Is Your Trading Strategy Worth It?

Many traders create detailed strategies hoping to beat the market—but how do you know if it’s truly better than doing nothing? With TradingView’s Buy and Hold line, you can quickly compare your automated strategy’s performance to a simple approach: buying the asset and holding it. This guide explains how to use the Buy and Hold line to evaluate your performance with Elite Trader Funding Automation tool.

What Is the Buy and Hold Line In Elite Trader Funding Automation?

It’s a benchmark. It shows how much money you would’ve made by simply buying an asset and holding it—no indicators, no signals, no exits.

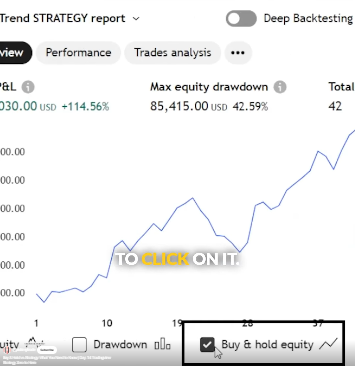

You’ll find it on TradingView’s Strategy Tester → Overview → Buy and Hold Equity. Once enabled, a blue line appears on your chart.

This helps answer a simple but critical question:

Is your strategy really better than just holding the asset?

Why the Buy and Hold Line Matters

Reality Check

If your strategy performs worse than Buy & Hold, it may not be worth the complexity.

Simplicity vs. Complexity

A simple buy-and-hold strategy may outperform high-frequency, rule-heavy systems.

Opportunity Cost

Your time, capital, and effort are limited. Use this line to evaluate if automation is truly worth the trade.

Real Strategy Comparison

Let’s say you’re using Elite Trader Funding Automation through TradingView and PickMyTrade. You test a Supertrend strategy. The Strategy Tester shows:

- Total Profit: $146,000

- Profit Factor: 1.48

- Buy and Hold Profit: $90,000

Your automation clearly outperformed Buy and Hold—great! But in another test, an RSI-based strategy had:

- Total Loss: $50,000

- High Win Rate, but

- Buy and Hold Profit: $80,000

This shows that a high win rate doesn’t mean better performance than Buy and Hold.

How Elite Trader Funding Automation Helps

Platforms like PickMyTrade.io let you run and backtest automated strategies from TradingView. You can visually compare performance against Buy and Hold to optimize your approach before going live with funded accounts.

Final Tips

- Always check the Buy and Hold line before trusting a strategy.

- Use it as a performance benchmark.

- Stick with strategies that consistently outperform Buy & Hold, not just ones with high win rates.

Ready to Improve

Use Elite Trader Funding Automation with TradingView and PickMyTrade to automate smarter—and ensure your strategy is really worth it.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade