In the world of trading, effective risk management is crucial for success. One powerful tool that traders can use to mitigate risks while maximizing profits is the One Cancels Other (OCO) order. This blog will guide you through the process of placing OCO bracket orders in Tradovate, a popular trading platform. We’ll explore how to set up these orders, manage multiple targets, and understand the benefits of using OCO orders for your trading strategy.

Understanding OCO Orders

An OCO order is a combination of two orders set at different price levels. It consists of an entry order, a take-profit order, and a stop-loss order. The key feature of an OCO order is that once one of the orders is executed, the other order is automatically canceled. This functionality makes OCO orders ideal for traders looking to manage their risk while securing profits.

Setting Up Your OCO Order in Tradovate

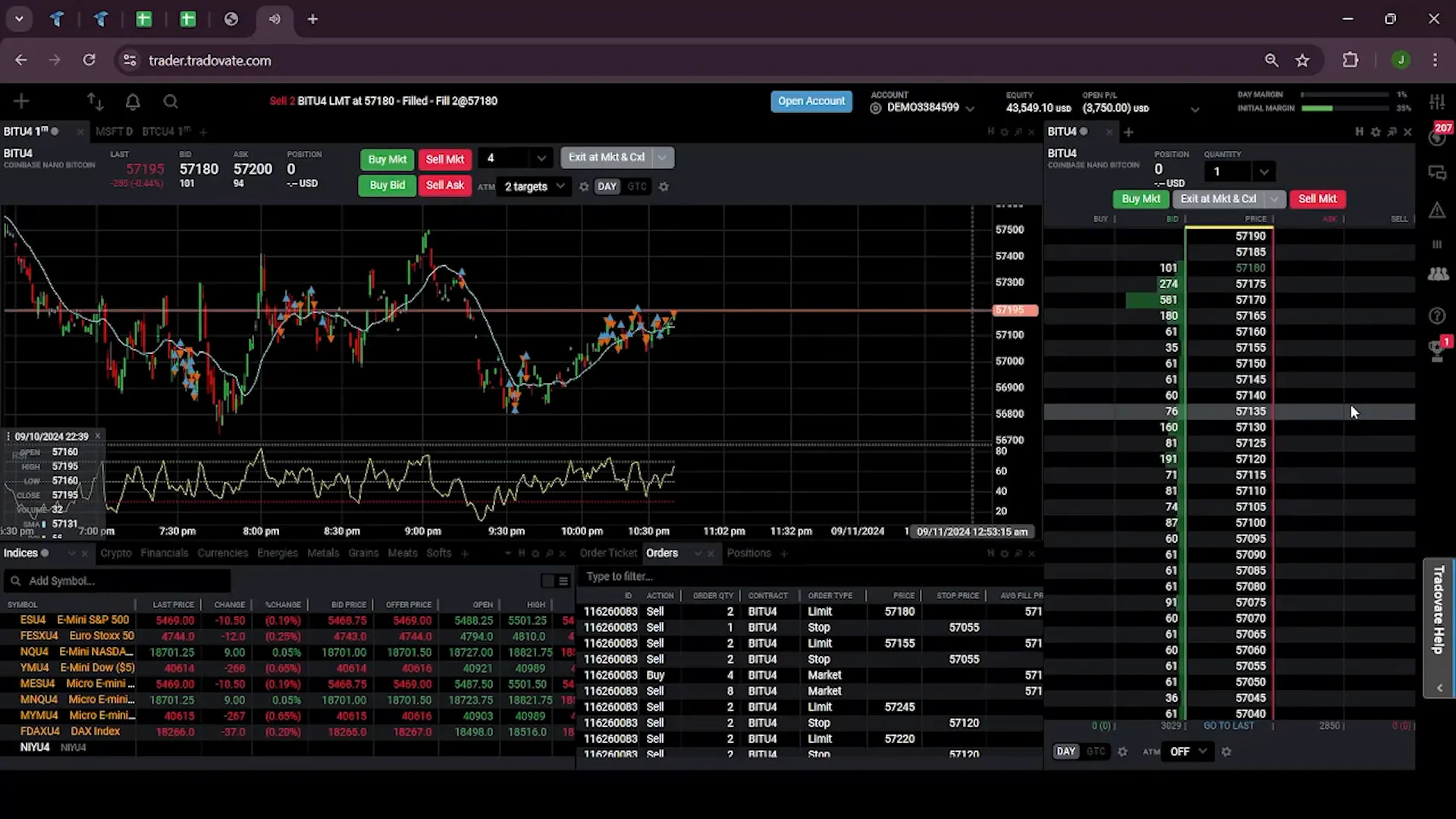

To successfully place an OCO bracket order in Tradovate, follow these steps:

- Access the ATM settings by clicking on the gear icon next to the ATM settings. Ensure that the ATM setting is activated.

