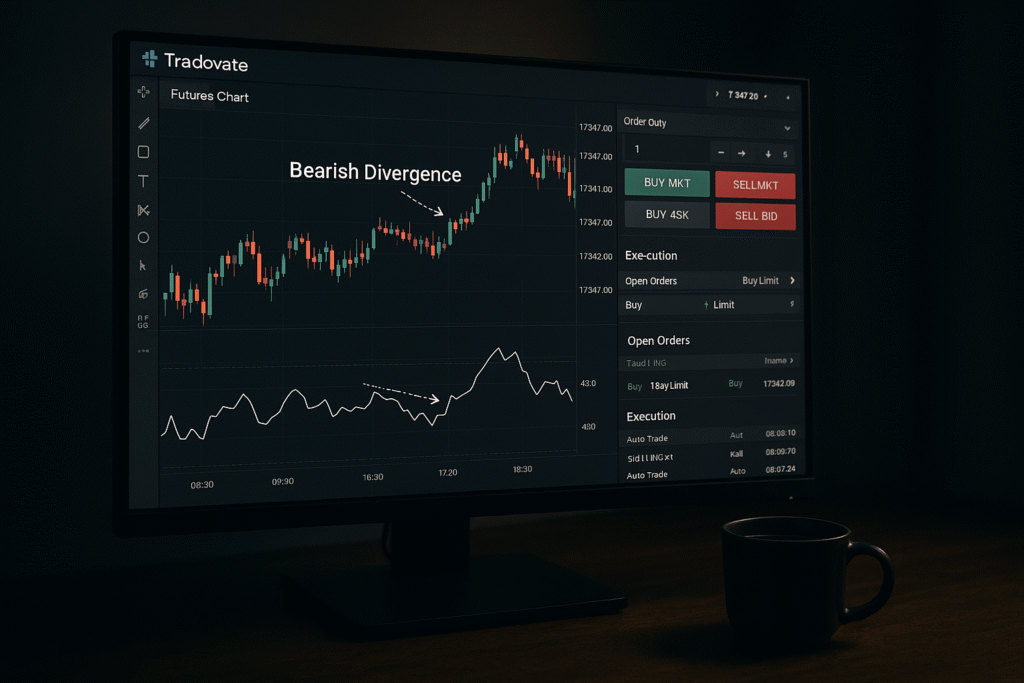

Identifying potential trend reversals is a powerful edge in futures trading. One proven method is spotting regular bearish divergence on charts, especially when combined with Tradovate automation tools. In this blog, you’ll learn how to identify this pattern and execute your trades using platforms like PickMyTrade, connected to Tradovate, Rithmic, and other automated brokers.

What is Regular Bearish Divergence?

Regular bearish divergence occurs when:

- Price makes higher highs

- RSI (Relative Strength Index) makes lower highs

This signals weakening momentum, even as price continues to climb. It’s often a sign that the current uptrend is fading, setting up for a potential reversal.

How to Spot Bearish Divergence on Tradovate Charts

- Use TradingView + Tradovate Charts: Connect TradingView to PickMyTrade with your Tradovate account.

- Look for Higher Highs: Scan price action for new highs.

- Check RSI: If RSI forms a lower high at the same time, you’ve spotted bearish divergence.

You can automate alerts for this setup using custom scripts or LuxAlgo indicators.

How to Trade Bearish Divergence with Automation

Once identified, here’s how you can turn this setup into a high-probability short trade using automated futures trading:

Entry

Enter a short trade after confirmation of the divergence. A good confirmation is a bearish candlestick pattern or breakdown below a support zone.

Stop-Loss

Set your stop-loss just above the most recent swing high to manage your risk.

Take-Profit

Target a previous support zone or a 2:1 risk-reward level.

Example Using Tradovate + PickMyTrade

Let’s say you see the NASDAQ Futures (NQ) forming a new high on Tradovate charts. RSI shows a lower high. Here’s how it could look:

- Short entry triggered via PickMyTrade once the next candle confirms reversal

- Stop loss placed 20 ticks above the high

- Take profit 40 ticks below entry at next support

All steps are automatically executed using the PickMyTrade + Tradovate integration, so you don’t miss out.

Why Use Tradovate Automation for Divergence Trades?

- Speed: Get in and out of trades with precision

- Emotion-Free Trading: Let your system do the work

- Chart Clarity: Tradovate’s footprint and candlestick tools help visualize divergence zones

- Broker Integrations: Supports Rithmic, TradeLocker, Interactive Brokers, and TopstepX

Final Thoughts

Regular bearish divergence is a simple yet powerful signal for trend reversals. By combining it with Tradovate automation using PickMyTrade, you can enhance your efficiency, reduce emotional mistakes, and capitalize on fading trends.

Ready to take the next step? Set up your divergence strategy on TradingView, automate execution via PickMyTrade, and trade smarter with Tradovate.

Disclaimer: Futures trading involves risk. Always use proper risk management and trade within your limits.

Also Check Out: Automate TradingView Indicators with Tradovate Using PickMyTrade