Even with a great strategy, not every signal leads to profit. In TradeDay Futures Automation, understanding why signals fail can help you refine your system and avoid preventable losses and learn more about automating futures trades. This guide will show you the key reasons signals fail and what you can do to improve accuracy.

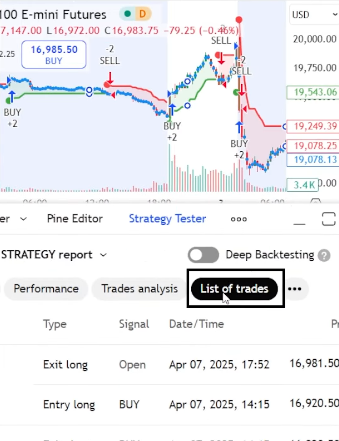

Review Your Trades with Strategy Tester

One of the best ways to learn why your automated TradeDay futures strategy fails is by reviewing past trades.

- Use TradingView’s Strategy Tester.

- Select the “List of Trades” tab.

- Analyze entries, exits, and outcomes.

This process helps identify which market conditions caused false signals—giving you data to refine your automation logic.

Common Reasons Signals Fail

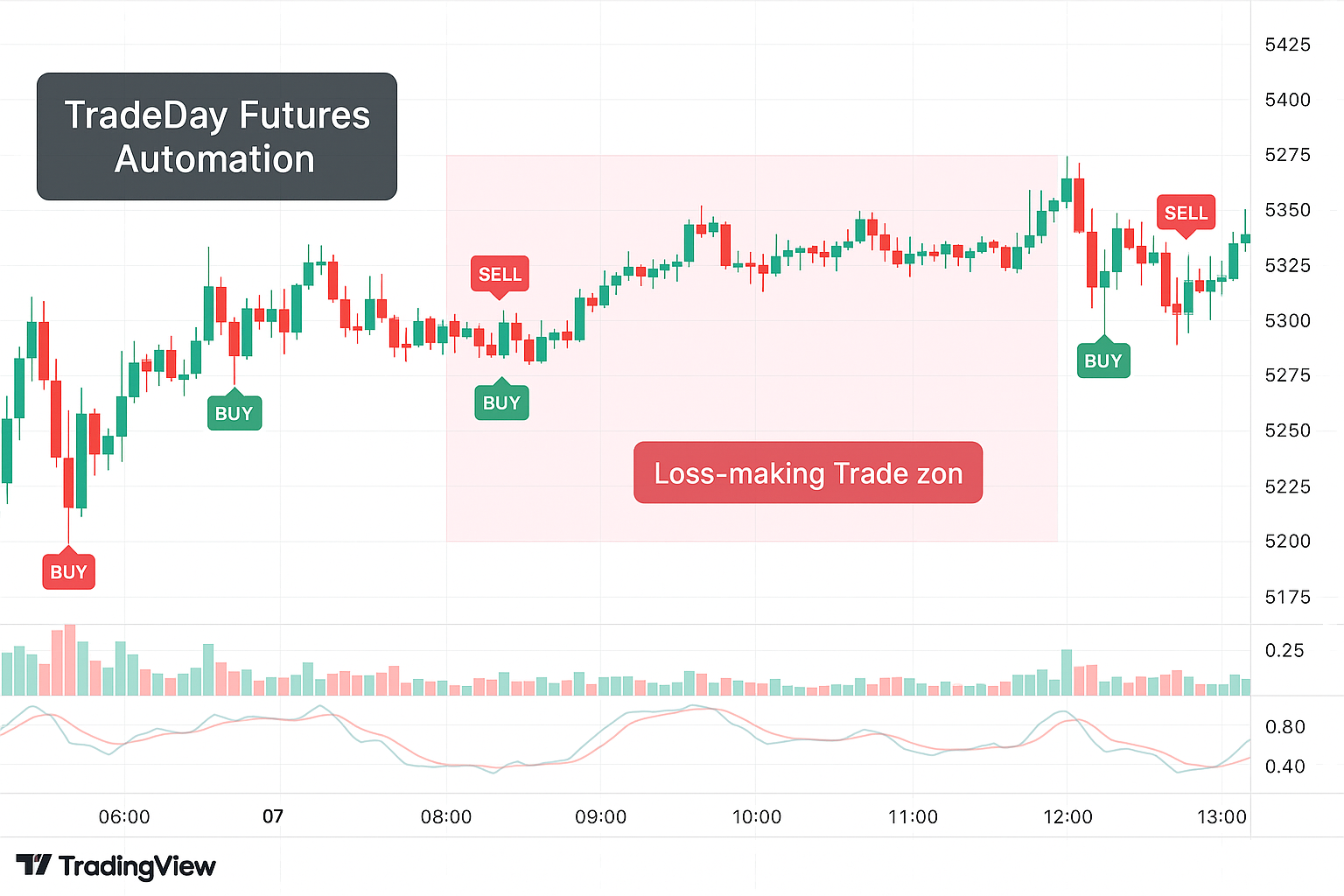

1. Sideways Market Conditions

Automation strategies often break down in range-bound markets.

- Buy signals fire, but price stagnates.

- Sell signals appear, but there’s no strong drop.

In TradeDay Futures Automation, this leads to frequent stop-outs and drawdown spikes.

2. Lack of Momentum

Even with a correct signal, if momentum is missing, the trade can fizzle.

Example: The Supertrend indicator gives a buy signal, but the price consolidates. Without momentum, there’s no follow-through—and the bot exits at a loss.

What to Do: Improve Your TradeDay Automation

Review Past Trades

Spot repetitive patterns in failed trades:

- Were they triggered during low volatility?

- Did they occur during news events?

Use this information to refine your automation filters.

Filter Low-Quality Signals

Don’t let your automation react to every signal. Add filters:

- RSI or MACD confirmation.

- Minimum volume or volatility conditions.

- Trend confirmation (200 EMA, etc.)

This increases the odds of success and reduces false trades in TradeDay Futures Automation.

Automate Wisely: Better Signals, Smarter Filters

Automated futures trading works best when logic is refined. Instead of relying only on indicator triggers:

- Test signals in different market phases.

- Combine momentum tools and trend filters.

- Only execute trades when the conditions truly align.

This helps your TradeDay Futures Automation become smarter—not just faster.

Call to Action

Want to improve your TradeDay performance?

- Start reviewing failed trades today.

- Add smarter filters to your bot.

- Automate with confidence, not randomness.

You can’t control the market—but you can control your logic.

Also Checkout: Auto Trail Orders Using Tradovate Automated Bot

I’ve definitely experienced the pain of signals triggering in sideways markets—it’s frustrating when the strategy looks good on paper but stalls in real time. Your point about using the Strategy Tester to spot patterns is a solid reminder that data beats gut instinct in refining automation.