- Choose an ATM name that suits your preference. For this example, we’ll use “OCO Bracket.”

- Set the order type to “Take Profit” and “Stop Loss.” For this example, we’ll set both take profit and stop loss to 10 points.

- Click the save button to confirm your settings.

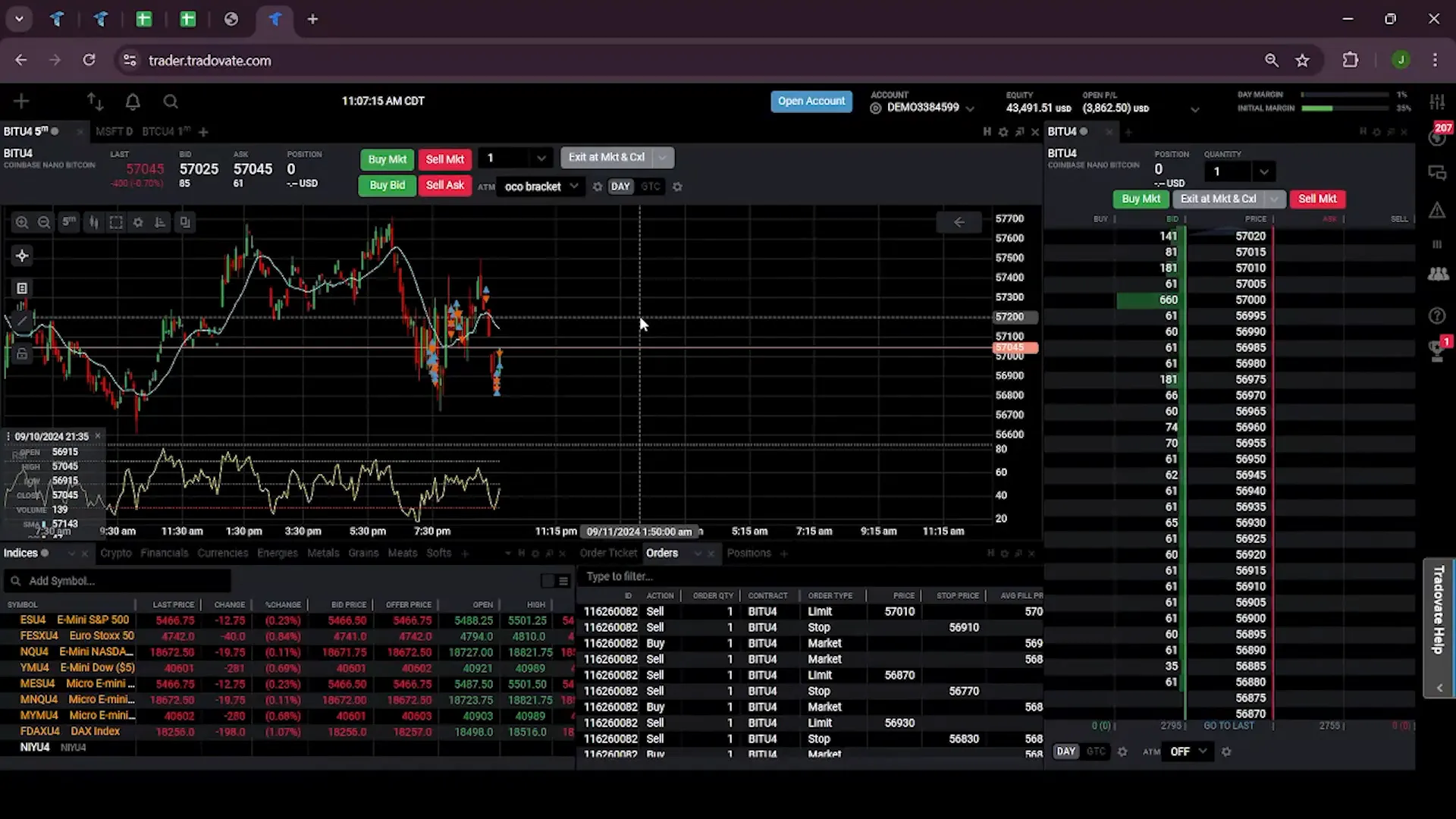

Now that your OCO order is set up, let’s see how it works in a live market scenario.

Executing Your OCO Order

Once your order is filled, you will see the following:

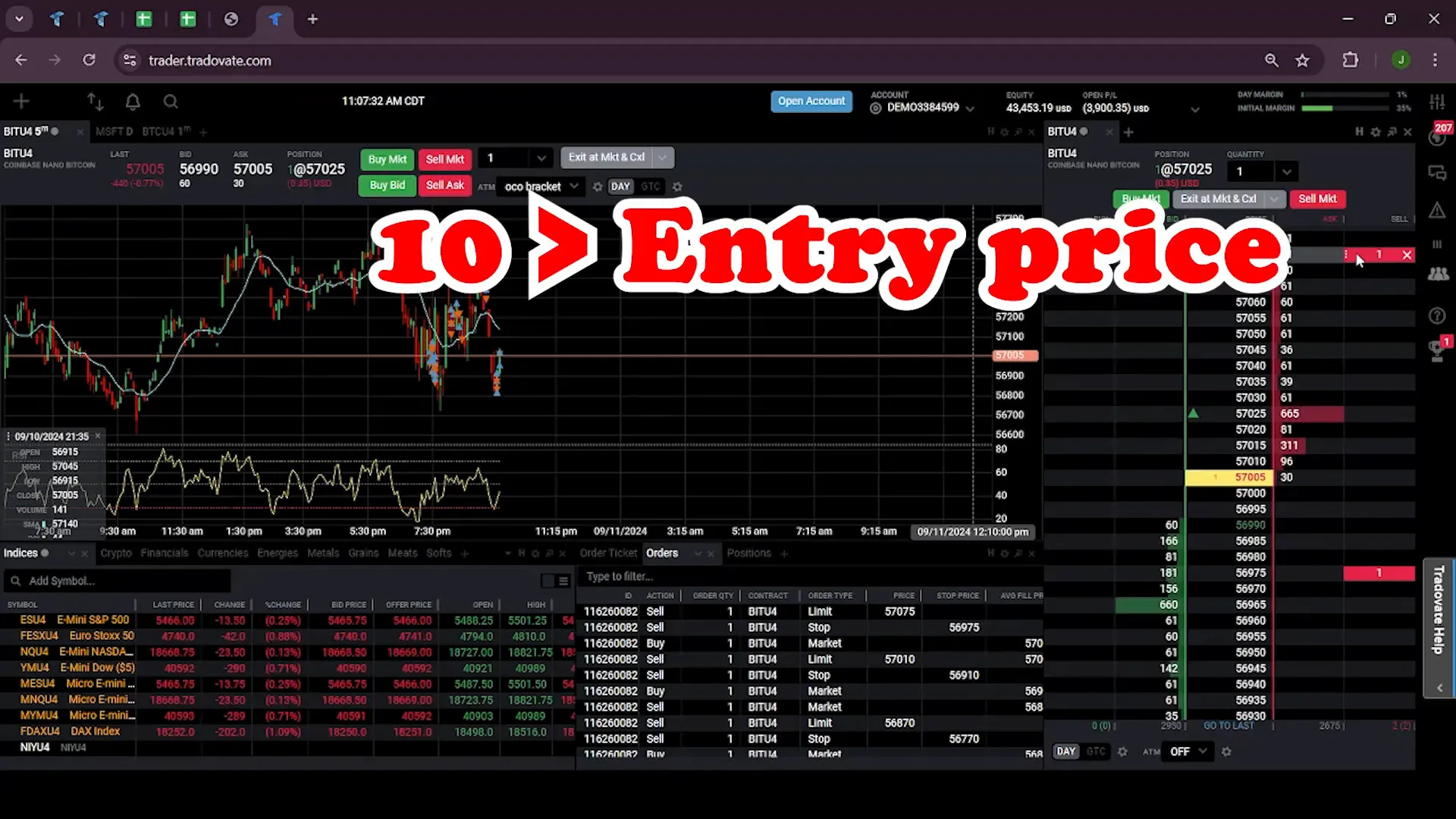

- The stop-loss order will be set 10 ticks below your entry price.

- The take-profit order will be set 10 ticks above your entry price.

In a scenario where the market moves against your position, the stop-loss order will be executed, and you will notice that the take-profit order is canceled automatically.

Using Multiple OCO Orders

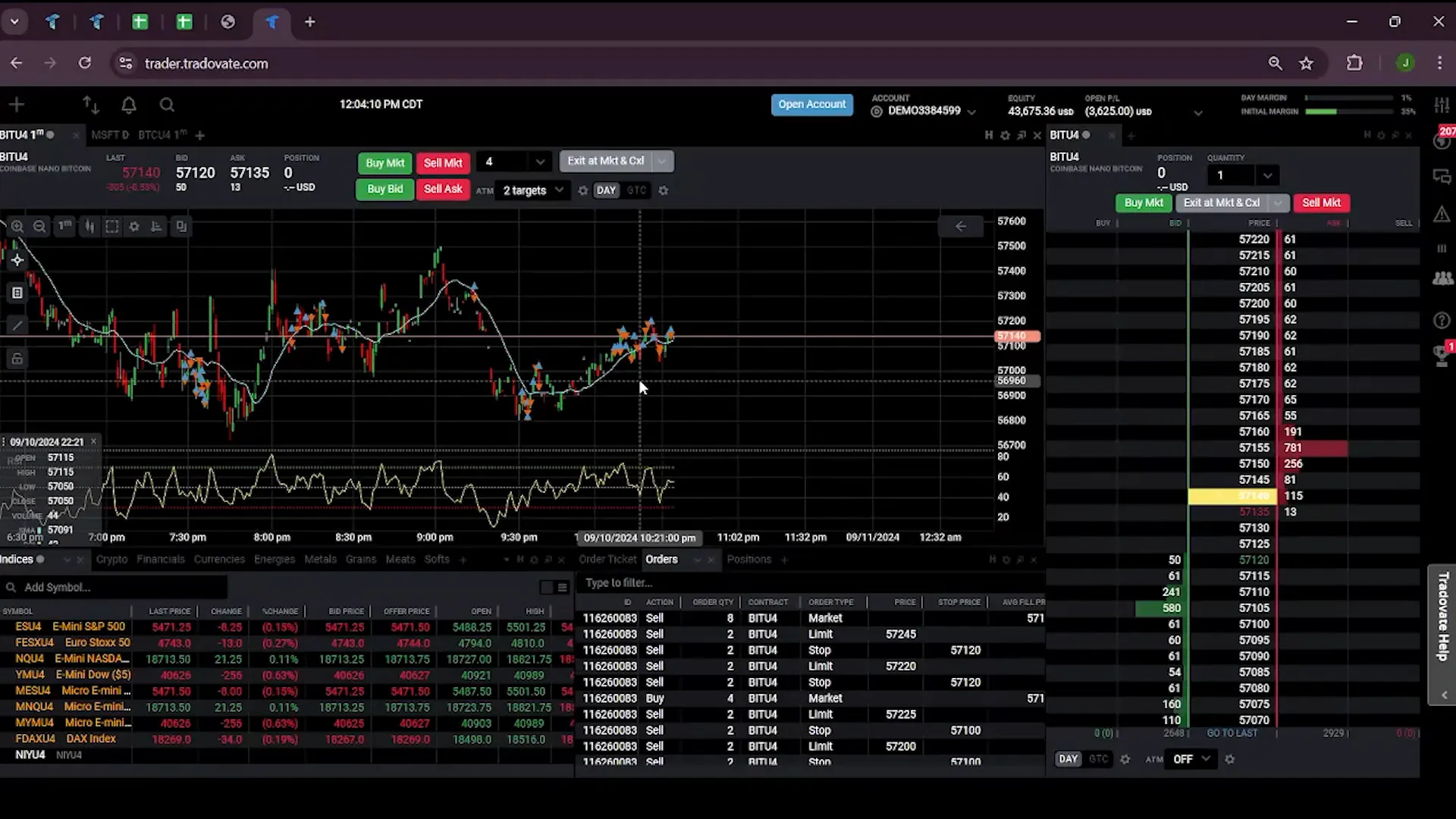

Tradovate allows you to utilize multiple OCO bracket orders to enhance your trading strategy further. Here’s how to set up multiple targets:

- In the ATM settings, change the ATM name to “Two Targets.”

- Click the plus button to add a second target.

- Set the first target to 10 ticks for two quantities and the second target to 15 ticks for another two quantities. The stop loss will remain the same at 10 ticks.

This setup allows you to take partial profits while maintaining a predefined risk level.

Monitoring Market Movements

Once your order is placed, you can monitor how the market reacts:

- When the market reaches the first take-profit level at 10 ticks, the first two units will be sold.

- If the market continues to move in your favor, the second take-profit level at 15 ticks will also trigger, selling the remaining two units.

- Should the market turn against you, the stop-loss at 10 ticks will cancel both targets, protecting your capital.

Why Use OCO Orders?

OCO orders provide several advantages for traders:

- Risk Management: By setting both take-profit and stop-loss levels, traders can effectively manage their risk.

- Automation: OCO orders automate the process of managing trades, allowing traders to focus on strategy rather than constantly monitoring the market.

- Flexibility: Traders can customize their orders based on their trading strategy, allowing for various profit-taking and risk management approaches.

Conclusion

Incorporating OCO orders into your trading strategy can significantly enhance your ability to manage risk and secure profits. By understanding how to set up and execute these orders in Tradovate, you can improve your trading efficiency and make more informed decisions. Whether you’re a beginner or an experienced trader, mastering OCO orders is a valuable skill that can lead to greater success in the trading arena.

For further insights into automated trading, check out PickMyTrade, where you can find automated trading solutions tailored to your needs.

Explore more on OCO orders and trading strategies on YouTube.

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.