Bullish divergence is a top signal for spotting potential reversals in futures trading. When combined with powerful tools like TradingView, Tradovate chart trading, and PickMyTrade automation, it can transform your manual analysis into a fast, automated setup.

Whether you’re trading on Rithmic, TopstepX, or using ProjectX charts, this guide shows you how to find bullish divergence and set up fully automated futures trades like a pro.

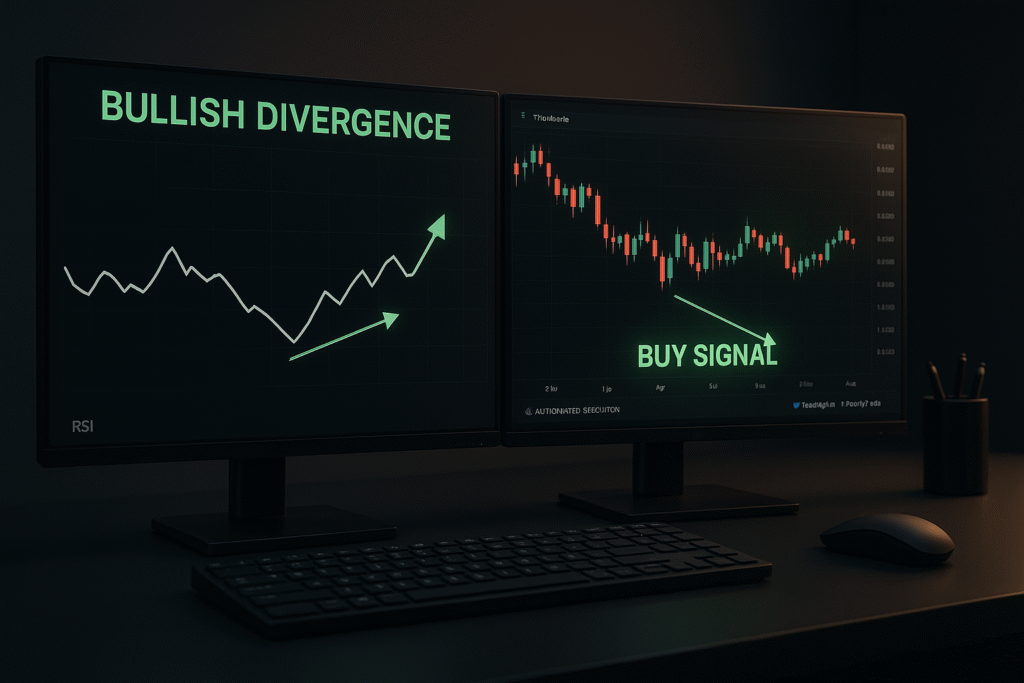

What is Bullish Divergence in Futures?

Bullish divergence happens when:

- The futures price makes lower lows,

- But the RSI (Relative Strength Index) makes higher lows.

This suggests the bearish momentum is weakening — a possible sign of a coming trend reversal.

✅ Pro tip: Combine RSI divergence with Tradovate supply zone strategy or candlestick confirmation for stronger setups.

Example: Bullish Divergence on Tradovate Charts

You’re trading NQ futures on Tradovate:

- Price makes a lower low at 14,850

- RSI forms a higher low, climbing from 32 to 40

- A bullish engulfing candle confirms the setup

Setup Entry:

- Long trade on candle close

- Stop-loss just below the low

- Target: 2R to 3R reward zone

Automate Your Bullish Divergence Trades

Stop manually entering trades! Here’s how to automate your divergence strategy using Tradovate and TradingView:

1. Use TradingView for Charting

- Apply an RSI divergence indicator or LuxAlgo

- Set alerts on RSI bullish divergence + support reaction

2. Use PickMyTrade for Execution

- Connect Tradovate to PickMyTrade.trade

- Set up webhook to send alerts to Tradovate

- Use Tradovate chart settings to fine-tune visuals and candles

3. Customize Risk Settings

- PickMyTrade lets you predefine SL/TP

- Auto-manage risk without needing to manually monitor trades

Why Combine Divergence with Automation?

Combining bullish divergence trading with automated futures execution allows you to:

- Enter trades instantly without delays

- Avoid emotional trading decisions

- Scan multiple markets with less effort

- Execute setups even when you’re offline

Popular Tools You Can Use

| Tool | Purpose |

|---|---|

| TradingView | Chart RSI, divergence, and candlesticks |

| PickMyTrade.trade | Bridge TradingView alerts to Tradovate or brokers |

| Tradovate app chart | Clean futures interface for analysis |

Final Thoughts

Mastering bullish divergence is just the beginning. With platforms like Tradovate, TradingView, and PickMyTrade, you can automate your futures trading strategy and level up your execution speed and consistency.

If you’re looking to automate long setups on ES, NQ, or YM, or use Tradovate-Tradingview Automation for real-time execution, now is the time to build your edge.

Also Check-Out: Automate TradingView Indicators with Tradovate Using PickMyTrade