMyTrade, which executes trades on your broker automatically. Always test on a demo account first.

Step 7: Keep Reviewing

Track results, analyze performance, and adjust. AI can help interpret trade logs and suggest refinements.

Key Reminders

- AI is not a guarantee of profit.

- Always backtest before going live.

- Use strict risk management with stop-losses.

- Treat AI as an assistant, not a replacement for your judgment.

Conclusion

Generative AI offers traders a new way to analyze markets, develop strategies, and even automate execution. With the right approach, beginners can use it to:

- Summarize news and sentiment

- Turn ideas into code

- Backtest strategies efficiently

- Automate trades with platforms like Pickmytrade

PickMyTrade makes it simple to connect AI-driven strategies to real broker accounts, turning TradingView alerts into live trades without manual execution.

The best results come from combining your trading knowledge with AI’s speed and flexibility. Start small, learn step by step, and build confidence as you go.

You May also Like:

Best AI Tools for Trading: Signal Generation, Strategy Building, and Automation

Can Grok AI Really Trade?

How to Use GPT-5 with TradingView Strategies for Automated Trading

1. What is generative AI in trading?

Generative AI in trading refers to using AI models (such as ChatGPT) that can create new content like strategy code, news summaries, or trade explanations instead of only analyzing data. It helps traders save time and explore more ideas.

2. Can beginners use AI for trading?

Yes. Beginners can use AI to simplify concepts, summarize news, and even generate trading strategies in plain language. AI acts as a tutor and assistant, so you don’t need coding or advanced financial knowledge to start experimenting.

3. Does AI guarantee profitable trading?

No. AI can make research and testing faster, but it does not guarantee profits. Successful trading still requires risk management, backtesting, and discipline. AI is a tool to assist traders, not a replacement for skill and strategy.

4. How can AI create a trading strategy?

You can describe your trading rules in plain English (e.g., “Buy above the 100-day moving average with RSI below 30”) and AI can turn that into a TradingView Pine Script strategy. You can then backtest the code to see how it performs.

5. What tools do I need to start AI trading?

At minimum, you need access to an AI assistant like ChatGPT and a trading platform such as TradingView. For automation, you can connect TradingView alerts to brokers through services like PickMyTrade.

6. Is coding required to use AI in trading?

No, coding is not required. AI can generate Pine Script or Python code for you. Even if you have no programming background, you can copy-paste AI-generated code into TradingView and backtest it.

7. How do I automate trades with AI?

Once AI helps you create a strategy, you can set TradingView alerts. These alerts can be connected to your broker via automation tools like PickMyTrade, which execute trades based on your strategy. Always start on demo before live trading.

8. What are the risks of AI trading?

The main risks are overfitting strategies, relying too heavily on AI without understanding markets, and poor risk management. Traders should always backtest, use stop-losses, and start small.

9. Can AI analyze market news and sentiment?

Yes. You can paste an article, tweet, or news report into AI and ask for a sentiment summary. It will quickly tell you whether the overall tone is positive, negative, or neutral, helping you make faster decisions.

10. How do I learn trading with AI?

You can ask AI to explain trading concepts in simple terms, analyze your trade journal, or suggest resources. Many beginners use it as a personal tutor to speed up their learning curve.